This article is continued from a previous entry, covering key NB-IoT deployments 1-5, which is available here. Both are taken from a new report, entitled NB-IoT – what has gone wrong, and when will it go right? The full report is available here. A webinar on the same topic is available here, with panellists from BICS, Sequans, and Nordic Semiconductor.

6 | China Unicom + Taihe Ann, China (smoke detectors, 2018/19)

Another golden oldie from the annals of China’s mad-paced IoT adventures, and a seminal deal in the history of NB-IoT; this one involves China Unicom and Huawei (of course), plus smoke alarm maker Taihe Ann, IoT module manufacturer Lierda, and systems integrator Dabang. Following pilot tests in 2018, the quartet deployed 170,000 NB-IoT connected smoke alarms in rental homes in the Yuhang district of Hangzhou in China’s Zhejiang province.

The group optimised various parameters in the NB-IoT detectors during the testing, such as time delay, sensitivity, and power consumption. The logic, like with most NB-IoT sensor installations, is to get a jump on infrastructure management – and, in the case of remotely monitored smoke detectors, operating as “automated sentries”, on life-threatening disaster scenarios.

The sensors, fitted with 3000mAh batteries and slated to last for three-to-five years, notify a cloud management platform and activate related devices, such as alarms, as the density of smoke or gas goes over a predetermined threshold. The platform can be organised to alert building owners or managers, as well as emergency services, via voice and text messages. Because they are battery powered, as per the NB-IoT prescription for low-powered IoT, they are well suited to old areas of cities where buildings are densely packed and sensors are hard to fit.

Taihe Ann is selling smoke detectors off-the-shelf with NB-IoT functionality and airtime from Huawei and China Unicom, respectively; China Unicom is also supplying the units via its enterprise channels to building owners for a monthly rental fee. The deployment has reduced the cost of fire monitoring and fire fighting, and improved response times, said China Unicom.

The 170,000-strong deployment across the whole of Hangzhou was supposed to be extended across the whole city of Hangzhou; but an update on the project has not been easy to find. Either way, the project has worked as a harbinger for similar deployments.

There are a wide variety of different examples of large scale deployments in China across a number of different sectors. For example, China Telecom has partnered with Sunsea AIoT to install 500,000 general-purpose ‘smart-city’ NB-IoT sensors across 37 square kilometres in the Jing’an district in Shanghai to variously detect smoke and gas, as well as other environmental metrics (and water pressure in fire hydrants). China Mobile has installed 100,000-odd NB-IoT alarm systems in China for sensing temperature, smoke, gas, and fire. There are countless other examples.

7 | China Mobile + City of Gaoyou-Yangzhou, China (streetlights, 2018/19)

China Mobile’s second appearance in this list; this one goes back a couple of years, like most of the China entries, but also goes somewhere different: into the smart street-lighting space, which has been the traditional reserve of proprietary IEEE 802.15.4 technologies, but is slowly migrating towards cellular (and non-cellular) standards. Of these, NB-IoT appears to be a prime candidate to pick up business, as China Mobile has demonstrated in Gaoyou, a county-level city under the administration of Yangzhou, in China’s Jiangsu province.

In truth, the China Mobile deployment in Gaoyou, publicised in another GSMA report, followed similar projects by its country rival China Telecom, which had already installed 280 NB-IoT controlled street lamps in pre-commercial trials in 2018 in (we think) Chongqing in China’s Sichuan province, variously in Xiajing province, and in the new smart-city development of Xiong’an in Baoding in Hebei province. But China Mobile, with a deal with the Yangzhou Gaoyou government, appears to have released more information about its project.

It says the test case showed NB-IoT worked, by connecting either individual nodes in the light poles or ‘loop controls’ for clusters of lamps to a cloud management platform, to reduce operational costs and also to establish a platform for further smart-city sensors. It noted, NB-IoT coverage tends to be good in cities, where cellular networks have been densified to cope with busy populations, and connectivity for lighting controls is therefore reliable.

It says the test case showed NB-IoT worked, by connecting either individual nodes in the light poles or ‘loop controls’ for clusters of lamps to a cloud management platform, to reduce operational costs and also to establish a platform for further smart-city sensors. It noted, NB-IoT coverage tends to be good in cities, where cellular networks have been densified to cope with busy populations, and connectivity for lighting controls is therefore reliable.

And in case you missed it – because it has been written about in these pages extensively – smart street-lighting is arguably the clearest smart-anything business case of them all. Remote-controlled streetlights enable city authorities and energy utilities to dim lighting in dynamic fashion, with the seasons and the weather, as well as for local events. They also introduce live monitoring of performance, and a means to run preventative maintenance. All of which drives down energy and labour costs, in the end.

The maths is simple, actually. When the hefty energy savings from the upgrade to LED fixture is added-in, the calculation even reveals a way to bankroll other smart-city apps with softer ROIs, which can be attached to new NB-IoT sensor platforms in lamp poles. The outlook, then, for NB-IoT connected street-lights is good. There is no word, we can find, on how many lights China Mobile has connected in Gaoyou, but it has expanded and repeated the project, it implies.

“The city is in a position to expand their intelligent city services and begin getting a fuller picture of the status of various locations as needed. The pilots deployed in various locations have taught China Mobile that NB-IoT is a clear contender to connect large numbers of streetlights and sensors in the future.”

8 | Zain + Saudi Electricity Company (SEC), Saudi Arabia (electricity meters, 2020/21)

Quite possibly the biggest NB-IoT deal of them, when it is finished; the Saudi Electricity Company (SEC) claims to have installed no fewer than 10 million smart electricity meters in about 12 months. How many of these are NB-IoT connected remains unclear; Spanish smart energy devices maker ZIV, owned by Saudi outfit Alfanar, says it has supplied 550,000 meters to the cause, offering dual-mode power-line (PLC) and NB-IoT connectivity.

Whether or not it is the same deal, ABI Research suggested the Saudi government has legislated to bring 10 million NB-IoT based electric smart meters online in due course. “The government in Saudi Arabia has announced plans to use NB-IoT for electric meters as well – which will see about 10 million endpoints come online in the next few years,” said Adarsh Krishnan, research director at the analyst house.

About four million of the new meters in the SEC deployment were manufactured in Saudi Arabia; the rest are from foregin makers. The ZIV design features a “sealed holster designed to also host a pluggable LTE Cat-1 module, it said. “This new model ensures a reliable data transmission, even in the most challenging media conditions: noise interferences, low impedance lines, and so on,” it commented.

About four million of the new meters in the SEC deployment were manufactured in Saudi Arabia; the rest are from foregin makers. The ZIV design features a “sealed holster designed to also host a pluggable LTE Cat-1 module, it said. “This new model ensures a reliable data transmission, even in the most challenging media conditions: noise interferences, low impedance lines, and so on,” it commented.

SEC launched its digital change project in late 2019, with smart metering at the heart of it. The new system fully automates the meter reading and billing process, and allows customers to interrogate and manage their own energy consumption in “almost real time” to better manage usage. Of note, it said it replaced 10 million legacy analogue meters across its service regions through the height of the Covid-19 pandemic, through 2020/21.

Zain’s involvement in the deal itself is unconfirmed; it is the chief NB-IoT operator in the kingdom, and has been active with Nokia in particular for some years to roll out NB-IoT infrastructure in the kingdom – so logic says the NB-IoT meters in the rollout will be connected to it. But reference is included in the header, here, just for the sake of consistently, to keep with the ‘operator + enterprise’ format of the article.

9 | Telia + Ellevio, Sweden (electricity meters, 2020/21)

Another example of NB-IoT, pegged for battery-powered sensor devices, being used to connect electricity meters, where power is in ready supply; again, it shows its value is not just in its low-power profile, but in its reach and reliability, as well. Swedish operator Telia has a headline deal with system integrator ONE Nordic to connect approximately 900,000 electricity meters for electricity distributor Ellevio, which supplies power to 35 municipalities in Sweden.

Telia was the first operator in the Nordic region to launch NB-IoT, in late 2017; the 10-year deal, with an option to extend for six additional years, is its largest NB-IoT contract “to date”. Rollout started early last year, and will run through 2023. Ellevio has noted the “broader and deeper coverage” afforded by NB-IoT – “ideal for rural and deep indoor locations,” it says. “[It] fits perfectly with our smart grid development. It will also allow us to develop and deploy a wide range of new IoT devices and services for our customers in the future.”

But for Telia, which worked with country-mate Ericsson on its NB-IoT network, the Ellevio / ONE Nordic contract is only a part of the metering puzzle in Sweden. It is also working with integrators Sagemcom and Landis+Gyr on deals to supply power utilities E.ON and Kraftringen in Sweden. Ericsson says: “[It is] in the midst of converting and managing more than two million of the 5.4 million electric meters across Sweden with cellular connectivity.” The deal with Kraftringen is for “more than” one million electric meters, according to Ericsson, leveraging LTE-M alongside NB-IoT; the deal with E.ON will presumably take it well beyond two million meters in Sweden.

Ericsson’s review of Telia’s work with NB-IoT in the Swedish utilities space is a good read; it says: “Telia was able to show that the total cost of ownership (TCO) of NB-IoT has become less than powerline communications and RF Mesh for last mile connectivity. It was also able to show that management of the millions of smart meters could be greatly simplified with the right technology.”

It continues: “It is rare in any industry to see the pace of adoption currently underway. Just two years ago, meter vendors were not building products designed for massive IoT deployments. Normally, a revolution like this takes five to 10 years. Now, demand is outpacing supply and vendors are racing to make smart meters a part of the smart grid as the industry has changed direction in a very short amount of time.”

10 | Vodafone + Bayer, Germany (asset trackers, 2020/21)

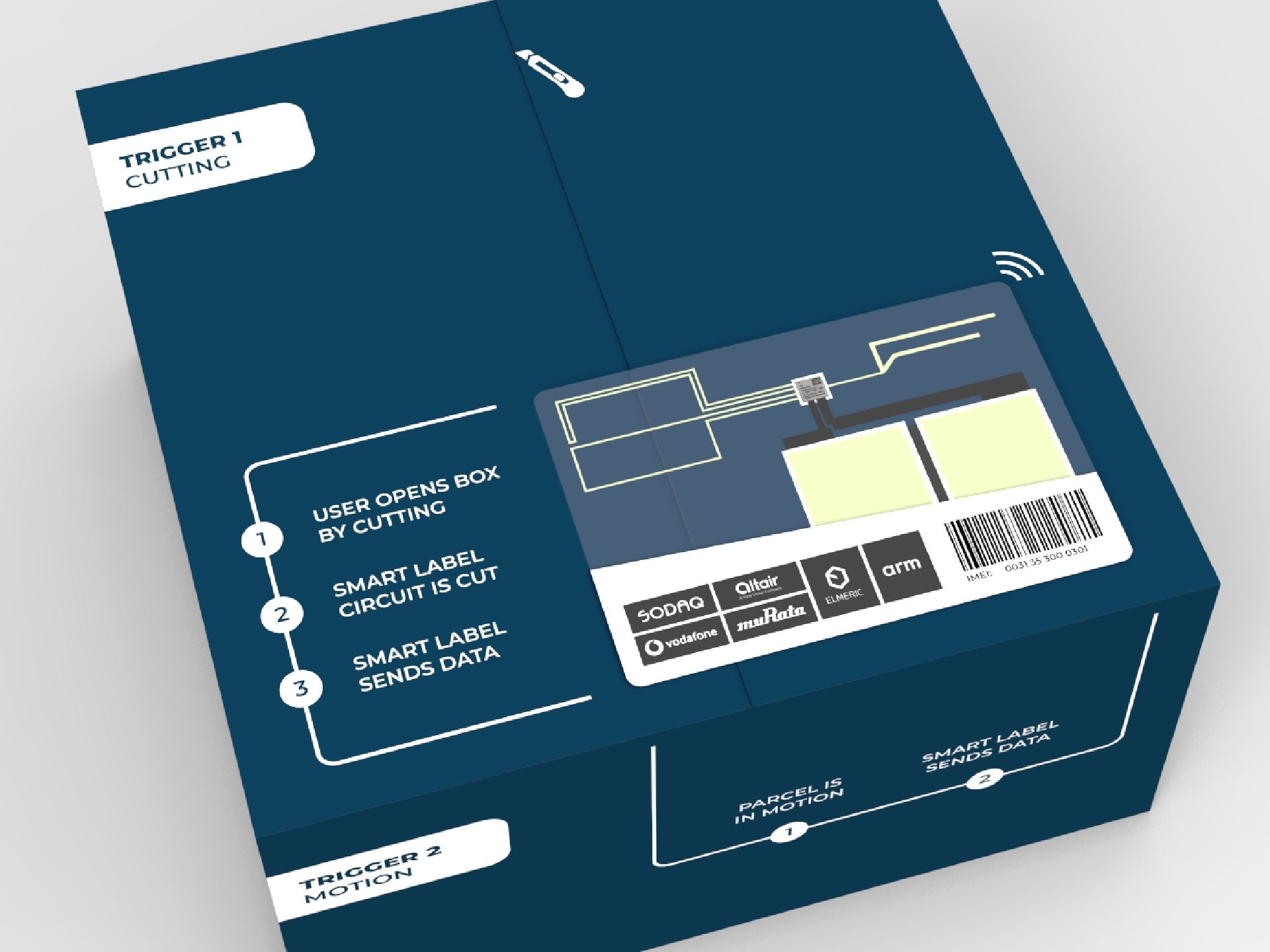

The big one, in ways – until the next one, of course; this deal between pharmaceutical and life sciences company Bayer and Vodafone is the first to exploit integrated SIM (iSIM) functionality, as well as some inter-market roaming. The working arrangement – also with Arm sister-company Kigen, chip manufacturer Altair Semiconductor (Sony Semiconductor) and module maker Murata – focuses on a printable NB-IoT-based tracking label, priced at a couple of euros, for monitoring Bayer’s products through the supply chain.

The smart label uses a proprietary version of iSIM functionality, as a layout on printable silicon, into the communications module, along with a printable battery, microprocessor, antenna, modem, plus a couple of sensors. Vodafone provided the reference, Arm issued the blueprint, Altair designed the chip, and Murata designed the module. Bayer, which retains the intellectual property (IP) rights and corralled the various parties together, prints the tracker, like any other stick-on postage label, and slaps it on everything that goes out of its warehouses. The solution is clever. The label connects to the cellular network when it is torn or cut, after printing and attaching to the package.

The new solution can be configured for LTE-M, or even straight cellular; NB-IoT has been pre-selected in the Bayer design to reduce power consumption and extend battery life, which is put at 18-24 months, depending on usage. Vodafone has a ‘bootstrap’ deal with Arm / Kigen to provide the initial connectivity on iSIM-based NB-IoT and LTE-M devices, as well as fallback in case of outages, to enable automatic zero-touch provisioning onto local IoT networks – which, in the Bayer setup, covers Vodafone’s own NB-IoT estate, plus newly-signed roaming territories.

The new solution can be configured for LTE-M, or even straight cellular; NB-IoT has been pre-selected in the Bayer design to reduce power consumption and extend battery life, which is put at 18-24 months, depending on usage. Vodafone has a ‘bootstrap’ deal with Arm / Kigen to provide the initial connectivity on iSIM-based NB-IoT and LTE-M devices, as well as fallback in case of outages, to enable automatic zero-touch provisioning onto local IoT networks – which, in the Bayer setup, covers Vodafone’s own NB-IoT estate, plus newly-signed roaming territories.

The unit’s reporting schedule and functionality has been optimised to conserve power. After tearing and provisioning, the label reports periodically – “once per day to tell you it’s around, and to report events after that”. The rota is kept to daily transmissions until the product moves out of storage, and onto the road, where cellular positioning provides a fix on the cargo. An accelerometer and temperature sensor are engaged, also, in case the goods are damaged in transit, and to trigger a response in distribution.

Reporting slows, again, on arrival, in storage at the other end. Usefully, an alert is issued when the package is opened, and the seal is broken, for a second time. This indicates the product has been put to use, and provides Bayer with additional data for inventory management and production scheduling. Bayer is using the label for tracking distribution of its agricultural products, notably chemical compounds or seed packs, initially.

The smart label is green(ish), as well. The battery is alkaline, rather than lithium-based, and so “dissolvable”; the same for the other printed components, bar the chip, which can be easily retrieved. The group are also looking into using biodegradable plastics, made from fish scales, for the substrate.

At writing, the product is in trial with Bayer, which is understood to have around 100,000 units in circulation. The firm wants to industrialise the solution to drive the price down. It translates “a few euros”, as Vodafone has it, as closer to €5. A similar printable iSIM tracker solution has turned up recently in a separate Vodafone trial in the UK, to help academics, businesses, and local authorities bring new intelligence and efficiency to environmental monitoring, smart farming, and public safety along the UK’s Jurassic Coast in Dorset and Devon.

The UK project uses a different “universal” sensor device, patented by Vodafone, which can house various sensors, and attaches to NB-IoT networks. Vodafone reckons it is in position to expand coastal monitoring using a similar solution into mainland Europe, to cover up to 68,000 kilometres of coastline, based on the fact its NB-IoT network covers 21 European countries.

This article is continued from a previous entry, covering key NB-IoT deployments 1-5, which is available here. Both are taken from a new report, entitled NB-IoT – what has gone wrong, and when will it go right? The full report is available here – or by clicking on the image below. A webinar on the same topic is available here, with panellists from BICS, Sequans, and Nordic Semiconductor.