Note, for more on this topic, and to hear more from MFA and others, join the Enterprise IoT Insights webinar on Industrial 5G (From Setting Standard to Becoming Standard) on April 28 – also featuring speakers from ABI Research, Schneider Electric, and Vodafone; check back here, also, for the editorial report on the same topic.

The problem with industrial-grade cellular is not with networks, anymore, really; 5G network equipment is variously available, and 5G network infrastructure is increasingly well deployed. The excitement in the private 5G market shows this. The problem is with devices, instead – insofar as there just aren’t that many of them. Most-anything badged currently as ‘industrial 5G’ is probably a Release-15 level consumer unit in ruggedised industrial garb.

They are ‘industrial’ in form, but not in function. In terms of their features – supposed to animate industrial machines and processes, and make cellular a springboard for new Industry 4.0 pyrotechnics – there just ain’t that much happening, as yet. Release 16-level private networks are going in, with some of these new capabilities, but there are scarcely any Release 16-level enterprise devices (a couple of routers, perhaps) to attach to them.

Is this a problem? Is there a delay? Not according to the 3GPP schedule, which says everything is time-tabled, and on track. And not, really, according to most (of the multiplying new-wave of) network vendors, which are selling private networks hand-over-fist – that is, hand-over-fist for recent-startups and late-comers, at least, likely stretched by their spluttering CBRS exploits or else just happy to have grown beyond limited indoor DAS installations.

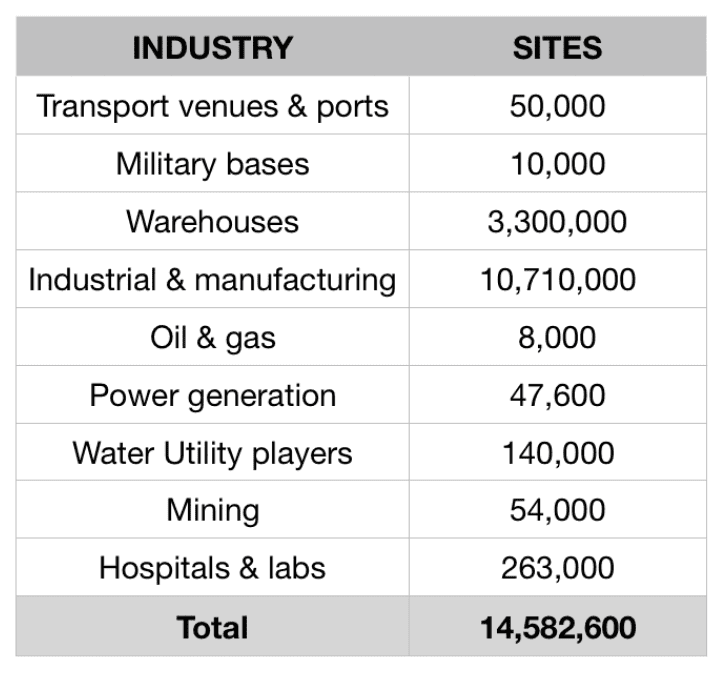

Ouch; not necessary. And even Nokia – whose enterprise division is, arguably, its prime business for growth and innovation – appears to be having a high old time in the private networks space. Except this is not completely true. Nokia, like everyone, is betting on a much bigger market; it has counted out its industrial targets, and settled on a market of 14 million sites, potentially, including 10 million factories and three million warehouses.

These ‘verticals’ define the Industry 4.0 epicentre, and these verticals reckon there is a delay with devices. This is why most of the CBRS activity in the US, as the first market for private networks, has been concerned with school districts and hospitality venues, and similarly prosaic Industry 4.0 affairs – which make consumer-like broadband their primary concern. Because this is not Industry 4.0 at all; and every factory in the world is waiting on 5G devices.

This goes for the early adopters, too, crowing about how 5G (LTE) saved their businesses. (Note, it never did, and they never said so; the headline was changed, and the story says devices are a problem.) This is why Siemens – a bellwether for big-ticket Industry 4.0 – is happy enough to tinker with its own 5G system until sometime after 2023, when Release 16 is popularised in devices and Release 17 is in the offing (whatever it says at Hannover Messe).

But we should be clearer: 5G NR already works for industry, in Releases 15 and 16. Harder-nosed control and automation provisions will come with Releases 17 and 18, but there are very decent industrial-grade features that could be better leveraged – if devices were available. Instead, Industry 4.0 is making do – quite well, as it goes – with go-faster functions appropriated from the latest consumer-geared mobile broadband (eMBB) service category.

This is where private 5G has found purchase in industry – with the likes of Lufthansa Technik, referenced above, and with plenty of others. Indeed, there is enough in eMBB for the industrial set to justify early commercial rollouts of private 5G networks; there just isn’t enough in it to do more, and certainly not enough to animate whole factories. Again, the reason is a lack of industrial 5G devices that draw-down on 5G NR specs outside of the consumer realm.

Not because the standardisation process is delayed, but because the IoT supply chain has failed. This is the tale the MulteFire Alliance (MFA) is telling – on behalf of network vendor-members like Nokia and Ericsson, but also for the broader Industry 4.0 community. “We have Release 15 devices, but they don’t have the right features for Industry 4.0 – because we haven’t had the blueprints. We don’t have any Release 16 devices yet; maybe sometime soon, maybe in pilot mode. But the important thing, again, is these blueprints.”

So says Asimakis Kokkos, chair of the technical specification working group at MFA. But what blueprints? And how will these blueprints make 5G work for industry – so that industrial 5G devices connect to industrial 5G networks to spring industrial 5G solutions, in new ways?

To be continued…

For more on this subject – and to hear from Asimakis Kokkos at MFA, alongside speakers from ABI Research, Schneider Electric, and Vodafone – sign up for the Enterprise IoT Insights webinar on April 28 on Industrial 5G (From Setting Standard to Becoming Standard) – plus the editorial report on the same subject.