Note this article is taken from a forthcoming editorial report from Enterprise IoT Insights on the state of the NB-IoT market; the report will appear here next week. An Enterprise IoT Insights webinar on the same topic, with panellists from BICS, Nordic Semiconductor, and Sequans, is scheduled for (this) Thursday October 7, sign up here.

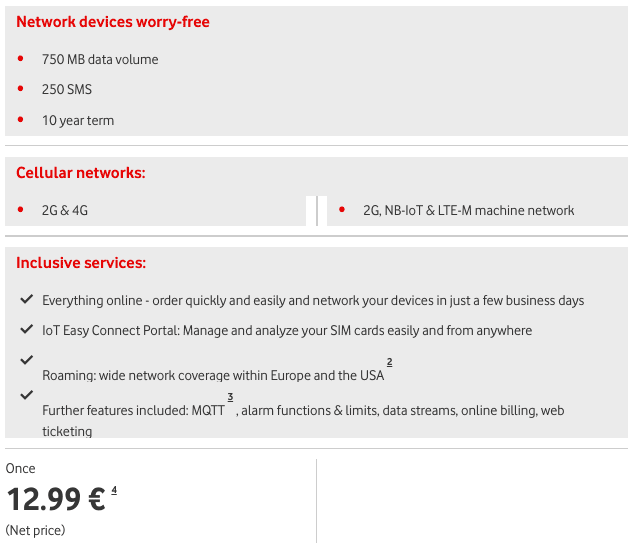

Confirmation that IoT – and specifically the sub-segment of the market sprung with cellular narrowband (NB-IoT) – has hit the big time, at last. Almost. Maybe; maybe just. Vodafone is poised to announce the biggest ever IoT airtime supply deal outside of China, stretching to millions of NB-IoT connections. The UK firm has rock-bottom airtime fees, at €12.99 for 10 years, and enough coverage, in 55 markets and counting, to make NB-IoT massive, finally, it says.

The contract, with an unnamed manufacturer, outguns the biggest non-China deals so far on equivalent low-power wide-area (LPWA) tech, including LoRaWAN and Sigfox, as well as NB-IoT, which have all struggled to break the million-mark on connection volumes. It is the news a large chunk of the broader tech industry, making bets on ‘massive IoT’ as a platform for digital change, has been waiting for. (And, worth mentioning; it has nothing to do with 5G, just a cobbled-together LTE technology that has been made into a laughing stock by twitchy market watchers.)

But the news is not in, quite yet. Vodafone is playing its cards close to its chest; there is no mention, for now, of the identity of its OEM partner, nor of the nature or remit of the deal; a formal announcement is pending. But it is multi-market and multi-million, it says, with IoT units going ready-connected, rather than bootstrapped for remote provisioning, into 20-odd markets in Europe, and wherever Vodafone has op-cos or roaming mates, potentially.

Speaking with Enterprise IoT Insights for a new editorial report on the state of ‘things’ with NB-IoT (out next week; check back here), Phil Skipper, group head of IoT strategy and business development at Vodafone Business, says the ball of snakes that has so far strangled cellular IoT – mainly around billing, roaming, interoperability – has been unravelled, finally. “This was never going to be a quick game,” he remarks.

“We are just now starting to see those first large OEMs coming to market. And there is one, which I can’t say much about, which is big – it is multi-million connections. This is what we are seeing now; that the various strings are coming together – the networks are stronger, roaming is in place, devices are rolling off the production line… For us, it is exciting because it breaks the scale barrier. That’s how we see this.”

The sentiment is the same as from IoT roaming provider BICS and IoT chipmaker Sequans, speaking with Enterprise IoT Insights last week (and appearing with Enterprise IoT Insights on an NB-IoT webinar this week; sign up here), that issues with cellular IoT billing and roaming are generally sorted, and that the industry’s time is now. Skipper says Vodafone’s trajectory with NB-IoT has gone along a straight-ish course.

“It has taken a long time because it is the first network to be built only for IoT. And because you have to roll the network out, which takes an amount of time, and, more than that, you have to roll it out so it delivers the performance the technology promises – in terms of deep penetration and long battery life. The other reason is the OEMs have been required to design NB-IoT into their products – which take time to go from the drawing board to production.”

He adds: “People forget it is an OEM driven market, and the OEMs are only interested if there is interoperability. So our focus, as the IoT business in Vodafone, has been to build the roaming footprint. You go to an OEM, and say to use NB-IoT, and they want to know which countries it works in. And our answer, now, is that it works across 55 networks – that we have 180-190 networks in the world, and we are already past 25 percent with NB-IoT.”

The ‘scale-breaking’ deal with the unnamed OEM is a European affair, it might be noted, extended through roaming across 20 countries. Skipper makes an interesting response to a jumbled question about how a vendor market trying to break-in new technology perceives ROI, and whether, in the end, Vodafone’s €12.99 deal for 10 years of NB-IoT airtime comes from a realisation that low-power IoT needs to be sold in the early days almost like a loss-leader.

He explains: “You can see where we’ve come from; we’ve said, ‘Right, €1.29 per year is the entry point, where it makes sense for us and it makes sense for customers. You have to think about the enabling price – €12.99 over 10 years. Because all of these myriad IoT applications only work if they get started, and we think the get-started price is €1.29 per year. The value [for the customer] is in what they do with it.

“The value for us is to take a smaller slice of a larger number of devices. But you have to enable that large volume of devices to enter the market. And the price is about right now, for the modules and the connectivity. We are heading down into the bottom of the pyramid, and to serve that segment you have to make sure you connect at a price point that supports the customer’s business case – almost rather than ours. Because then they can scale.”

The €12.99 prepay plans, called IoT Easy Connect, cover LTE-M and 2G, as well as NB-IoT, in most countries in Europe, and allow for 750MB of data and 250 SMS messages over the 10-year life of the contract. They are available online, and are geared more towards IoT developers, and hobbyists; larger-scale airtime contracts are negotiated individually, flexing four ways effectively between traffic volumes, power usage, connection volumes, and price.

Skipper says: “If someone turned up on the doorstep and wanted to buy five million, then we‘d have a different conversation. But the basic mechanism is in place. That is the trick. It is not just about how much you charge, but the flexibility to charge any way the customer wants – prepayment, post-payment, or rolled into the hardware… But with IoT, there has always been a limit to how low you go, and this opens up a new part of the market.”

Note this article is taken from a forthcoming editorial report from Enterprise IoT Insights on the state of the NB-IoT market; the report will appear here next week. An Enterprise IoT Insights webinar on the same topic, with panellists from BICS, Nordic Semiconductor, and Sequans, is scheduled for (this) Thursday October 7, sign up here.