The latest release of the 5G New Radio (NR) standard has, at last, fixed a problem for cellular-based sensor comms with the emergence of a cut-down version of 5G for massive-scale IoT deployments. On paper, anyway; in reality, the news only confirms a waypoint on the horizon, pointing to a commercial pathway in 2024, for existing LTE-based massive machine-type communications (mMTC) to migrate onto single 5G-based networks.

The bigger question is whether it will save cellular-based IoT, as a commercially viable technology to deliver massive-scale industrial change? Because (if one thing is clear), of all the huff and puff about planet-saving future tech, none has been longer-promised or bigger-hyped than IoT – and the cellular market has so far made a hash of it, while more disjointed, more resourceful non-cellular operatives have swooped in, as well as they have been able.

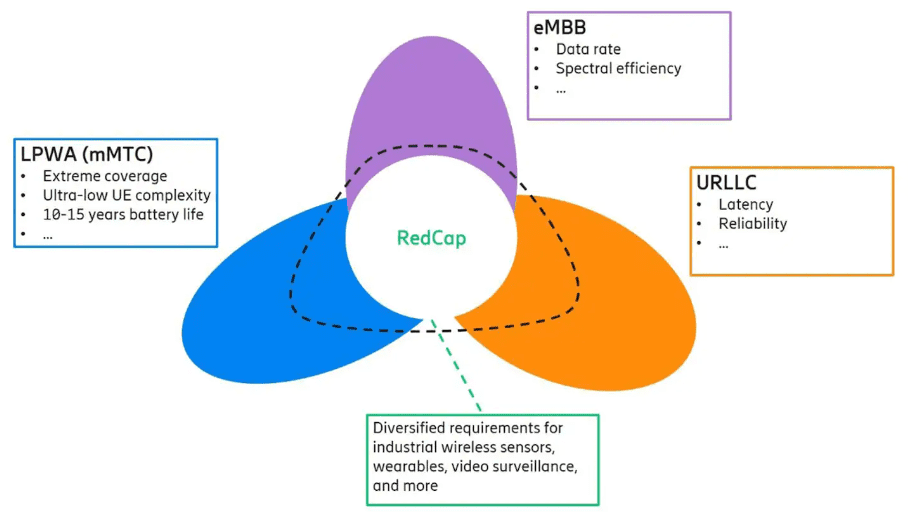

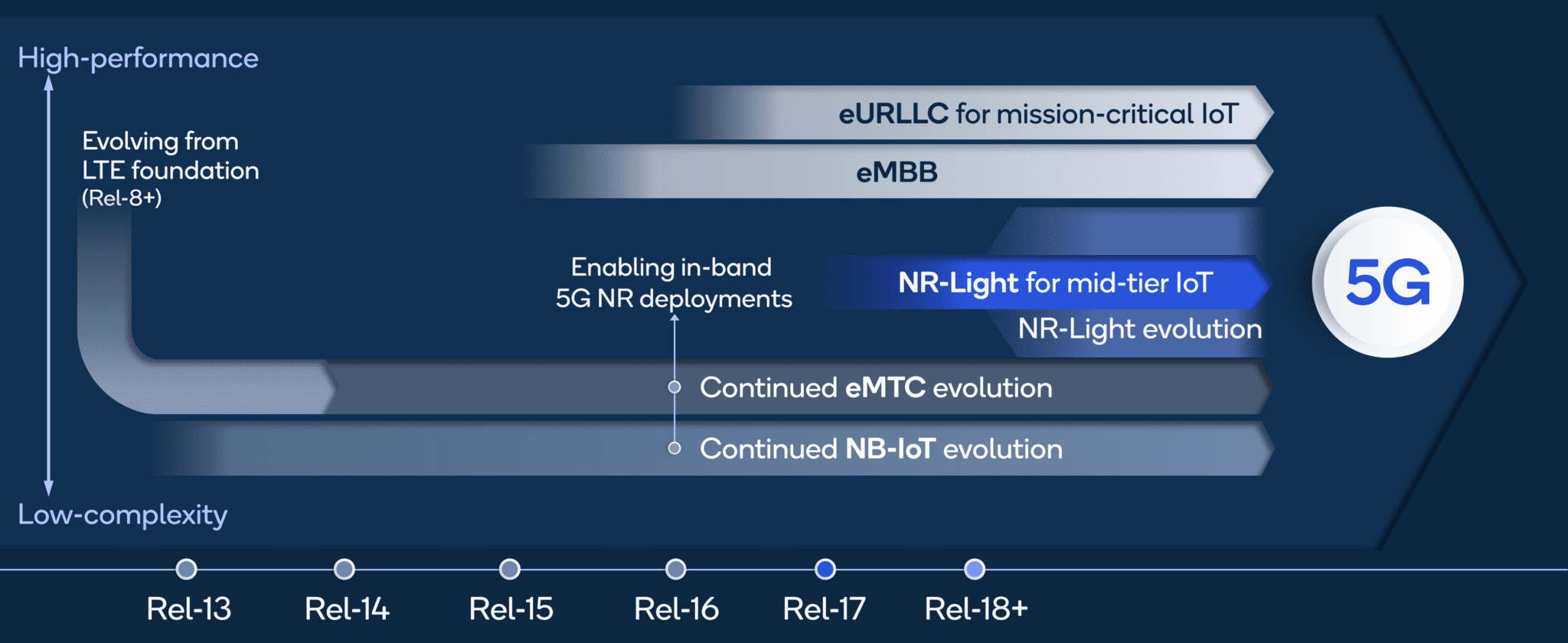

But before we editorialise any more, and before we get squinty about the small print, we should recap; the Release 17 standard, frozen in June, includes a provision for IoT sensors to connect to 5G with significantly reduced network – and therefore hardware, and therefore cost-linked – capabilities. This new specification, called Reduced Capability (RedCap; previously ‘NR-Light’, and variations-thereof, in 3GPP work items), sits provisionally between mMTC and eMBB in the 5G NR power hierarchy.

To add context; it sits two rungs below URLLC, affording the headiest view of IoT comms, in this 3GPP ladder – which is most commonly presented, actually, as three points in a 5G NR family triangle. The thing about these three specification-types, however, is that only two are 5G-native. The twin low-power wide-area (LPWA) technologies underpinning mMTC, the massive (machine-type) IoT segment, are LTE-based, albeit compatible with 5G NR radios.

And only these technologies, ultra low-power NB-IoT and 2G/3G-like LTE-M, offer support for stripped-back, dirt-cheap, long-life, mega-scale IoT. So, as it stands, and going forward, cellular IoT needs LTE to make a fist of traditional IoT, at all – and it has a fight on its hands with well-entrenched non-cellular standards like LoRaWAN in unlicensed bands. But RedCap promises to fix that – somewhere down the line, as always with cellular.

RedCap is designed, ostensibly, to make this familiar triangle of 5G NR family-tech into a venn diagram (see above), where it overlaps with the other three operating scenarios. This is actually Ericsson’s diagram, taken from a full-blooded writeup about the new NR release. In terms of capabilities, it is supposed to plug a hole. Ericsson comments: “RedCap is positioned to address use cases that are today not best served using eMBB, URLLC, or LPWA (LTE-based mMTC) solutions.”

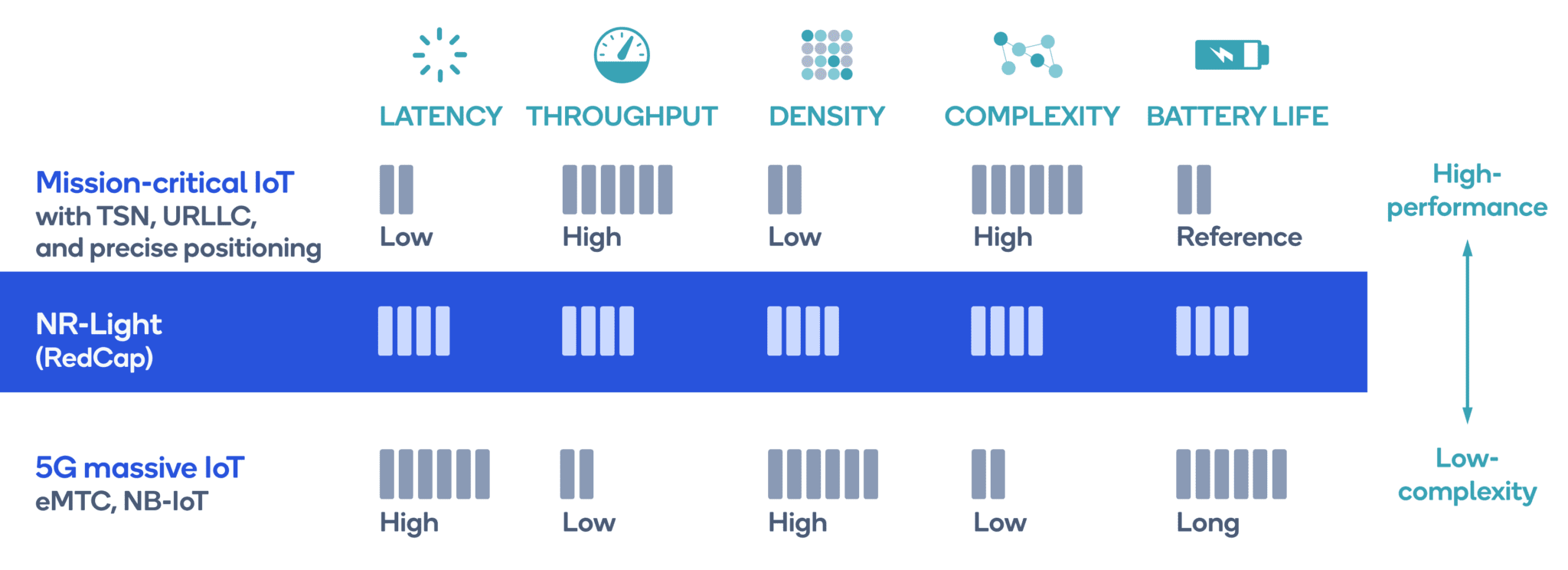

RedCap is positioned “as a lower segment than eMBB… but higher than LPWA,” it writes in a blog post. Huawei says the same (exactly, word-for-word, perhaps lifting from the same 3GPP messaging). Elsewhere, Qualcomm slots RedCap in between (see image below) mission-critical IoT, served currently by consumer-like NR-based eMBB, but shortly by developing URLLC provisions, and massive-scale IoT, served by non-NR NB-IoT or LTE-M (or non-cellular LPWA tech like LoRaWAN).

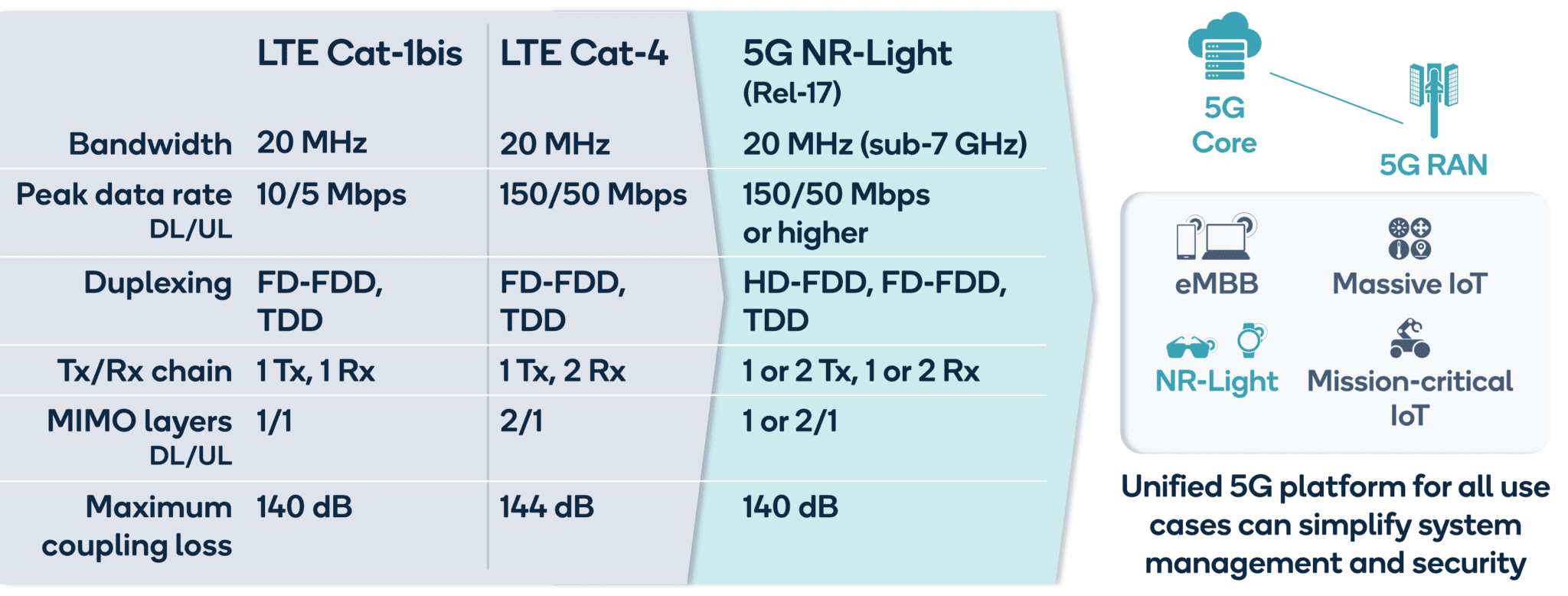

Analyst house Omdia calls RedCap the ”big missing piece of the 5G IoT puzzle”. But operationally, it is closest to LTE-M (see Qualcomm graphic below), described as “the most popular and widely used cellular IoT standard” by Omdia – and therefore to 2G/3G, still being used for legacy cellular M2M devices. Certainly, many of the use cases sound the same: the standard 3GPP line is about industrial sensing, video surveillance, and wearable technology.

Telit writes in a blog post: “In some ways, 5G RedCap seeks to cover the needs currently met by LTE-M [Cat 1 through Cat 4]. It’s a light version of the 5G standard. 5G RedCap is designed for use cases in which ultra-low latency isn’t essential, but reasonable throughput is needed to ensure data flows for next-generation applications can be supported. It’s expected to be useful for wireless industrial sensors, video surveillance and smart wearable technology.”

Omdia suggests LTE-M-level pricing for NR-based IoT gadetry, to serve similar mid-level IoT use cases, is just the ticket for the cellular industry to make a sustained go of massive-scale sensor networks. It notes a 10-time (1000%) delta between LTE-M and eMBB module costs, as it stands, going from $30 to $300 per unit, respectively; there is no NR-provision, until now, for such “mid-speed (IoT) applications”, it says.

It writes: “The price gap between the 4G and 5G modules is one of the essential factors – if not the most crucial factor – that will continue to limit 5G adoption in IoT applications… To reduce the price gap… there is a need to develop a 5G standard with fewer features and reduced hardware complexity.” RedCap is the answer, it says. “Without RedCap, 5G NR is missing a key technology piece for IoT.”

Qualcomm talks, as well, about “applications in smart grids, environmental sensors, predictive maintenance, utility meters, high-resolution surveillance, and more”. Which sounds very LPWA actually – and probably more NB-IoT and LoRaWAN, even, than LTE-M. Nevertheless, the talk about its near-term (post 2024) usage is all about plugging a tech/app gap; Huawei, say, references “mid-tier applications… with capabilities between these extremes”.

Ericsson is good on the technical achievement, around what has been jettisoned with RedCap: bandwidth requirements, say, are reduced to 20 MHz and 100 MHz in frequency range 1 (FR1; 4.1 GHz to 7.125 GHz) and FR2 (24.25 GHz to 52.6 GHz); the number of ‘receive branches’ is reduced, also, meaning a reduction in receive antennas; the max number of downlink MIMO layers, equal to the number of receive branches, is also reduced.

There are other innovations, too, to make 5G viable for low-power IoT sensors apps, notably with more flex around modulation order, duplex operation / support. Ericsson writes: “Substantial cost and complexity reduction can be achieved… [to] establish RedCap as a distinct device segment from eMBB or [URLLC].” The upshot is lower device complexity, which results in lower cost, longer life, and enough grunt to get most IoT jobs done.

But the message about hole-filling might be considered a smokescreen; most of the industrial IoT applications linked with RedCap are variously quite-well served, from a technical point of view, by LPWA network solutions using NB-IoT, LTE-M, or LoRaWAN – or Sigfox or MIOTY (TS-UNB), or whatever else. And the 2024 time-frame for Release 17 level RedCap-equipped IoT devices to appear gives the rest of the market room to manoeuvre, also.

And with key RedCap advancements – including higher transmission rates, advanced positioning, ‘sidelink’ near-field comms, and even support for unlicensed spectrum – only defined in Release 18 (see Qualcomm graphic below), coming out in the second half of the decade, the IoT game for the cellular crowd remains a long haul. The big short-term (2024) boost is industrial enterprises, including those deploying private 5G, will be able to get two-for-one on IoT networks.

Omdia explains: “Enterprises looking to deploy a mix of… high-performance and mid-speed devices must deploy two [5G and 4G/LTE] separate networks… [which] creates extra cost and complexity. There is no upgrade path for existing… [LTE-M] devices to migrate to 5G NR. Since most operators do not have immediate plans to phase out 4G networks, this issue is not a primary concern. However, this issue will become a more critical factor in a few years.”

So really the motivation with RedCap, as Omdia indicates above, is to migrate new and legacy M2M/IoT contracts to 5G NR in time for sun-setting LTE and, with it, NB-IoT and LTE-M. Qualcomm states: “As the 5G evolution continues, there will come a time in the future when communications service providers start to migrate away from 4G toward 5G. With this in mind, 5G NR-Light becomes the platform of choice for future-proofing new mid-tier IoT designs.”

Or does it? It still sounds like a long way off – like another future cellular tech without an ecosystem, or an easy way to sell, and a track record that does not bring much optimism.