A long-time pain for many businesses has been dealing with poor indoor cellular coverage. Fortunately, recent advances in cellular technology have given rise to a more modern approach to improving in-building cellular coverage.

The emergence of new shared cellular spectrum options, such as Citizen’s Band Radio Services (CBRS), and the use of so-called “small cells ” have paved the way for a new architectural model dubbed neutral host networking that is poised to unravel this long-standing predicament.

Context is key

At issue is how businesses can best offer users within large indoor environments pervasive and reliable connectivity to the different public cellular services over a single common shared network infrastructure they already have in place.

Today the vast majority of indoor office floor space in the U.S. is largely delivered from outdoor macro cell towers owned and operated by big mobile network operators (MNOs). But because these signals often have problems reaching users inside buildings, businesses have been forced to install elaborate, expensive, and complex distributed antenna systems (DAS).

A DAS network is a complex array of cellular antennas, dummy radio heads and back-end equipment, or base transceiver stations, for each MNO. All this equipment requires a totally new set of cabling to be installed throughout the premises. The cellular signal is typically distributed throughout the building using an extensive web of fiber optic or coaxial or cabling. In this model the cellular radios don’t provide any signal processing but simply relay the signal to the requisite MNO base station located at a central hub.

While DAS solutions have existed for years, they suffer from one or more shortcomings such as high implementation costs, lack of scalability, limited control, or a loss of important end-user features. Moreover, the implementation of a DAS network in a football stadium, office building, hospital or shopping mall can often cost millions of dollars more for all the necessary equipment, along with the tuning and optimization that will be required.

Rise of neutral host networks

While not a replacement for existing DAS deployments, neutral host networking was developed to radically reduce the cost and complexity of legacy DAS design. By allowing small cell radios, operating in the CBRS spectrum, to be deployed and connected over the existing enterprise local area network (LAN), businesses effectively eliminate the need for discrete fiber-optic cables to connect each DAS radio head to a central hub, the development of the hub itself, and the placement of the cellular base stations.

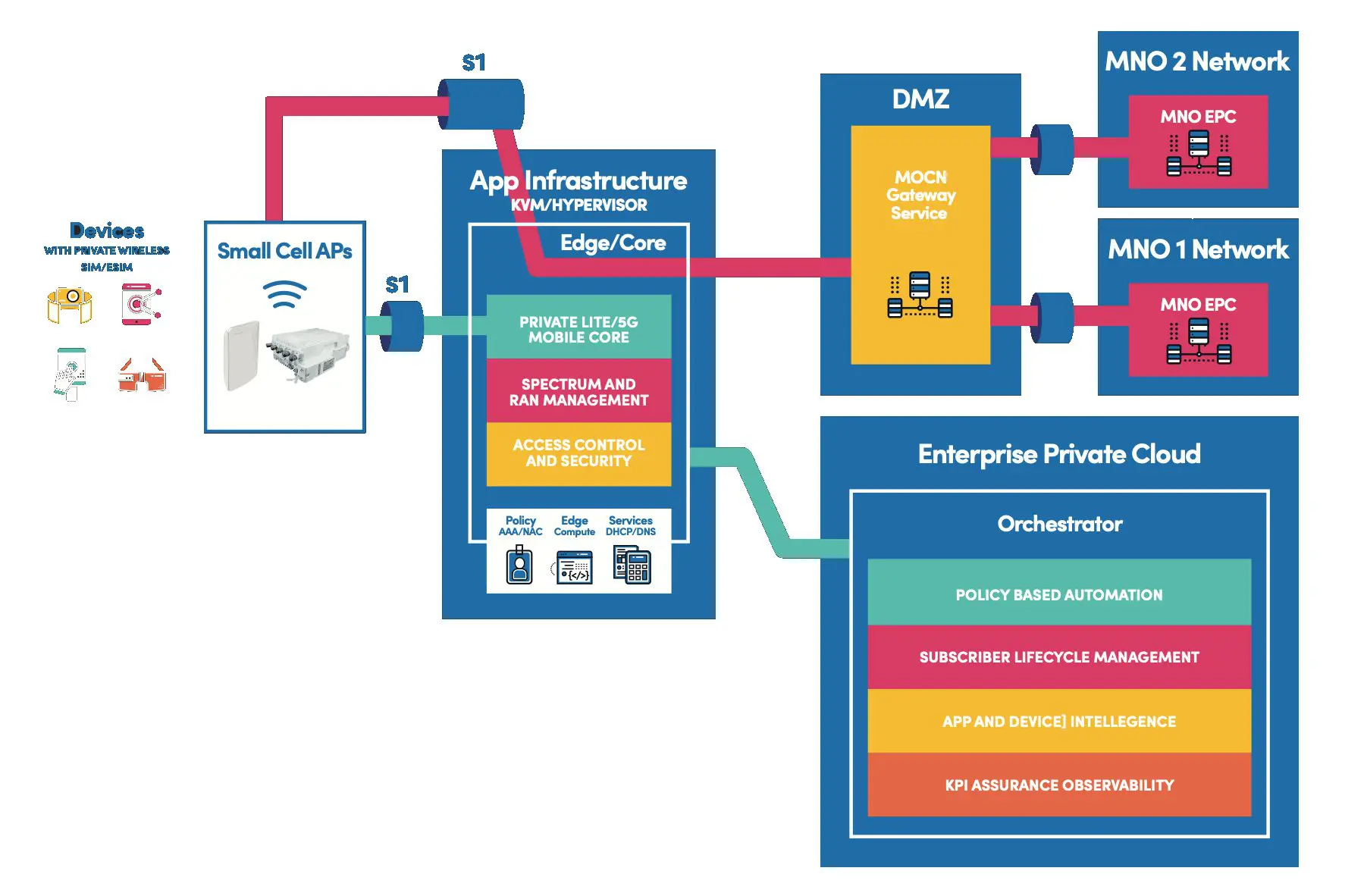

These small cells radios are deployed much like Wi-Fi access points but broadcast cellular signals from different MNOs simultaneously with traffic offloaded and securely tunnelled over broadband or Internet connections to the respective mobile network operator (MNO). This is achieved through the use of a multiple operator core network (MOCN) gateway that establishes a secure tunnel between the private wireless core and the MNO core. The MOCN gateway provides critical services for NHN to operate efficiently and with data security in mind.

By leveraging the CBRS band as a common shared spectrum for indoor access, a portion of the radio access network (RAN) bandwidth can be allocated for MNO use. This eliminates the need to use separate infrastructure equipment required by from each carrier to propagate their public licensed cellular service.

Indoor small cell-based neutral host networks offer a significantly reduced footprint, lower cost, and higher flexibility than DAS systems. Unlike DAS radio heads, each neutral host radio access node adds more capacity to the network. So as capacity demands increase more nodes can be added where demand is high.

By doing so, multiple parties – both private and public – can securely share the same network infrastructure within an organization. This provides wireless connectivity to a wide range of MNO subscribers with the goals of increasing public cellular network coverage and capacity while dramatically reducing capital and operating costs by using a shared network infrastructure approach.

In other words, one private LTE/5G network using shared spectrum such as CBRS can provide service to mobile subscribers from multiple MNOs – effectively extending public cellular services quickly wherever they are needed.

This new architecture leverages the RF and IP design efforts for multiple operators and even private networks – further improving the cost-efficiency.

For enterprises, the dramatic price differential of neutral host networks, when compared to traditional approaches, stems from eliminating the need for discrete fiber-optic cables to connect each radio head to a central hub, the development of the hub itself for each MNO and the placement of the cellular base stations.

For big telecom providers, the neutral host model gives carriers easy access to a good RF footprint without incurring additional deployment expenses– attracting new business customers that require local connectivity to enterprise as well as mobility into the public network for ubiquitous access by leveraging existing infrastructure already in place and utilizing new CBRS spectrum. MNOs can also offload capacity leveraging a private neutral host networks in areas where networks are prone to user/bandwidth congestion issues, providing added scalability.

No business models yet

While the neutral host networks give operators additional coverage at a lower cost, companies better cellular coverage and subscribers better connectivity, the business model for how all this will work remains an open question.

At this stage, it looks as though three distinct neutral host deployment models emerging:

- The business can opt to deploy their own private cellular network and sign NHN contracts with the MNOs of their choosing.

- The MNO can offer to install and deploy a private cellular network within the building and add neutral host services. The business would then lease the private cellular network and associated NHN access capabilities.

- A third-party service provider can install and manage a private cellular network on behalf of the business. The company can then lease access to the cellular network and negotiate NHN access to one or more MNOs.

The different models vary when it comes to who controls, who pays and who maintains the network. Ultimately, it comes down to what the business needs and the level of operational control required.

So, what now?

For organizations looking to benefit from neutral network networking, there are several key questions to consider such as:

- How many cellular networks need to be supported?

- What type of coverage is required and where?

- Will the network also serve as a private cellular network?

- How many users, devices or IoT systems will access the network?

- What type of traffic will run over the network?

- Can the network be easily deployed and operated by existing IT staff over what’s in place?

Because most companies already have a Wi-Fi infrastructure in place. The wireless LAN can serve as a useful tool in determining the number and placement of small cell radios. Because small cells operate at higher power levels, a single small cell radio can supply the equivalent coverage of three-to-five Wi-Fi Access Points indoors and up to 10 Wi-Fi access points outdoors.

As mobile usage continues to soar, neutral host networks are poised to have profound and disruptive impact on businesses looking to increase productivity, cut costs and simplify IT operations. In 2023 look for neutral host to be the killer application as new private enterprise wireless services emerge.

Rajeev Shah is the Co-Founder and CEO of Celona, a Silicon Valley-based pioneer and innovator of enterprise 5G LAN solutions. With over 20 years of enterprise and carrier wireless experience, Shah held executive positions at companies that include Federated Wireless and Aruba Wireless.