Right, let’s see how good my notes are two days later; shortly following a shot-across-the-bows from a top analyst at a London private 5G event (Omdia’s Pablo Tomasi at Private Networks in a 5G World), Sweden-based Telia and Germany-based Deutsche Telekom, on behalf of the rest operator community, adjusted their hats, set out their maps, and never once looked fazed by the squall in the market about their right to play at Industry 4.0.

Say what you want, but serious-minded mobile operators have read the room, at least. They have sat across the table from hard-nosed industry, heard the same questions about their suitability, and responded appropriately – just by figuring it out, together. They recognise that the demand-side is gnarly and angsty, and the supply-side is busy and buzzy, but they also sound measured, deliberate, realistic – and not at all entitled, like some might say.

These were the impressions from Telia and Deutsche Telekom, as they came on deck following the bow-shots from Tomasi – and all the rest of the multi-sided, mutter-mouthed industrial 5G market. The operator set could not have asked for better captains on the day. Henning Huuse, manager of 5G business development at Telia, wanted to talk about his company’s work with Norway’s premier industrial park; the park-chief questioned Telia from the start, he explained.

It was a disarming gambit; here was a telco that knows, by experience, exactly how it is perceived – by the control freaks of industry, the big beasts of OT, the mega bots of IT, and all the upstarts of telecoms. “Two years ago, the CEO [of the industrial park] said, ‘This is way too important to leave to telcos. We need our own spectrum – to do it alone”, said Huuse. “And we took that as an invitation.”

The doubtful client in this remembered dialogue is the Herøya Industrial Park in Telemark, 150 kilometres south of Oslo, one of the biggest industrial parks in Norway, with a busy port and fresh water supply, where industrial companies like Air Liquide, Equinor, Caverion, Nippon Gases, Nordic Electrofuel, Ranold, Vianode, and Yara Porsgrunn have made a home. Huuse’s interlocutor was Sverre Gotaas, chief executive of the Herøya park.

Telia’s initial response was just to interview his tenants. “That was the key – to understand the needs of the different companies on site. And when he said telcos don’t understand industry, he wasn’t wrong. We’re good at telco stuff, and they’re good at industry – and they wanted to know how to be more efficient, how to improve security, how to make more money.” Anecdotally, a Telia poll said most wanted 5G for AGVs and industrial IoT (80 percent, both).

Video analytics, digital twins, augmented and virtual reality (AR and VR), were also commonly cited (by 60 percent, he said); asset tracking, too (40 percent). But the deal-breaker was Telia’s multi-pronged attack to stand-up industrial-grade cellular for every use case; a win that contradicts Tomasi’s suggestion in the intro session that operators were over-complicating their private 5G offer, and muddying their private 5G specialism.

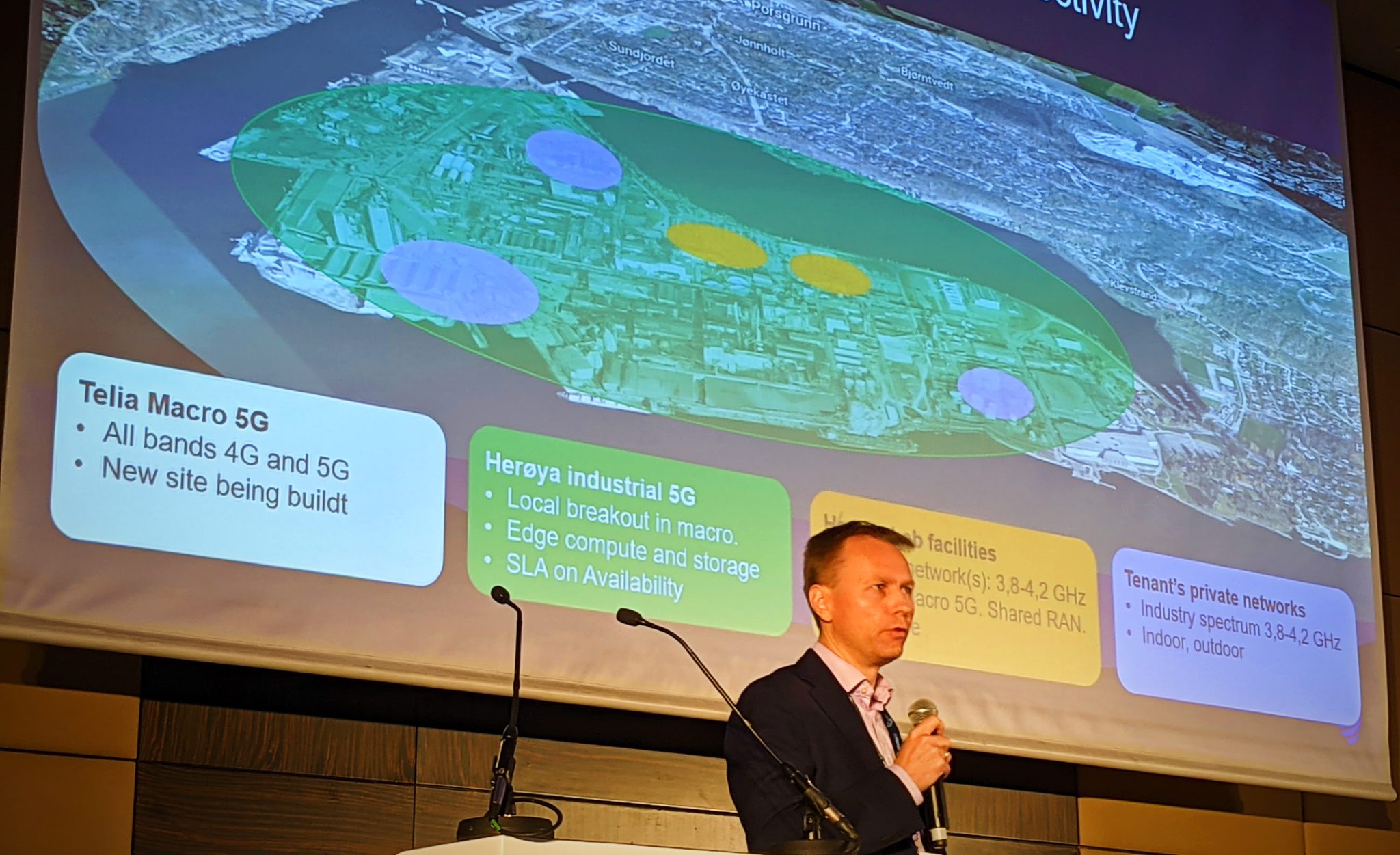

Telia drew up a plan for three layers of private coverage, on top of its general-purpose public network (the white sphere over the park-map in the above image). These included: a virtual-private umbrella layer (green sphere) across the site with a local core and edge-based macro RAN reinforcement (and SLAs on availability); private networks with shared RAN (in orange) in local 3.8-4.2 Ghz spectrum; and all-private tenant networks in the same band (in purple/pink).

“That picture changed the CEO’s mind, after saying he would not work with telcos. And you see from it the need for orchestration. Because you don’t want wireless anarchy on a site like this. You don’t want tenants to build networks that don’t work well together,” said Huuse. He explained, briefly, their respective roles; from estate-owned site-wide safety and security monitoring, and backup service, through to high-stakes Industry 4.0, optimised for each tenant.

The pair have just formalised their partnership. “A mutual understanding between industry and telecoms is key. That is the way we turned around the CEO of the company, and became friends… We have an ambitious plan, to be the most advanced site for industrial connectivity in Europe. Those are his words, and he wants to do it together with Telia,” reflected Huuse.

The idea is to manage “advanced connectivity as a competitive advantage” for the Herøya Industrial Park; to drive operational improvement (“increase security, automate stuff”), and also to make the park itself a better business. “It already has… a good location, port access, fresh water, and it needs good connectivity, as well – to be at the cutting edge. That way the park is more attractive, and makes more money from leasing land.”

There is talk about bringing “new business models to monetise connectivity”, also. But the key to Huuse’s address was this idea of enterprise-led wireless anarchy and operator-managed wireless order. He explained: “We can separate on the spectrum side, but also on the radio planning, and how to place radios, and the output effect of these things. That is when it becomes interesting to work with a telco. Because this anarchy will come when everyone does their own stuff, and caters only to their own business. That is why orchestration is important.”

He added: “Is this market for telcos? Definitely. But not exclusively. Many other companies can join the market, too. But as telcos, we feel we have the competence to take that orchestration role, and provide private networks as-a-service.”

Twenty minutes later, Antje Williams, senior vice president at Deutsche Telekom, was on stage, preaching patience – which is a revelation in itself; for a telco to keep its head, while all around rival suppliers are losing theirs (and blaming it on telecoms). She made a bunch of hype-righting points: notably, that private 5G is, effectively, an all-China market for the moment, with industry incentivised by the government to install 5G (from Chinese suppliers).

By contrast, just 15 percent of (about 110) ‘vertical’ spectrum licencees in Germany have so far committed to commercial (or planned-commercial) operations; the rest are doing tests – which ABI Research made clear in a recent Enterprise IoT Insights report is time-limited, with future governmental and institutional funds shortly pegged for 6G. “I see the same in the US,” she said; a statement that will likely get the backs-up of the twitchy CBRS crowd.

So don’t be so easily carried away; scorching CAGR forecasts from analysts start at almost-freezing, she reminded the room. “That is the situation we are in; we have to make sure we go from research to business. At the moment, the number of campus networks is too low for operators to make investments in.” The end of the sentence is scrambled in the notes, but the message is that private 5G is not even a given, without hard work and urgent progress.

There are no (Release 16) industrial-grade 5G devices, she noted. “We started with NSA, and we thought it was a good idea. Customers wanted SA. ‘Okay, but there are no devices – so bear that in mind.’… And we have had a couple of escalations now because they can’t use the network [because there are no devices].” How do you justify a network you cannot attach to? How do you build a market based on a lie? Or so Williams implied, in different words.

It is not because the invention is bad, but because a lot of things have to happen for it to work.” In fact, Williams was talking, here, in the past tense, about the humble washing machine; once a novel piece of kit that no one could plumb and no one wanted – because housewives were proud, or something. It was presented as a management parable, accredited to one Guenther Dueck, an IBM engineer and writer of “ideological and philosophical non-fiction”.

Williams said: “It is still early. We had the impression back in 2019 that it was going to start [quick], and every enterprise was going to buy a 5G network – because everyone wanted to know about it. But wanting to know about something does not not mean the same as wanting to buy something. Do we think that, in the end, every company will have a 5G network? No. [And] we still have to do work, and believe in it and push it.”

It was a candid review, perhaps a little wearied by the fanfare in the market – and a good response to Tomasi’s opposite-bombast about private 5G “fading away” from operators, and a good advert for telcos at large. She addressed the telco-in-industry jibe directly. “You [doubt] whether telcos are the greatest on earth to provide [private 5G to industry], but we have not reached that proven point yet,” she responded.

“We see research upon research, and the only value for operators is with managing networks. We have no hardware. Building infrastructure… lots of companies do that.” She said no more about the land-grab for control over the supply and management of private 5G networks; just that “time will tell”. More interestingly – and significantly, potentially – she suggested industrial-private 5G will (and must) be twinned with legacy industrial networking, mostly Wi-Fi.

“We have to have a little patience. [And] we have to [be resourceful] to get this done, and think about combinations. We should not be religious about 5G. If we want 5G to enter the market, it has to adapt to other tech. No one is going to throw-out everything else, and replace it all with 5G. I don’t see that. That is not realistic.” Again, as a single response to the idea the old telco market has a god-complex, it was perfectly judged.

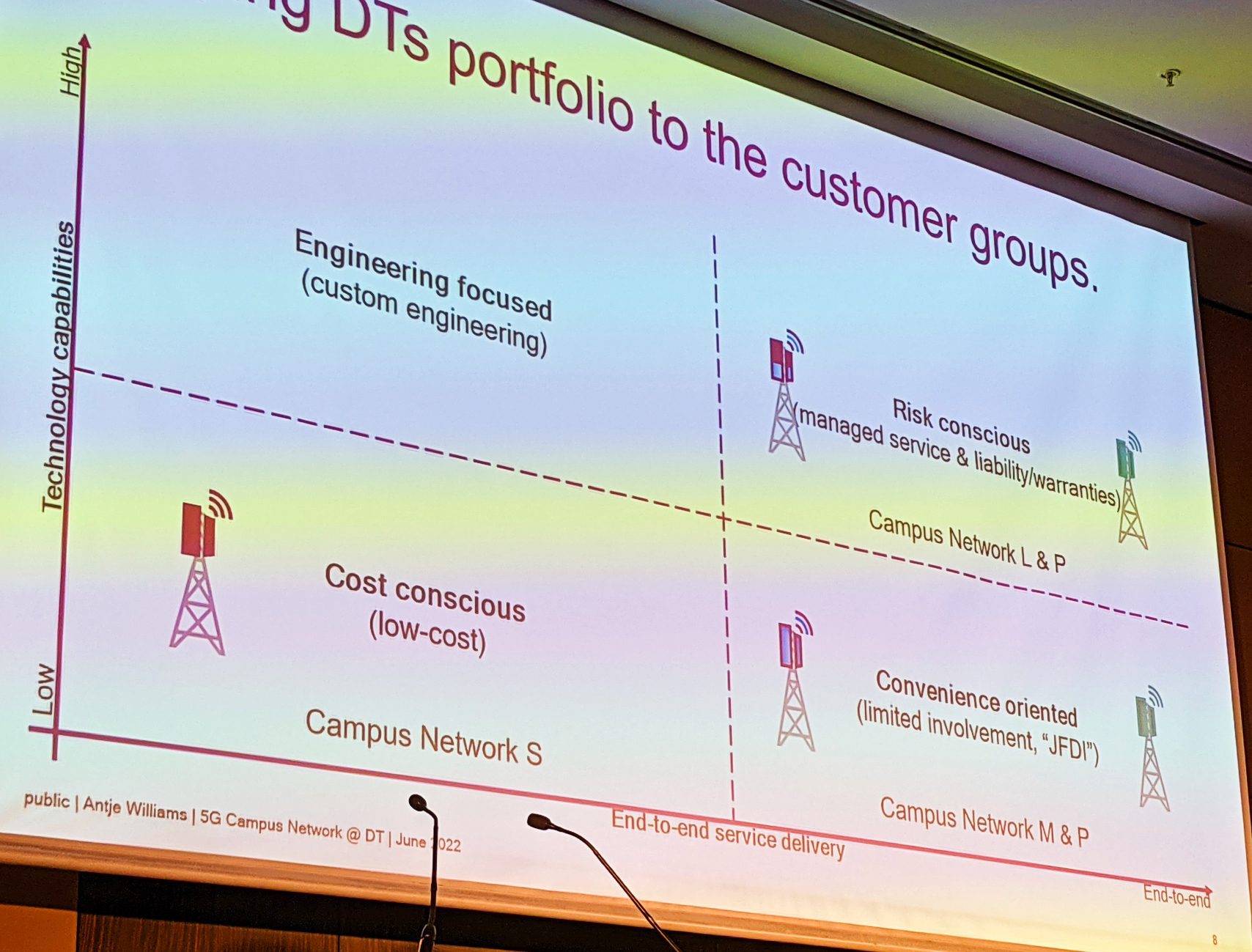

Indirectly, Deutsche Telekom also hit back at this notion that operators are muddying their message to enterprises. The company’s private 5G portfolio (see image, above) looked rounded. Williams explained how its ‘Campus Network S’ product offers “enhanced public comms” with local reinforcements of the macro RAN (the same at Telia’s green layer), its ‘Campus Network M’ and ‘L’ lines introduce a virtual private network (IP VPN) and private core, respectively (Telia’s orange layer), and its fully-private P-series puts everything on site (Telia’s purple layer).

So what’s the deal? It looks like a comprehensive offer. Williams named a couple of different user types: US automotive supplier BorgWarner is taking one or other system from Deutsche Telekom in Hungary; Accenture is going some other way at a plant in Essen; the University Hospital (UKB) in its hometown, Bonn, is doing the same. In general, ‘cost-conscious’ users, lower on the performance and service axes (see image), will go for S-type networks, she said.

Meanwhile, ‘convenience-oriented’ users (appear to) want less tech and more service, and might take M- or P-type services, and ‘engineering-focused’ users want all the tech and none of the service. Deutsche Telekom is not much interested in the former group, and not at all interested in the latter. “We are not playing in the research field, because we want to sell a service,” she said.

The last user group, in the Deutsche Telekom analysis, is ‘risk conscious’ and wants high-end tech capabilities, a fully managed service, and steep liability/warranty assurances. It probably describes the kind of blue riband Industrie 4.0 company that Germany does well (Bosch and BMW, and the like); these are L and P customers, reasoned Williams. And yet interestingly, she said, these types of firms, and these types of instals, are reticent.

“The number of companies asking for 5x9s [reliability] is limited. We just haven’t seen it. It would mean doubling infrastructure so the private network is decoupled from the public – to ensure that kind of reliability.” More interestingly, still, as referenced above, is Deutsche Telekom’s view of the interplay between cellular and Wi-Fi in enterprises. Total risk is attached to rip-and-replace strategies in the eyes of enterprises, so forget the talk about usurping Wi-Fi, she said.

More importantly, industrial 5G will continue to lean on Wi-Fi just to deliver on its own promise. The likes of incoming Wi-Fi 6 and 7 will be important to help with the 5G upload burden – while cellular operators continue to cripple it at the knees by dictating in-market 5G downlink/uplink ratios that favour the classic consumer case of Netflix streams on commuter trains. Or something like; Enterprise IoT Insights will investigate and write more.

In the meantime, answers on a postcard. But here is Williams, as we wrote her down. “What is very unpleasant for sales teams is abstract discussion about whether Wi-Fi 6 is better or not. Wi-Fi 6 has important advantages. Upload is one. We are struggling with uploads [because of] traditional upload / download dynamics. So we have to find solutions. We truly believe in convergence, and customers don’t want to choose, anyway; they just want connectivity.”