The global value of the cellular IoT market will almost double to $61 billion by 2026, from $31 billion in 2022, according to Juniper Research. The growth will be driven by high-end 5G and, in particular, low-end NB-IoT and LTE-M, it said. These opposite cellular tech families will be “key” to capture new IoT business in a pincer movement between high power and high performance wide-area use cases and low-power wide-area (LPWA) systems.

Juniper Research said NB-IoT and LTE-M, as the twin cellular IoT set for LPWA use cases, will be the fastest-growing cellular IoT technologies over the next four years – with a remarkable 1,200 percent jump in LPWA connections forecasted in the period to 2026. “The low cost of both connectivity and hardware will drive adoption for remote monitoring in key verticals, such as agriculture, smart cities, and manufacturing,” it said.

In a press statement to flag its new paper on the subject, it did not give a value for cellular IoT in 2026; however it said 5G IoT services will generate (just) $9 billion of revenue by 2026. Nevertheless, this $9 billion figure represents another significant jump – of 1,000 percent over the next five years, it said, albeit from a standing-start of $800 million in 2021. It said operators must offer “value-added services, such as network slicing and edge computing, to IoT users”.

Which is what the operator community is already gearing-up and setting-down in the case of slicing and edge computing, respectively. By contrast, the growth in cellular IoT will come, said Juniper Research, as legacy 2G and 2G networks are retired, and operators are forced to migrate long-established machine-to-machine (M2M) and early-established IoT traffic onto LTE-M networks, in particular.

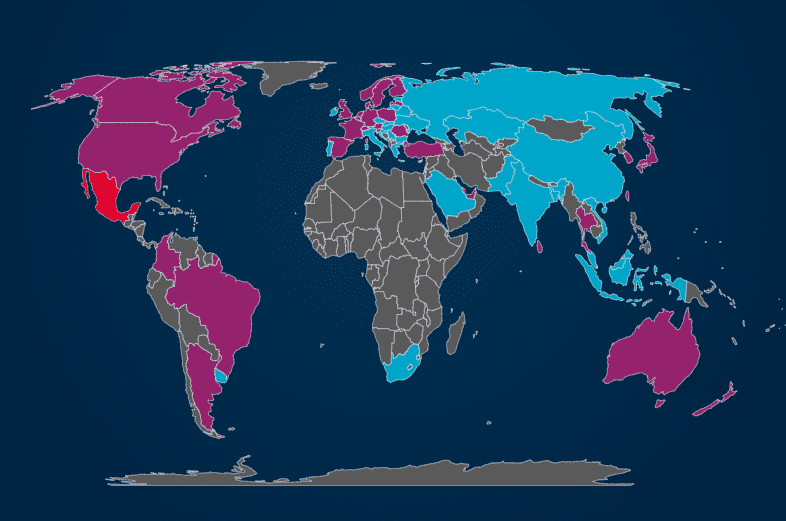

The consensus in the market is NB-IoT is increasingly the candidate for modish true-LPWA cases – which will also grow in popularity, the firm said, as newer IoT-geared LPWA cellular networks become the default for machine and sensor applications. The GSMA counts 106 NB-IoT networks and 53 LTE-M networks, globally (see below).

![]()

Juniper Research stated: “Demand from enterprises for low-cost monitoring technologies, enabled by LPWA networks, will increase as these legacy networks are shut off over the next four years.” But it also noted the arrival of 5G in enterprise premises affords a framing technology for a wider range of business applications, including high-fidelity and high-density IoT traffic.

Charles Bowman, co-author of the new Juniper Research paper, said: “Operators must educate users on the suitability of LPWA as a replacement technology for legacy networks. However, many IoT networks cannot solely rely on LPWA tech. More comprehensive technologies, such as 5G, must underpin IoT network architectures and work in tandem with LPWA tech to maximise the value of IoT services.”