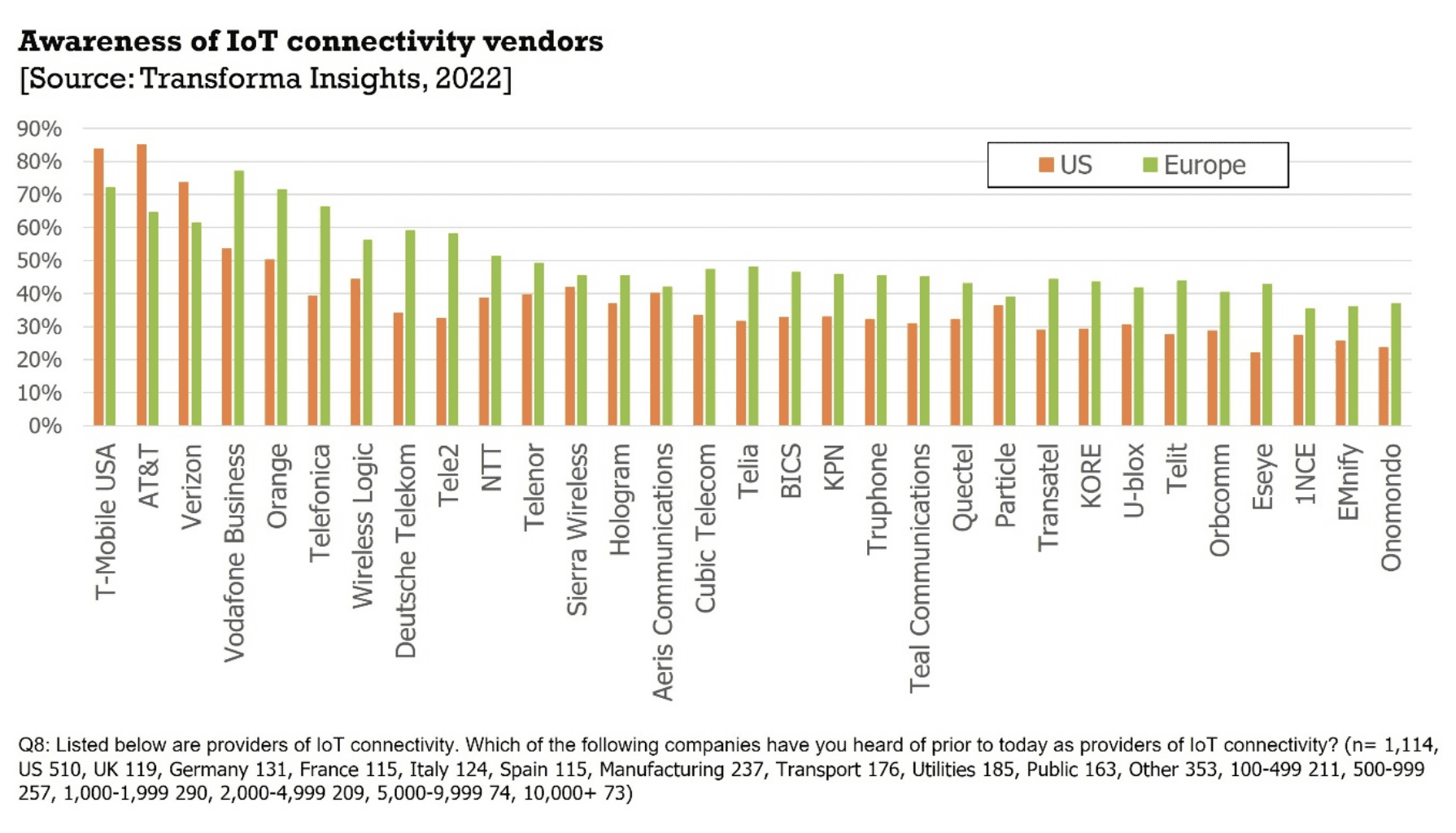

Earlier this year, Transforma Insights undertook a survey of 1,100+ enterprises in the US and Europe, asking about their buying behaviour and vendor preferences cellular IoT connectivity. As part of that survey, we asked respondents which connectivity providers they were aware of, which they used, and which they would be interested in using in future. In this article, we explore the responses to those questions.

Mobile operators lead awareness in IoT

The big cellular network operators dominate the ratings in terms of awareness. Top of the pile overall was T-Mobile. This was somewhat surprising given that its IoT operations have been relatively limited compared to its peers AT&T and Verizon. The high awareness in Europe is also possibly a reflection of awareness for the overall T-Mobile brand.

The greater fragmentation in Europe in terms of which operators have strong presence in each of the markets also was probably an inhibiting factor on Europe-based operators having a stronger overall presence. Nevertheless, Vodafone and Orange were still the strongest in terms of awareness amongst European respondents.

The top six connectivity providers across the whole study were mobile network operators (MNOs). The highest rated IoT MVNO was Wireless Logic, followed by Sierra Wireless, Hologram and Aeris.

It was also noticeable that European respondents were overall generally more aware of the different operators, reflecting the greater fragmentation of the market and the need to cast the net wider when considering which operators to select. Respondents are categorised based on where they are located, not where they procure connections. Therefore high scores for non-region players is expected.

But who was most popular?

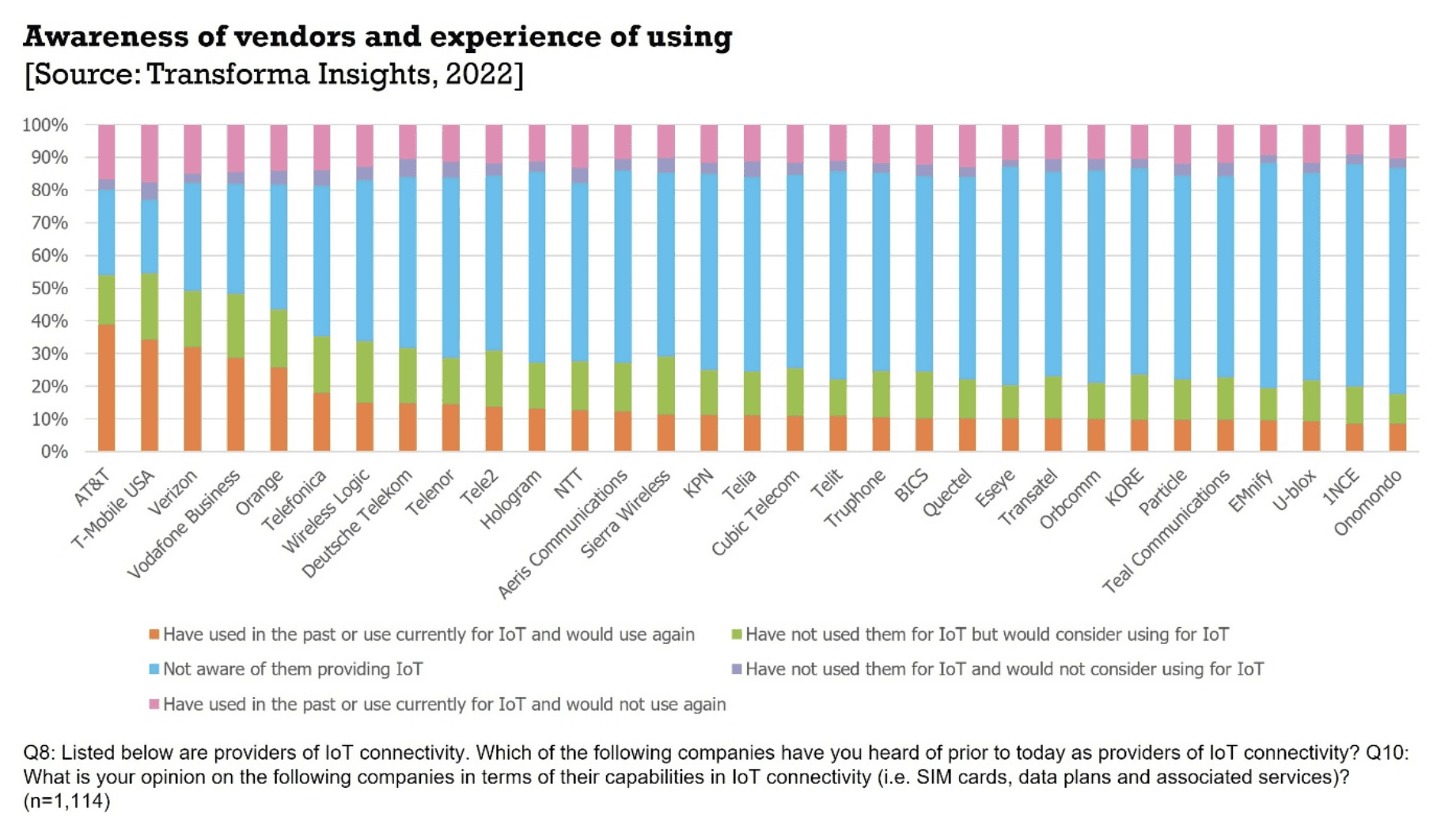

Awareness is one thing, popularity is another. We also asked the respondents which of the providers services they had used, and which they would be interested in using in the future (or using again if they had already been a client). This is illustrated in the chart below. Overall, the US operators score highest in terms of having used the provider and being keen to use them again. Again, this in part reflects the greater concentration of US respondents with the relatively fewer MNOs.

Vodafone, Orange and Telefonica are the next biggest scorers in that category.

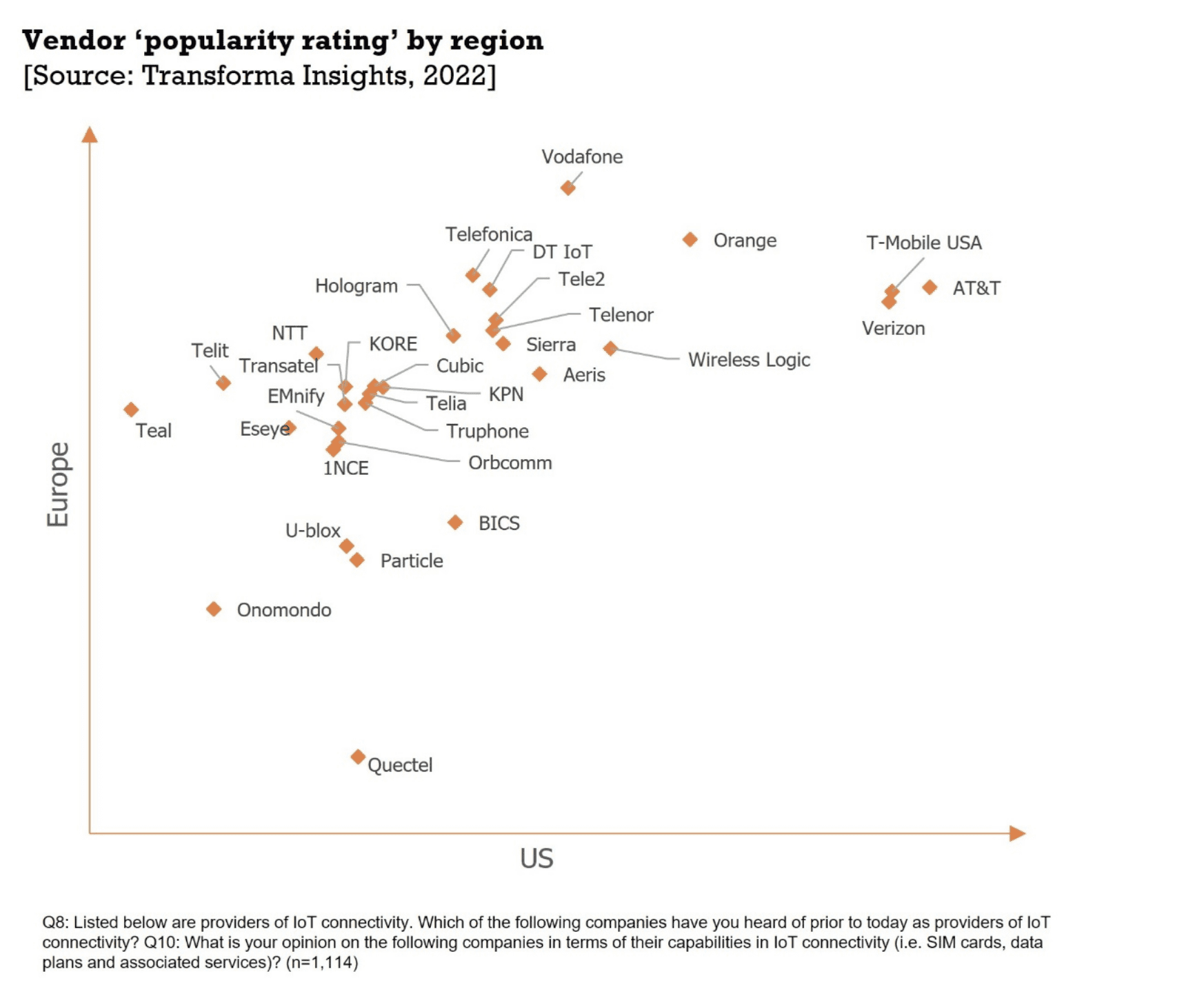

But that ranking only really reflects that one metric of having used that provider and being interested to use them again. In order to properly reflect the responses given, we applied a popularity rating. This awarded points according to the responses. Those that said they had used them and would use again were allocated as +5 points. Those that said they had used and would not use again were -5 points. Where they haven’t used that provider, the equivalent was +2/-2 depending on whether they would use in the future or not. And those respondents who said they were not aware were allocated -0.5 points.

The result of that popularity rating is presented in the chart below, including the application of a geographical dimension. Here we can see that unsurprisingly the big US carriers score highest in the US, while Vodafone, Orange and Telefonica are the leaders in Europe. Amongst the MVNOs, Wireless Logic, Sierra Wireless, Aeris and Hologram score relatively well.

Top level figures hide a lot of granularity

The figures presented in this article are showing simply the top level figures with splits by region. That hides a lot of the variation within the responses, where the most valuable insights sit. For instance, on a regional level, Deutsche Telekom suffers a little from the fact that it runs a network only in Germany (and not the other four territories in which our respondents were based: France, Italy, Spain and the UK), likely bringing down its awareness figure relative to, say, Vodafone which runs networks in four of the five territories.

Taking Germany alone, Deutsche Telekom is one of the top two carriers. The large Sweden-based (or largely Sweden-based in the case of Telenor) contingent of providers suffers a little from having no Swedish-based survey respondents. As one would expect, Orange scores well in France, Telefonica in Spain and so forth. Across all of the vendors there is a reasonably wide variation by geography, with, for instance, Aeris and Sierra Wireless scoring higher in the UK than in other geographies.

In terms of sectors, we find that Wireless Logic and Deutsche Telecom perform proportionately stronger in the manufacturing sector, and T-Mobile USA relatively weakly. Energy utilities overall are quite negative about most providers but have a very positive view of Orange in particular. And very large organisations (10,000+ employees) disproportionately favour Telenor and Telefonica.

About the survey

More details of the survey and the methodology used can be found here: ‘Enterprise IoT connectivity survey 2022’.