The big news out of Hannover Messe a couple of weeks back was that there was no news – not from Siemens about private 5G, anyhow. Not real news, at least; just word that its new private 5G system – incorporating home-made 5G core and radios – will be ready in 2023. And a message, as well, that the whole industrial 5G story is over-egged, as Siemens always said, and that its timing was right all along.

In the months before, the sense was Siemens might use the big Industry 4.0 fair to formally enter the 5G networking fray; in the end, it was just to show a prototype system, plus new support for Profinet, the popular layer-two protocol, in its new line of Scalance MUM853-1 industrial 5G routers. Enterprise IoT Insights caught up with Sander Rotmensen, director of industrial wireless communications for the firm’s digital industries business, to dig a little deeper.

He responds: “We will launch in 2023. Which is pretty big news so far as we are concerned. There are no more details than that. There are more trade shows to come, where we will release more information. But this is a pretty big step for us – from talking about it, to showing it, to announcing its release in Germany.”

But some new information does (did) come out of the conversation, principally about its subsequent rollout beyond Germany. The message is Siemens will put focus on the Industrie 4.0 market at home, and let the rest of the world work out how whether or not it aligns with local spectrum availability in Germany, at 3.7-3.8 GHz, going a little lower, as well, before it looks up again, to see if it is required to get its head down again, in order to address everywhere else.

Rotmensen says: “We will cover other countries when they have spectrum available for enterprises compatible with our RAN, which covers 3.6-3.8 GHz. If other countries jump on different spectrum, then there is going to be work to do. We can’t just install it in every country. The focus to start with will be on Germany.” Is the plan to expand RAN compatibility elsewhere, eventually? “Over time, for sure. But the question is really, when will other countries release spectrum for enterprises? Because we can’t go many places with 3.5-3.8 GHz compatibility, as yet.”

Some other questions; will Siemens integrate Wi-Fi into the new system – as a multi-radio technology solution, as others are doing? “We treat them as separate technologies,” explains Rotmensen. “We have Wi-Fi 6 devices in our portfolio, and available now – the latest Wi-Fi 6 devices is a more compact version of the one we had before. But they are different and separated, for now. Over time, they will grow together of course, because both will be used in factory venues – maybe 5G for new mission critical applications, and Wi-Fi for existing applications.”

He adds: “There is a much better ecosystem of Wi-Fi end devices at the moment – because you can still connect legacy Wi-Fi standards to Wi-Fi 6, for example. So they (Wi-Fi technologies) will go hand-in-hand, but Wi-Fi and 5G will start to go hand-in-hand as well.” With its Scalance line of Wi-Fi and 5G devices, he noted the similarities already with their industrial design; the only difference is the number of antenna connectors on the 5G unit (two more).

He says: “Put them side by side, and you see there is very little difference – just the number of antenna connectors. So it is very easy for industrial end users to work with one mechanical design; they just order strawberry or vanilla, and design for their customer. It is the same with antennas, beyond just the end devices. The Wi-Fi and 5G antennas in our portfolio are the exact same; you can use 2.4 GHz and 5 GHz [for Wi-Fi], and 3.4-3.8 GHz [for cellular].”

What about the 6 GHz band, which is being opened up with Wi-Fi 6E and 7? ““We’re looking at that, of course. There needs to be some closure with standardisation still. There are some gaps, still, that need to be filled for it to be useful in industry. But we’re looking at it, and it’s a very interesting topic.” And what about in terms of use cases; does Siemens expect Wi-Fi crossover with the newly-prescribed ultra-critical cases that are supposed to go on 5G?

“It is hard to predict. It depends on the rollout in IT. For industry, it is all about dedicated licensed spectrum. With the additional spectrum in the US, where 1,000 megahertz of extra spectrum will come available, it is likely that some will be set aside for mission-critical industrial applications, which is untouchable by IT. But it will really depend on each company’s policy,” responds Rotmensen.

“In Europe, we have just shy of 500 MHz of spectrum for WiFi 6E and 7. So it might be a little bit more difficult. But maybe a lot of users will move from 5 GHz into 6 GHz. But the key for mission critical applications is licensed spectrum, like we have with 5G. It is always going to be better. We will have better opportunities with WiFi 6E and 7, but time will tell how good they really are.”

For now, the “most important thing” for Wi-Fi, from a Siemens point of view, is its collection of Wi-Fi 4 devices, which come with support for Profitnet (a portmanteau of process-field-network, commonly stylised as PROFINET) as standard, and enable fast handover between radio cells. The inclusion of Profinet, Siemens’ preferred layer-two OT protocol for managing time-constrained two-way comms between SCADA systems and industrial machines, in its Scalance MUM853-1 industrial 5G routers is a big deal, reckons Rotmensen.

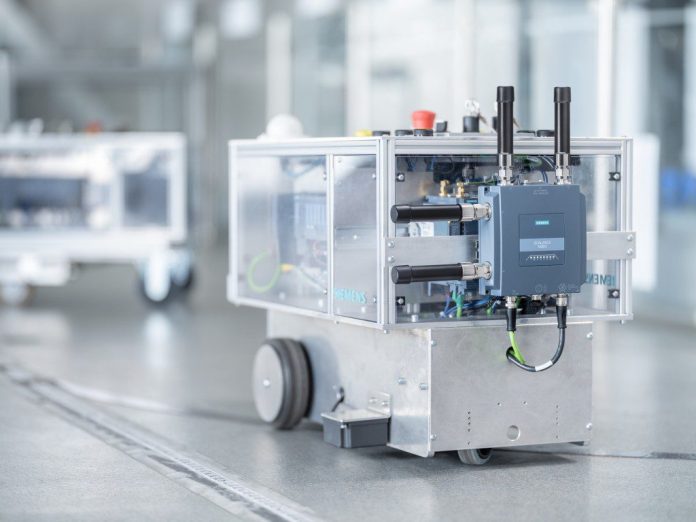

He explains its importance for managing automated guided vehicles (AGVs) on a factory floor – versus straight layer-three comms over a private LTE network, for example; already being used in early-stage proofs and small-scale deployments for running AGVs, by retro-engineering the same Virtual Extensible LAN (VXLAN) trick Siemens is offering out-of-the-box, or via some other “classic VPN tunnel” (as described below).

“If your AGV or AMR is only connecting every so-many minutes, to automatically go to this position and grab this item, then you don’t necessarily need Profinet. But if you have a central controller, which is managing safety across an entire factory, then Profinet and Profisafe will give you benefits. Because you need real time behaviour to ensure the emergency stop works on time, for example. That is where Profinet plays a role,” he says.

Some clarification, please; so, as it stands, any industrial automation or control over an advanced LTE or Release 15-level 5G network is not running on a layer two protocol? And therefore is not offering the kind of real time dead-man stop control that industry wants, ultimately? “Either that, or they are using Profinet with a tunnel solution; maybe they have a VPN tunnel between. But the VXLAN protocol we use is much more feasible to connect multiple devices,” he explains.

“For example, we can have a tunnel between a Scalance SC600, which is a hardwired or Ethernet device, on the LAN side, and connect up to 16 MUM routers over the wireless network at the same time with just one setup. So that is more convenient, and it is also more performant as a separated VPN tunnel. But there are of course multiple ways of doing this. We are just the first one putting this in a standard off-the-shelf product as far as we are aware.”

Right; so when other 5G device vendors talk about Profinet and Ethercat, they are using some other tunnel mechanism – so far as you are aware? “It is either VXLAN or a tunnel. But the biggest problems are the 5G end devices. There are no end devices with a layer-two capable chipset currently. And so you need something on top – and the something-on-top we’ve selected is VXLAN because it has the most performant and easiest to setup.”

But, so far as Siemens is aware, there is no other Release 15 device with this built-in? (We ask because a number of device – and network – vendors were showing layer-two controls on 5G gateway devices at MWC, a couple of weeks prior to Hannover Messe.) “Not as far as I am aware. There is lots of stuff about Profinet and 5G, but they are all proof-of-concept,” comments Rotmensen.

The back-and-forth continues. Will Release 16 chipsets have this Profinet compatibility embedded? “I hope so. But that is up to the chip vendors.” Are there other layer-two protocols we need to think about? “There are definitely others, but Siemens is very focused on Profinet, of course.” In the end, is Release 16 the magic drop for industry, where 5G starts to get real? “Yes, I think so. 5G really starts for industry with Release 16.”

He clarifies (necessarily, given the fact Siemens is going to market in 2023 with a Release 15-level private 5G system): “There are possibilities with Release 15, of course. Hence why we have brought out these Release 15 devices, and hence why we will deliver a Release 15 network. So, there are definitely interesting things in there, but it really starts going with Release 16 – with even more exciting features in Release 17 and Release 18, which is when we have the most important things covered, I hope.”

Siemens cuts a relaxed image with private 5G; it is in no rush, it seems, happy in the knowledge that industrial 5G has been over-hyped by non-industrialists, and that even the 2023-drop of a late Release 15 system will capture the early Industry 4.0 market, albeit only in one European country. “Release 18 is when industrial 5G starts to fulfil all the promises 5G vendors have been putting out there over the last years,” says Rotmensen.

But just explain again; why, if there is no rush, release a 15-era system at all? Why not wait for a full-fat industrial 5G system that really motors? “It has to do with availability of the technology, first of all. The first Release 16 end devices will come in early 2023, but they won’t have all the industrial features. Just because the standard says the features are there does not mean they are – it doesn’t mean you can actually create products out of it.

“Because the chipset vendors also need to include these features. What we want to ensure is that customers get the feel of it. I mean, you could dub something as Release 16 because it has a couple of Release 16 features in there, even if it is mostly Release 15. But I don’t think that is right to do. We need to be honest with our customers about how industrial 5G will arrive. We need to call it Release 16 when it fulfills Release 16 features.

“We are being a little bit more careful, and more sensible, I would say, in the way we communicate around this. Because over-promising is never good. We are holding back, a little bit. We are focused on the industrial requirements, instead of just selling the latest as the greatest. Because if the industrial benefits are missing, then what’s in it for industry?”

And just on this migration from Releases 15 to 16 and so on, and from eMBB to URLLC and suchlike; is connectivity the killer app in the end? Is there an argument to suggest the (industrial) market gets sidetracked by TSN and 6x9s reliability? And that actually, as Siemens is doing with Release 15 devices and networks, there is a good platform of use cases just with eMBB-style connectivity – just for Microsoft Teams and PTT, and getting workers talking with machines to an extent?

Is there a point to make that those things are valuable in themselves – and that, actually in the end, the Release 16 industrial features are quite niche, even for industry? Is that right or wrong? Rotmensen responds: “It depends how you look at it. It could be right. But it is also not completely right. Because you still need to serve your niches. The goal is to create one network for everything. Which means we need to make sure we combine wired solutions with wireless solutions going forward.

“And today, with wireless LAN in a factory, you find single applications running on single wireless LAN networks. With 5G, it will be possible to run multiple applications in one network. Slicing inside a private network will help with solutions like that. And therefore, fulfilling only 70 or 80 percent of what you could do with the technology is not really justifying the business case. So I think in the end, we need to make sure we are in for everything.”

And finally, is there a sense at the moment that industrial customers, opening-up the 5G box, are disappointed at what they find? “I think industry in-general thinks we are still not where we expected to be with 5G. And I think many customers now think that Siemens was right to be cautious – that what Siemens said, all along, was the reality,” says Rotmensen.

“We were in the 5G Arena at the Hanover fair back in 2019 and all these people were promising the moon and the stars; and we were like, ‘Okay, hold your horses, this is nice in a lab, but wait before you try it in a factory’. We have always been the reality check, and I think that has helped us in our interactions with many potential 5G users.”