The IoT hardware market has, suddenly, shrunk – in order to expand, and to rebalance the western power-play. So say market watchers, reacting to the twin acquisitions this week by US-based chipmaker and Semtech, which has confirmed a deal to splurge $1.2 billion on Canadian outfit Sierra Wireless, and Italian-American IoT module maker Telit, which has agreed a share-exchange for the IoT assets of French industrial firm Thales.

The Semtech deal is, arguably, the most interesting, on the grounds it unites non-cellular and cellular IoT – in the form of LoRaWAN and NB-IoT / LTE-M, noisy neighbours in the old IoT hood – under a single roof. It also has the non-cellular specialist, owner of the LoRaWAN protocol, as the alpha in the transaction. Which shows, at once, how powerful the top-feeder in the unlicensed IoT ecosystem is, and how crucial its opposite cellular-tech is for the future.

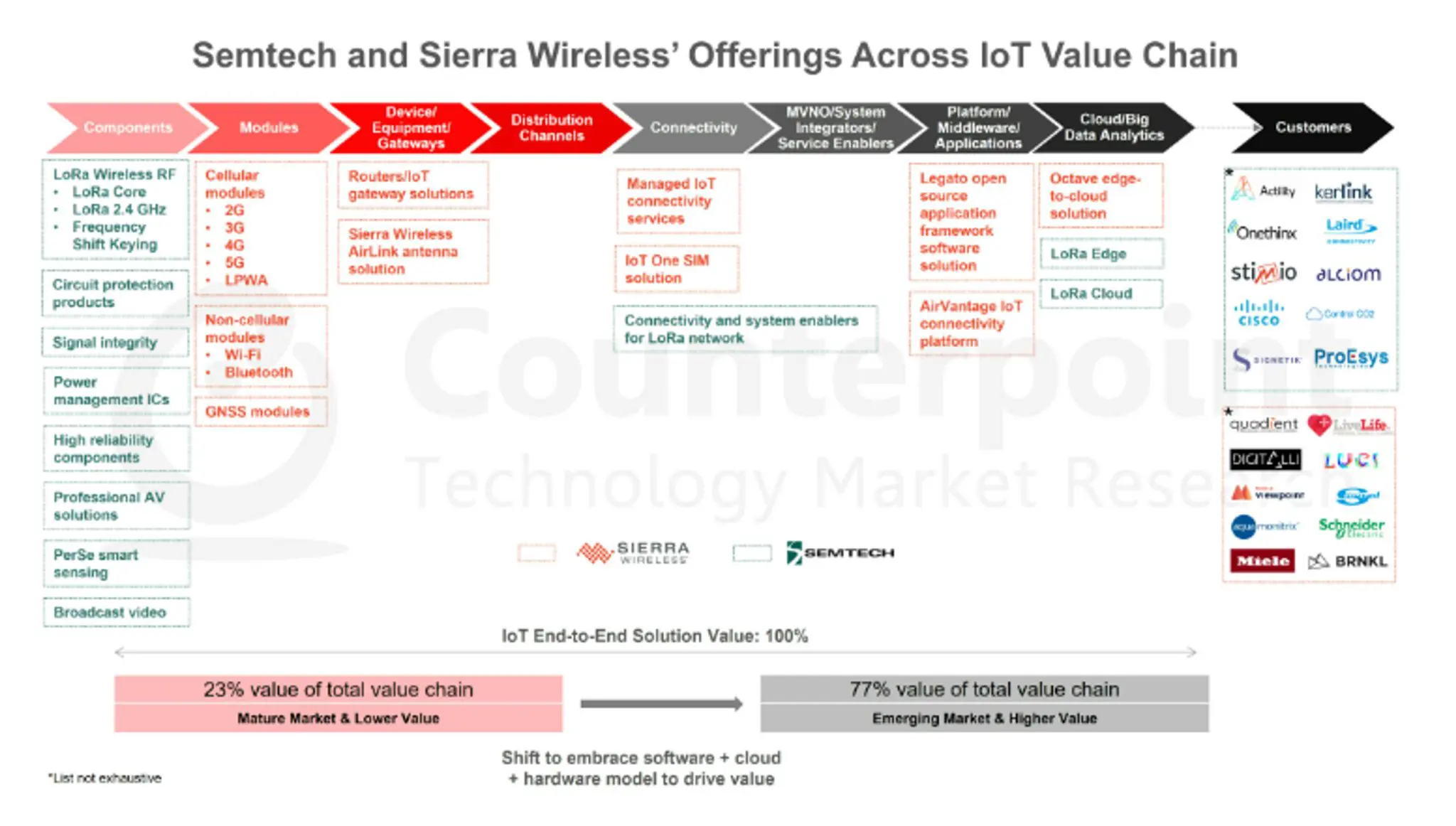

Neil Shah, partner at Counterpoint Research, calls it a “surprising acquisition”, which shows the importance of cellular IoT to the non-cellular brigade – “to complement and catalyse the proprietary LoRa IoT ecosystem”. (The below graphics are his.) Sierra Wireless is one of the world’s largest (“top 10”) IoT module vendors, he notes, with a “thriving” gateway and services business to boot. It is focused squarely on 3GPP-devised cellular technologies, including LoRaWAN-like NB-IoT.

He reflects: “It means Semtech will no longer be just a horizontal solution provider… but a more vertical player to expand into module space and also gateways and cloud services. It offers Semtech the scale to offer a comprehensive IoT platform solution from chip to cloud, blending cellular and LoRa/LoRaWAN… It cements LoRa’s place in the wireless IoT space as a fallback option for multiple advanced 4G- and 5G- based combo IoT solutions.”

He adds: “[Hybrid] cellular-plus-Lora industrial applications – such as security, smart campus, smart factory, and private networks – will be a big opportunity for Semtech.” There were a few minor warnings, and wonderings. Shah suggested Semtech would do well not to rock the LoRa/LoRaWAN boat, which is buoyed by a tight-knit developer ecosystem. “It needs to be careful to not disrupt the standalone LoRa ecosystem partners and customers,” he said.

He adds: “[Hybrid] cellular-plus-Lora industrial applications – such as security, smart campus, smart factory, and private networks – will be a big opportunity for Semtech.” There were a few minor warnings, and wonderings. Shah suggested Semtech would do well not to rock the LoRa/LoRaWAN boat, which is buoyed by a tight-knit developer ecosystem. “It needs to be careful to not disrupt the standalone LoRa ecosystem partners and customers,” he said.

The what-if trade-off is how LoRaWAN slots into the cellular IoT line-up, and whether NB-IoT is knocked out in the process. Sierra Wireless has a decent (possibly declining) line in low-end NB-IoT based cellular IoT gateways, and, while a case can be made for a complete-not-compete symbiosis with LTE-M, LoRaWAN and NB-IoT appear, on paper, like techno doppelgangers. “It could dent some of the opportunities for NB-IoT type applications,” says Shah.

Matt Hatton, founding partner at Transforma Insights, in a long blog post, published here, counters: “Sierra Wireless has been notable for slewing strongly towards LTE-M, and away from NB-IoT. Its own assessment states: ‘There are no NB-IoT use cases that LTE-M can’t also support’. Transforma Insights disagrees with this analysis, but having Semtech/Sierra Wireless as a strong advocate for [dual mode] LoRaWAN/LTE-M is a very strong possibility.”

He also raises the prospect Semtech will push cellular-backhaul for local LoRaWAN breakouts, and orientate Sierra Wireless’ production to make an increasing go of public LoRaWAN, already progressing in the LoRaWAN community with options for inter-network roaming, inter-stellar backhaul, and community-based networking adventures with Helium / Nova Labs and Amazon / Sidewalk.

He comments: “Could Semtech launch its own LoRaWAN gateway powered by Sierra Wireless cellular-based backhaul? All the pieces are in place, although how this would play with other gateway manufacturers is unclear. Conversely, might Sierra Wireless focus more… on public LoRaWAN networks? It’s very likely, and provides a boost to public LoRaWAN deployments.”

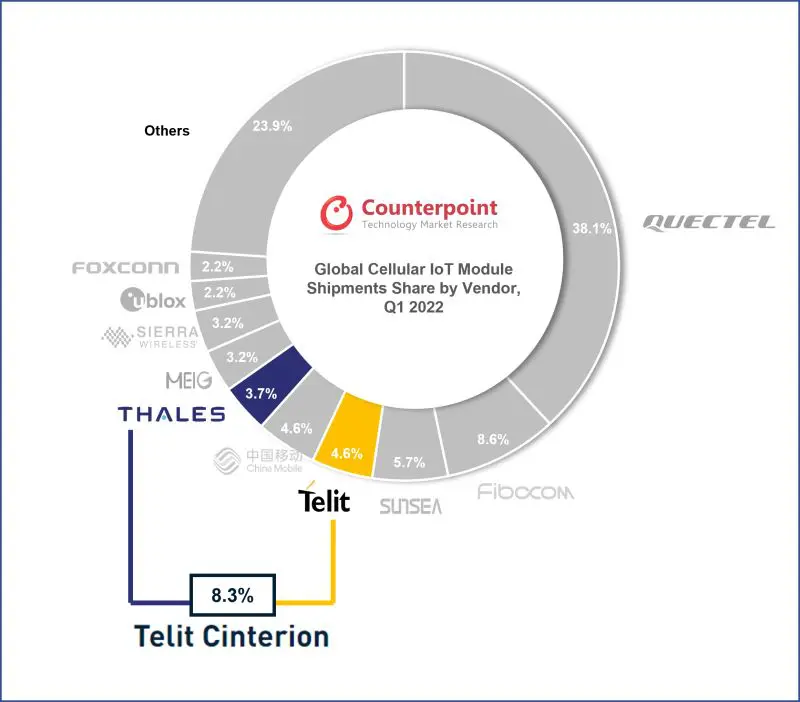

Equally, the response to Telit’s deal for Thales’s IoT division – which will see a conjoined IoT business reemerge as Telit Cinterion (and Telit’s automotive IoT unit spun-out separately), with a 75/25 equity split between the two, respectively – has been greeted by analysts as “good business”, which will create the second largest IoT module vendor on the planet, only behind China-based Quectel.

Retention of the Cinterion brand, incidentally – which has already survived acquisitions by Gemalto and Thales – is also logical. “To rename it would have been to lose brand recognition,” reflects Jamie Moss, research director at ABI Research. He comments: “It makes good business sense, and combines different but complementary competencies. Thales is strong in (LTE-M forebear) LTE Cat.1… [and] Telit is strong in LTE-M and the 5G future of cellular LPWA.”

He goes on: “This creates a company that can lead the way with breakout current-gen cellular IoT tech and emerging next-gen cellular IoT tech. As 2G and 3G networks are shuttered, 2G and 3G module shipments are falling dramatically, and LTE-M is taking their place. 2022 will be a strong growth year for LTE-M, which complements and does not at all replace the still-growing LTE Cat.1 market.”

Ultimately, the two deals are perceived as part of a macroeconomic fightback against Chinese tech. Shah comments: Growth in China, driven operators, has contributed to more than half of the cellular IoT module shipments globally, and is one of the key reasons for the rise of Chinese module vendors such as Quectel, Fibocom, and Sunsea, which have been leaving traditional western vendors like Telit, Sierra Wireless, and Thales behind.

Ultimately, the two deals are perceived as part of a macroeconomic fightback against Chinese tech. Shah comments: Growth in China, driven operators, has contributed to more than half of the cellular IoT module shipments globally, and is one of the key reasons for the rise of Chinese module vendors such as Quectel, Fibocom, and Sunsea, which have been leaving traditional western vendors like Telit, Sierra Wireless, and Thales behind.

“And they are behind on every score – in terms of scale, experience, technology, partnerships. While the IoT industry is still in its infancy, along with the new 5G era, there is a need for a bigger western or non-Chinese vendor to maintain the balance. With the Telit and Thales M&A, it creates a relatively bigger player with double the potential revenue share.”

Hatton says: “One of the features of these announcements is that they affect all three of the triumvirate of cellular IoT hardware makers that dominated the global market as little as a decade ago. Collectively Cinterion, Sierra Wireless and Telit accounted for the majority of IoT shipments. However, over the last decade the Chinese vendors such as Quectel and Fibocom have swallowed the lion’s share of the market and driven down prices a bit further.

“What do you do in the face of shrinking market share? You consolidate or you find new markets. All three have tried, variously, to do both. They’ve all made acquisitions or been acquired and have diversified. Sierra Wireless went into the connectivity space, as noted above, whereas Telit has recently beefed up its offering as a full MVNO. But these further mergers to gain more scale in IoT hardware make sense. They need scale.”

Read more from Matt Hatton at Transforma Insights: Semtech/Sierra, Telit/Thales set ground for new east-west IoT clash (Analyst Angle)