European aviation and aerospace firm Airbus effectively headlined the latest Private Networks Forum (PNF), hosted by RCR Wireless and Enterprise IoT Insights, in May, as the premier (the first, at least) enterprise on the schedule. Fresh from a panel with Intel, Qualcomm, and Telefónica, which explained the new industrial scissor movement to tailor enterprises with new layers of 5G and Wi-Fi, the company was back to present its own fittings.

Patrick Castagnino, in charge of connectivity and strategy innovation for digital aviation at Airbus, explained the different applications, making clear Wi-Fi remains strategically important for aviation services, but that dedicated 4G and 5G bring new possibilities. He said: “Wi-Fi is not powerful enough or performant enough. Only cellular works inside the aircraft; [only cellular] connects everywhere, and any worker – across multiple manufacturing campuses.”

It was a carry-over from the previous session, which said the same, but worked as an essential start-point for the Airbus tale, too – just because the path to digital transformation for Airbus, like for others in the aviation game, vaults beyond existing networking infrastructure. “We started with a proof-of-concept [in Toulouse] four years ago with 4G, for multiple reasons – firstly to combine Wi-Fi and cellular,” said Castagnino.

The motivation to test out cellular was to raise security and performance in its connectivity estate, he said – “compared to Wi-Fi”. It was not, he made clear, just for the sake of it. “It depends on the use case. We use Wi-Fi in static mode and 4G/5G in other use cases – when we need full connectivity and roaming across the site… [But] with a static environment or machine, Wi-Fi is [already]l very well adapted, [and] we are deploying Wi-Fi 6 [as well].”

The quotes are taken from across the PNF presentation. He went on: “We are using them in combination – the best tech for our needs, [every time]. 4G/5G [ensures] continuity of service [when roaming between access points]… [and is] key for mission critical comms, as well.” Mobility, coverage, performance, in other words; with Wi-Fi ever more adept at serving familiar point solutions, in factories and airports, other indoor enterprise venues.

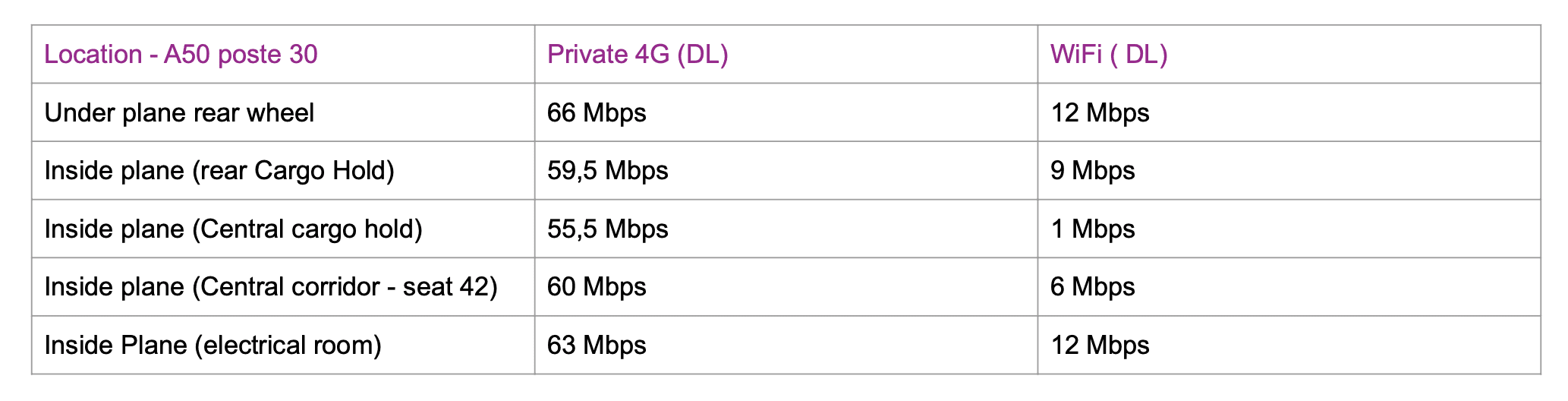

A slide late on (see image) compared downlink rates for private 4G and Wi-Fi in a 150 square-metre hangar, populated at any time with up to 10 aeroplanes; it said 4G is steady at 55-66 Mbps in and around the aircraft – going from outside, under the wheel, into the cargo hold and control room – while Wi-Fi vacillates between 1 Mbps and 12 Mbps, tops. “Private 4G is much better than Wi-Fi,” he said, pointing to Wi-Fi bounce in metal rooms and vehicles.

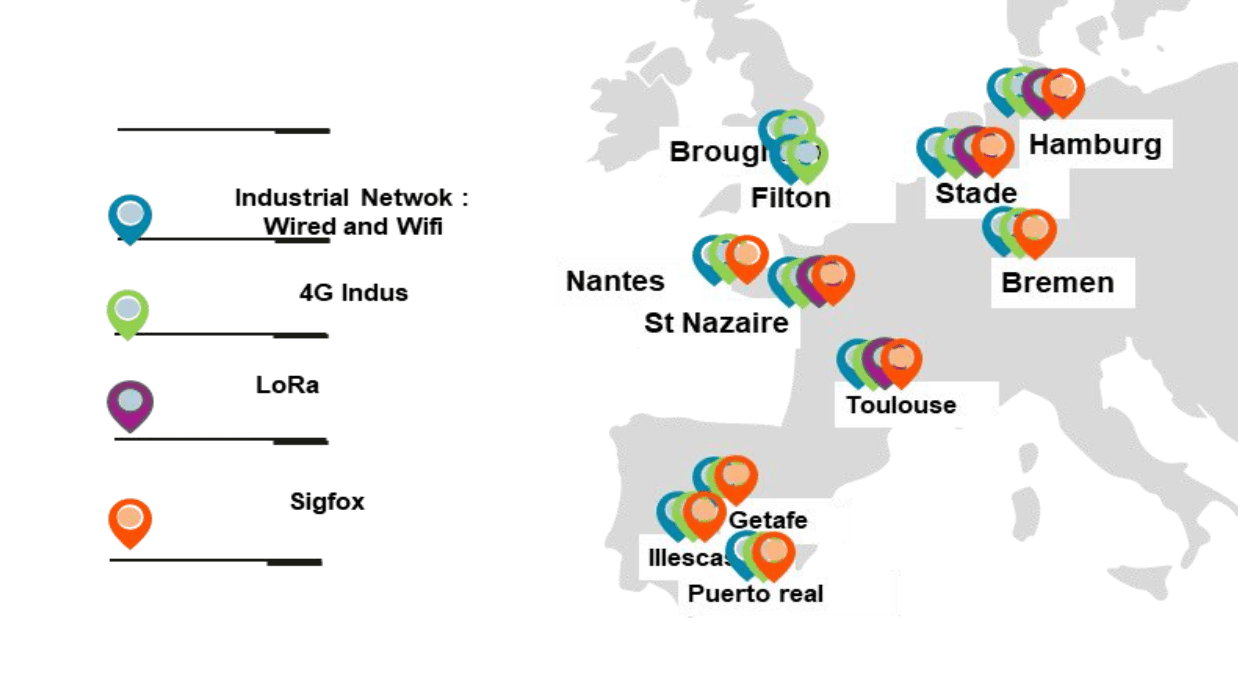

The presentation ran through key use cases for the airline industry, as Airbus has propped them up over the past few years on Ericsson networking gear across multiple sites (seven) in both Toulouse (4G, going to 5G NSA) and Hamburg (5G NSA), in France and Germany, and is to replicate in Spain and the UK “in the next months”. Castagnino said his company’s private 5G pursuits are predicated on the fact these markets are difficult to rationalise with public network infrastructure.

“The main challenge [is] regulation and spectrum,” he said. It is a problem for private network deployments too, just because, in the case of France and Germany, where Airbus has focused its initial efforts, local regulators have made spectrum available at 2.6 GHz (Band 38) and 3.7 GHz (Band 43), respectively. The workaround has been to develop a dual core, managed centrally in France. “It was a big challenge to harmonise our core network,” he explained.

But the result is the right one, he added. “That’s how we will manage the full European campus.” The reference, here, is to centralised management of multiple sites across Europe, including the forthcoming rollouts. SA upgrades will follow the geographic expansion; the upgrade path is less urgent, he noted, because 4G works very well. “Why [are we still using] still 4G? Because 4G is fully adapted to 95 percent of our needs,” he reasoned.

Airbus’ decision to go it alone, separately from traditional telco operators, is down to security, which remains the north star for digital change in just about every Industry 4.0 scenario. “The data has to be stored on our campus without external connectivity. That is one of the main reasons for selecting private networks.” The only data flowing out of is network data, for network control; all the industrial data remains locked into the edge networks.

Airbus’ decision to go it alone, separately from traditional telco operators, is down to security, which remains the north star for digital change in just about every Industry 4.0 scenario. “The data has to be stored on our campus without external connectivity. That is one of the main reasons for selecting private networks.” The only data flowing out of is network data, for network control; all the industrial data remains locked into the edge networks.

But back to the use cases, which are the things on Castagnino’s mind, actually. Private cellular is being used already in Toulouse and Hamburg for site surveillance, flight-to-ground data offloads (“95 percent of the volume”), quality inspections, automated guided vehicles (AGVs), collaborative robotics, digital twins “the shop floor with digital mockup”, private mobile radio (PMR), and asset tracking (“Supply Chain 4.0”, including via international roaming).

Airbus is running the whole gamut of Industry 4.0 cases, then, mostly on 4G for now. “Connectivity is everywhere in the aviation domain,” noted Castagnino.