Note, this is the foreword from a new report on IoT tracking in the supply chain industry; the report is linked here and (repeatedly) in the article below – and also in the images at the bottom. The title of this piece might have been, ‘everything to write and nothing to conclude’, as per the message in the below text; this is rhetorical to an extent, because the report draws clear conclusions, as suggested also in the text below. These are, however, the same conclusions to be made about the IoT market in general, just amplified in the chaos of the supply chain market.

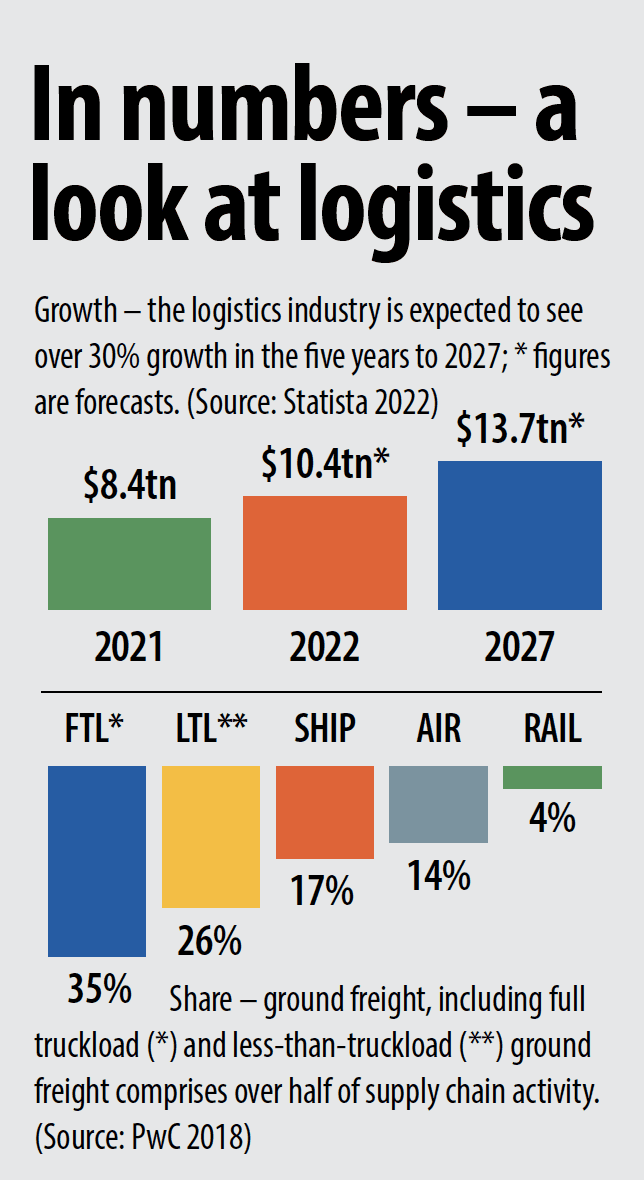

So, what are we dealing with here, exactly? Because the supply-chain industry is big and rangy, and hard to pin down. The global logistics market was worth $8.4 trillion in 2021, and is forecast to be worth $10.4 trillion by the end of 2022 and $13.7 trillion by 2027 – growing at around 24 percent in 12 months and 30 percent over five years (see below). Most of it goes on the road – over 50 percent is on ground freight. But the global market is required to navigate railways, water-ways, and air-ways, as well – and run in and out of factories, ports, warehouses, and other points between.

And, as the adjacent narrative tells, there are deep pockets and deep silos to complicate matters for any blue-eyed tech vendor promising to remake a market that goes back thousands of years. As per the title of this report, logistics is arguably the hardest Industry 4.0 sector of them all. There is no conclusion, in these pages, except to state the obvious – that the transformative potential of such a complex web of trade would be revelatory if it can be untangled by technology – and that new digital pyrotechnics (IoT and AI, in all their forms) look more and more like they are up to the task.

And, as the adjacent narrative tells, there are deep pockets and deep silos to complicate matters for any blue-eyed tech vendor promising to remake a market that goes back thousands of years. As per the title of this report, logistics is arguably the hardest Industry 4.0 sector of them all. There is no conclusion, in these pages, except to state the obvious – that the transformative potential of such a complex web of trade would be revelatory if it can be untangled by technology – and that new digital pyrotechnics (IoT and AI, in all their forms) look more and more like they are up to the task.

To paraphrase someone’s comments in the proceeding pages: the logistics industry might be starting behind the rest of the Industry 4.0 pack, all nestled in their own easy closed-loop venues, but could have the most explosive finish of any enterprise sector. There might be no other conclusion to write, but the dialogue and discussion in these pages is interesting – and also fun to read (if the stakes were not so serious), because of the quality of the interviewees.

This report discusses the potential Industry 4.0 upside for the supply chain sector in all its disjointed promise, with some history and context to start, and a long discussion about the developing maturity of the IoT market, and the urgent need for it to accept its role as a useful addition to the Industry 4.0 cause – and not the the story itself. A series of case studies are included at the end, which present the best of IoT as a tool for change in the hands of enterprises. Enjoy.

For more, check out the new editorial report from Enterprise IoT Insights, on: IoT tracking in the supply chain and logistics industry – how IoT grew up and got real in the hardest industry of them all. The report is free to download; see images below for a snapshot. Check out our upcoming calendar of editorial reports on page 36 of the report.