We need to talk about private networks (some more). Because earlier this month, Enterprise IoT Insights opened the European edition of Private Networks Forum with a salutary address about the market, going so far as to suggest business is “flying” in most major industrial economies. The exception is Germany, the argument went, because a disproportionate number of local 5G projects in Germany are stuck in pilot, waiting on higher-grade 5G in 2024/25.

It was designed to invite discussion, to kick off a day of wrangling about the state of ‘things’ in Europe. And the sense is that expectation in Germany, the home of Industrie 4.0, is highest – and hard to live up to. Because cellular, as it stands, even in isolation in private networks, does not cut it for the big beasts of manufacturing, nor the government schemes and private institutions researching how to jump-start Europe’s biggest industrial economy.

Because the manufacturing sector does not just want go-faster broadband; it wants something else, and something more. It wants a wireless Ethernet network, effectively, which brings equivalent latency, reliability, and control to production lines, but does away with fixed infrastructure – to fast-track industrial intelligence and automation, and to make it flexible and take it further, without being hamstrung by rigid architecture and high-stakes innovation.

And cellular does not deliver this, yet – until industrial-grade 5G appears in proper force in later 3GPP releases. And manufacturing, whilst keen to engage in experiments, is reluctant to take the plunge on unfinished tech, especially when its production infrastructure turns on longer upgrade cycles. Which is plain and logical. But the (excellent) session that followed this introductory address ranked Germany second, behind the US, for private network deployments.

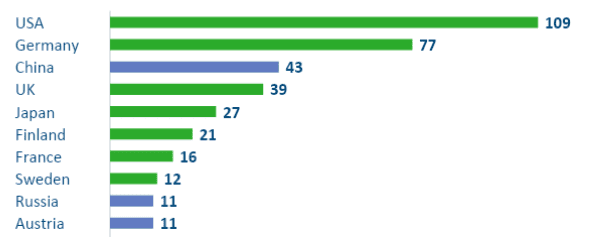

Germany is flying, suggested the GSA, presenting new research into ‘private networks in numbers’. The GSA counts 77 customer references for private LTE/5G networks in Germany, compared with 109 in the US, 43 in China, 39 in the UK, and 27 in Japan. That is the global top-five for private cellular – and there is a notable gap from Germany to the rest; Germany’s total (77) is 80 percent higher than China’s (43), and 97 percent higher than the UK’s (39).

Germany is flying, suggested the GSA, presenting new research into ‘private networks in numbers’. The GSA counts 77 customer references for private LTE/5G networks in Germany, compared with 109 in the US, 43 in China, 39 in the UK, and 27 in Japan. That is the global top-five for private cellular – and there is a notable gap from Germany to the rest; Germany’s total (77) is 80 percent higher than China’s (43), and 97 percent higher than the UK’s (39).

So, what gives? Is Germany racing ahead with 5G-geared Industry 4.0? Or is it, actually, in some kind of suspended animation, while 5G catches up on its grand promise of industrial revolution? Well, both statements are true, and neither is right; as always, it is a matter of perspective. Is the private cellular market at large racing ahead? We should look at the GSA count, again – because it is weird. One swallow, even 889, does not a-summer-make; that total looks underwhelming.

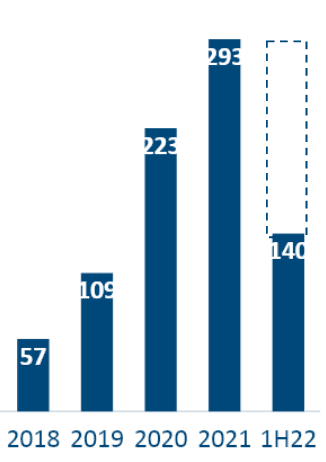

Speaking during the post-intro session at Private Networks European Forum, Luke Pearce, research manager at GSA, reveals the latest data – directly from Ericsson, Huawei, Nokia, Samsung et al – says there were 109 new customer references (named and unnamed) for private networks in 2019, with the figure rising steadily to 223 in 2020, and 293 in 2021. So far in the first half of 2022, there have been 140 new references.

Which means average growth was flat for the six months to the end of June – and negative, actually, compared with the aggregated half-year total (146/7) from 2021. This may be seasonal, and growth may accelerate through the end of 2022. “Let’s wait for the full year, as we expect quite a few in the second half,” says Pearce. But whatever; the market is hardly cooking up a storm. Quite a few? Neither Germany, nor anywhere, is “flying”, arguably.

The GSA figures suggest the whole market is in stasis, actually – at least so far as serious-sized €100,000-plus deployments go. (The numbers discount “small demos and free trials”, it might be noted.) Even if the noisy supplier market, on the opposite side, is a hive of activity (50 vendors and 66 operators are selling private 5G, says Pearce), a total compound growth (101 percent over five years) means nothing if it starts from practically zero (nine, in 2019).

Private shrunk-down LTE has been a going concern for three years, at least, and longer as a localised macro exercise. And remember; there are supposed to be 15-odd million potential enterprise venues for private cellular, according to Nokia’s seminal market-sizing from a few years back. But the GSA figures are weird, as well, because they do not make sense. Nokia has just reported 515 “large customer” references for private LTE and 5G networks.

Which – if these are like-for-like numbers – would imply Nokia has a total market share of 57 percent. Impossible. UK-based private network specialist Quortus, part of Ericsson since last December, has talked in these pages of its “first 2,000 networks” – which would represent 200-plus percent market share (if networks equaled customers, and they don’t; they are always more). I mean; right? Because Nokia and Ericsson are contributing to the GSA numbers

Which – if these are like-for-like numbers – would imply Nokia has a total market share of 57 percent. Impossible. UK-based private network specialist Quortus, part of Ericsson since last December, has talked in these pages of its “first 2,000 networks” – which would represent 200-plus percent market share (if networks equaled customers, and they don’t; they are always more). I mean; right? Because Nokia and Ericsson are contributing to the GSA numbers

So either someone can’t add up, or someone is lying – or someone is barking up the wrong tree. But other GSA figures look conservative, too; China’s total (43) is less, by three times, than the anecdotal envelope maths Enterprise IoT Insights ran on the China market in August. “There are 2,000-3,000 [private networks in China] – and 95 percent run off a public core”, was the key line, then. But again; like-for-like, apples-for-apples?

Matters of perspective. Another skewed angle says the Federal Communications Commission (FCC) in the US has granted 20,625 private access licences (PALs) in the 3.55-3.7 GHz CBRS band, as of a couple of months back. For its part, BNetzA in Germany has issued 243 licences in the ‘vertical’ 3.7-3.8 GHz band, with a 12-month window for enterprise holders to go live with cellular networks. (Even these numbers look out of kilter, but let’s plough on.)

Clearly, licences do not mean networks, but splicing permit numbers with reference cases suggests (bear with me) that 0.5 percent (crazy, wrong) and 32 percent (reasonable, possible) of licence applications in the US and Germany translate into per-region enterprise deployments. Further, Federated Wireless has handled 40-odd percent of US applications (8,250-9,250 of the FCC sum?) via its SAS mechanic; at MWC in February, it claimed 350 customers.

(Three-hundred and fifty is a 40 percent share, by the way.) It is also adding “1,000 new nodes per week”, it said. Clearly, we are muddying the water; the FCC score is for PAL licences, and the Federated Wireless count (we think) includes GAA deployments. At the same time, as a hypothetical exercise, those numbers (8,500 and 350) would produce a passive-to-active run-rate of about four percent – for enterprise references, not networks.

Let’s pause; we are in a tangle. A word, again, quickly on the GSA reference numbers; as discussed, the 889 total counts customers per region (North America, Europe, Asia Pacific), rather than total networks – or customers, full stop. Of those, 340 (42 percent) are public/named references, and 454 (58 percent) are non-public/anonymised. As an aside, 382 are in Europe (43 percent). The action is where the spectrum is, says GSA.

Let’s pause; we are in a tangle. A word, again, quickly on the GSA reference numbers; as discussed, the 889 total counts customers per region (North America, Europe, Asia Pacific), rather than total networks – or customers, full stop. Of those, 340 (42 percent) are public/named references, and 454 (58 percent) are non-public/anonymised. As an aside, 382 are in Europe (43 percent). The action is where the spectrum is, says GSA.

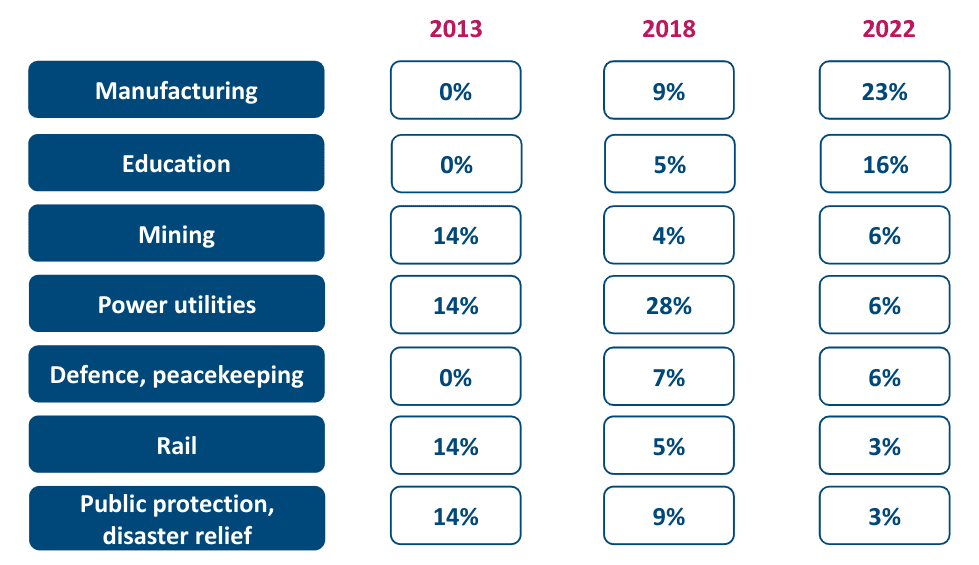

Indeed, the trends exposed in the GSA stats are notable, and should be taken as granted. Most installations are on LTE; 507 of the 889 references (57 percent) are LTE-only. A further 165 run LTE alongside 5G. In total, 5G features in 354 GSA cases, meaning 189 are 5G-only. But these are almost all experiments, notes Pearce – which, we reckon, explains the existential angst about the Industrie 4.0 picture in Germany, discussed at the start. “The number skews towards long-term expensive trials, or deployments within more educational and testbed validation facilities.”

He adds: “A limited number are running real industrial operations.” Standalone 5G (SA) is used in just 37 “deployments”, he adds. On verticals, the manufacturing sector is the big one for private LTE/5G, with 165 “different identified companies involved in known pilots and deployments” (111 at the end of 2021). As a sub-segmentation, discrete manufacturing fills all the top spots – automotive, equipment, and appliance manufacturing, in that order.

Process-based production disciplines – like food, chemicals, and metals – have just a “handful” of references. Instead, education, mining, power utilities, and defence / peacekeeping round out the top five customer markets. There has been an “uptick in some of those middle ones”, as well, notes Pearce – citing “strong growth” in the logistics sector, in airports, sea ports, and road ports (warehousing) during the past 12 months.

Perhaps crucially for the purposes of this article, Pearce adds a caveat. “While [this analysis] gives an indication of the number of customers deploying private networks, it does not give a view of the value of the market, nor the number of networks deployed. And so in public protection and disaster relief, one customer could represent a nationwide deployment, which could be equivalent to many hundreds or thousands of campus-style networks.”

Which is interesting, and perhaps where the confusion is. Enterprise IoT Insights quizzed Pearce briefly at the end of the session. Eight-hundred and eighty-nine seems lower than the sense of it – if Nokia is claiming 500-odd references (and Ericsson/Quortus claims 2,000 for starters, and Federated Wireless has 350 in some form, and we heard China has 150-odd all-edge installations, and so on). So how do we square that?

Pearce responds: “So Nokia, Ericsson, and Huawei are part of the [private networks] specialist interest group, [as] founding members. All of their references are collected in this database. But some of those references, like public for protection and disaster relief, could have hundreds or even thousands of separate networks. And we are generally seeing an appetite for multi-site deployments now – increasing from one trial to more.”

It does not make sense, still. Nokia’s claim of 515 references is for customers, also, not networks. So, what – Nokia has a 57 percent share, among GSA contributors? Give over. And all the others? Surely not. There is no time to press further. Pearce says: “We are looking at an average of two or three networks per customer [now]. So certainly, yes, the number could be slightly higher than 889.” The session closed, and the GSA trend points were affirmative, even if more clarity is needed (and will be pursued) on customer / network numbers, and on market shares, too.

All sessions from Private Networks European Forum are available on-demand, here.