Ferrovial plans to use private 5G for its own asset-specific operations, and as a value-add for new (and prospective) customers

Across its its six business units—highways, constructions, airports, mobility, energy and water—Spanish firm Ferrovial has annual turnover in excess of $7 billion, more than 18,000 employees around the world, and, most relevant here, big plans for private 5G networks. The company’s Adrian Talbot, head of the Centre of Excellence for Mobility and Digital Infrastructure, explained to Enterprise IoT Insights how private 5G networks can benefit Ferrovial projects when their under construction, once they’re complete and under operation by the company, and serve as a value-add to facility users outside of the Spanish giant.

“We see…digital infrastructure as a key value creator for our future growth,” Talbot said during a session at the recent Private Networks European Forum, available on-demand here. The right investments, he said, can future proof assets for the users and operators, improve user interaction, facilitate dynamic asset management, and support emerging and as yet undefined services. “We see 5G as sitting as the ubiquitous connectivity layer that brings everything together and enables that broader interaction.”

Talbot said Ferrovial has conducted detailed analysis of the financial boon private 5G can bring across its business over varying time horizons; looking ahead, he said, private 5G “could bring additional value up to maybe even 25% of where we are today from a variety of different sources with a number of different levers that could accelerate that even further.”

The two main areas where Talbot sees private 5G creating value for Ferrovial are in the infrastructure development process, then, “In the future that can include 5G network infrastructure both within our own existing assets but also on behalf of third parties” through Ferrovial using the network it deployed for itself as an active of passive neutral host for others.

Bottomline, Talbot said, “We certainly see that the private [5G] network is a key tool in our arsenal in terms of driving value and competitiveness in our projects, and in our own assets both on behalf of us but also on behalf of our customers.”

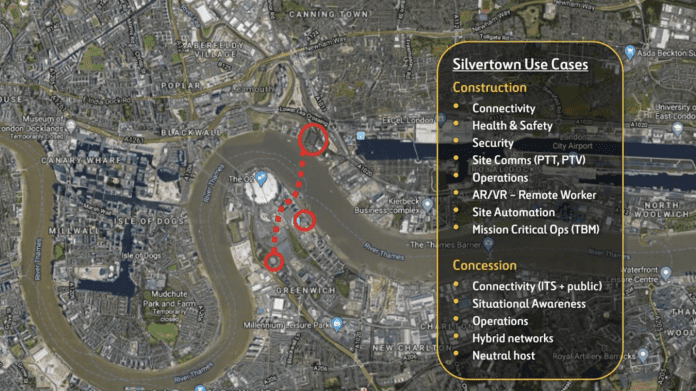

Connecting construction sites for the Silvertown tunnel project in London

Talbot highlighted the work Ferrovial is doing via joint venture with BAM Nuttall an SK E&C to build and operate a 1.4-kilometer twin-bore road tunnel under the River Thames in London, connecting the existing Blackwall Tunnel south of the river with the Tidal Basin Roundabout in Silvertown. Called the Silvertown Tunnel, the project contract is work well over $1 billion, and is meant to support ongoing population and job growth in the Silvertown area.

Talbot said the private Standalone 5G network is being used to provide contiguous coverage across multiple construction sites that are part of the larger project. “Over the course of the project, our hope and intent is to drive from a testbed scenario into mission critical communications. And we’re well on the way to achieving that. Once we get into the concession period when the tunnel is built and in operation, as we’ll be the operator, we’ll continue to use the private 5G network to support the business-as-usual services.”

The network uses spectrum in the 3300 MHz to 4200 MHz (Band n77) range which was set aside by U.K authorities for use in private networks. Talbot did note that ecosystem, infrastructure and device support for Standalone 5G in this frequency band matured relatively slowly. “It is having an impact on our ability to drive and validate some of the use cases but, as I mentioned, things are improving.”

As for the use cases at the Silvertown sites, he called out connectivity, health and safety, security, site comms (including push-to-talk and push-to-video), operations, AR/VR for remote workers, site automation, and other mission critical operations.

At airpots, Ferrovial, which has relevant assets at Aberdeen, Glasgow, Southampton, Heathrow and JFK among other locations, Talbot sees an “extensive” number of airside and landslide use cases, chief among them providing a unifying connectivity medium to replace the variety of networks in place today. “All of them can be replaced by 5G and all of them can be heavily enhanced and improved by the use of good quality private 5G network.”

He did note that the global COVID-19 pandemic and associated decline (and ongoing inconsistency) in travel demand has delayed the firms exploration of private 5G in airport settings.

As for “connected corridors,” a key piece of Ferrovial’s global business, Talbot painted a detailed picture of how more technologically-advanced transit infrastructure can be used to save lives, benefit logistics and fleet management, create new service revenue opportunities, and provide a benefit to proximal communities.

“All of this leads to a massive opportunity for an infrastructure player like Ferrovial to support,” he said. “You can actually extend your reach beyond the right-of-way with your 5G network…into the areas adjacent to the corridor,” he said. For example, a private 5G network that’s primarily meant to support connected corridor enablement could also serve as a platform for delivering fixed wireless access to communities, schools and other nearby locations.