More operator-bashing this morning at a two-day Informa event in London (Private Networks in a 5G World, June 14 and 15); the opportunity to take cellular into enterprise premises is “fading away” from them, remarked Pablo Tomasi, principal analyst at Omdia, kicking-off the conference stream with a state-of-the-market address about inherent “complexity and fragmentation”, and the drawn-out challenge to make private 5G replicable across enterprises and scalable across industries.

Tomasi went so far as to suggest the “big opportunity” (biggest opportunity / biggest unchallenged opportunity?) for operators, as it stands, is to “jumpstart” the private 5G market in new geographies, where, as yet, regulators have not made ‘vertical’ spectrum available to enterprises. They have missed the chance, already, in most big economies, the argument goes, where competition is already fierce; newly-enlightened, they would do well to double-down on subletting local outbreaks of national spectrum elsewhere before regulators cleave these markets open, too.

“So they can become first entrants in these markets,” he said. “[Because] eventually regulators will liberalise spectrum [in these regions as well] and the market will continue.” The message is that mobile operators, as incumbent rights-holders and one-time monopolists of cellular spectrum, should use it or lose it with enterprises – while they can, in big industrial centres with slower moving telco regulation, such as in parts of Africa, Asia, and (South) America, as a priority.

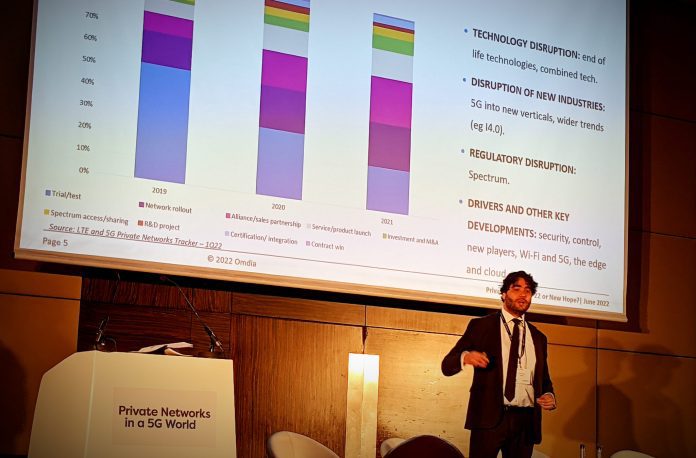

It was an intentionally stark reminder, at least, that the private 5G supplier market is anyone’s game – and that while the game is all-action in attack, with suppliers rapidly developing a tiki–taka system of play around the 12-yard box, a demand-side wall of industrial defenders has effectively ‘parked the bus’. It remains a cagey affair, and the two sides are only just learning how to negotiate a score. “Over the last few years, [the number of] trials and tests have diminished, and rollouts have expanded – but only a steady space,” commented Tomasi.

He suggested, as well, the supply-side is composed more broadly of self-styled galacticos, struggling to justify their own hype, only just learning to play as a team. “There are lots of alliances, which tells us it is an extremely active market. It is a crowded market, a very friendly one – where[suppliers] compete [also]. But there is no perfect offering yet – not from telcos, not from vendors, not from hyperscalers… Enterprises have to [shop around]. And lots of them are looking at themselves too closely in the mirror, thinking they are too good,” he said.

His company, Omdia, has counted (“tracked”) 50 private 5G product launches in the past 12 months, he said. “Which shows that everyone wants to be in this market. But a lot of the… big splashes are not commercial [launches].” The big argument around telcos appears to be they are wrongly entitled and poorly equipped – that just because they have handled spectrum and networks historically, does not mean they should walk into enterprises as if they know it all. “Let’s be honest, this is a difficult scenario. What is their unique asset, ahead of a system integrator?”

It was a rhetorical question, which followed a statement about the vaunted RF skills of telco engineers. Tomasi dealt with spectrum, too. “Some still tell me this is a big asset. But it is a roadblock – because the market only starts when it is liberalised.” The sense that “everyone wants to help” telcos is only (really/probably) because they offer a(nother) route to market. “I don’t think everyone wants to help telcos [actually]. The vendors just want all the partners they can get – the telcos, the SIs, the specialists – to keep moving their products into the market.”

It was a grim verdict, like they can’t do right for doing wrong. Their portfolios are too broad, he suggested. This is the “CSP dilemma”, apparently; how to be a specialist and a generalist, at once – or rather just how to pitch to every different enterprise in every different industry as a specialist. “Each of them has a portfolio full with private, hybrid, and public network options. There is nothing wrong with that on paper; it means they can cater to different needs. But there is a time and place for each [solution], and it is a big challenge to provide them under the same umbrella.”

The argument does not quite hold; the market is in its infancy, as every commentator protests, and so expectations that operators should have this right already are wrong. The challenges are the same for all sides; the “cultural transformation” faced by operators is more considerable, just because they are (in their home countries) massive, corporate, and entrenched. Their self-regard is well perceived, as per the Tomasi scene-setter in London; but their best talkers and their outward-lookers (mostly, but not always, in their international SI divisions) know this very well.

It was instructive that the two speakers that followed at this event (Henning Huuse from Telia and Antje Williams from Deutsche Telekom) did not sound anything like execs from the kinds of delusional old telcos that Tomasi had just described. Both acknowledged that operators are perceived to have lost, already, even before the game has properly started, and talked, alternatively, about happy relations and realistic strategy, and showed the operator community in the best light. We will write up something of their contributions later this week.

And Tomasi listed all the problems with the tech, itself: that the incoming Release 16-version of the standard, with its first flush of industrial-grade functions, is still in the wings (“not delivered yet”), and that everything else is LTE, but for some consumer-style 5G installs, mostly for testing. “5G could become the technology everyone wants, but most large deployments are LTE, in test centres.” An Omdia poll of enterprise execs says a lack of industrial devices (31 percent), high costs (26 percent), and a lack of spectrum (24 percent) are killer issues for users, still, he said.

“[Availability of] devices is the concern everyone has. And if there are no devices, then why [install a] 5G [network]?” Some other findings from the (industrial-industry) poll: 61 percent of enterprises will cover two or more sites; 97 percent want additional digital services on top; and, most interestingly, 64 percent are using safety KPIs, such as reductions in deaths and injuries, as SLA measures for the success of their deployments (and not normal telco metrics around network performance).

What else? Weirdly, that (only) 33 percent have (or are considering?) Wi-Fi as an alternative, along with 23 percent for public cellular and 14 percent for wired tech. (The low numbers for the first and last measure suggest these reflect future considerations.) The point is plain, however, that 5G must coexist in enterprise; no one doubts this. And the accepted forecast about 5G taking over from 4G as the default private cellular tech in 2025 was also repeated; it goes from 21 percent of revenue in 2022, to 54 percent in 2025, and 84 percent in 2025/6, says Omdia.

And the presentation, a full tour, concluded (invariably) that Industry 4.0 is not really about 5G, at all – no more than it is about Industry 4.0, in fact. It is just about industries, enterprises, use cases, and applications; everything flows from these definitions. “To 5G or not to 5G? That is not the question. The market has to start with the enterprise problem, and work to a solution – which may or may not include 5G, and may or may not include a private network at all… It is not a 5G sale and not a connectivity sale; it is a solution for an enterprise problem.”