International cellular provider BICS has said it has NB-IoT roaming coverage in a dozen countries, with new NB-IoT deals being signed at a faster rate than on LTE-M, and a loose target of “more than 20” NB-IoT roaming contracts by the year-end. The Belgium-based firm said issues with network interoperability and airtime billing, as well as with roaming, have been largely dealt with, and suggested NB-IoT is poised finally to drive the kind of ‘massive’ scale the IoT market has promised for years.

At the start of 2021, BICS offered IoT roaming in 30 markets, via either NB-IoT or LTE-M tie-ups. Speaking last week, ahead of a new Enterprise IoT Insights report and webinar on the state of the NB-IoT market (scheduled for October 7; check back here for the report; sign up here for the webinar), the company said it is offering IoT roaming on 12 NB-IoT networks and 30 LTE-M networks. But NB-IoT roaming coverage is catching up fast, it said, reflecting a late second wind for cellular narrowband.

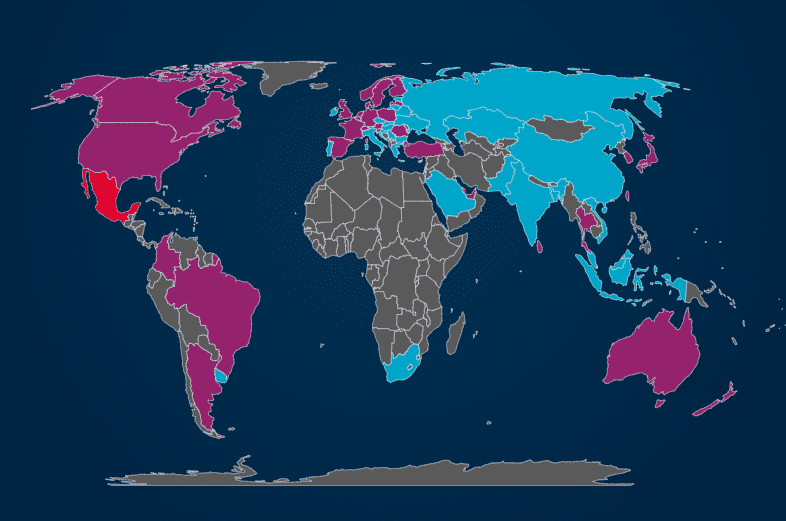

There are, at last count, twice as many NB-IoT networks as LTE-M networks (106 versus 53, says the GSMA). Significantly, only Mexico shows up on GSMA maps as a single-mode LTE-M market; everywhere else is doing NB-IoT as well, or NB-IoT on its own. The valedictory shouts that went up early last year, from some tech rivals and telco critics, when NTT and DISH ditched NB-IoT in Japan and the US, going backwards on major infrastructure gambles, now sound like far-off cries, maybe.

![]() These episodes say more, perhaps, about the short-term priorities of the protagonists than the long-term prospects of the technology, or of the so-called ‘massive IoT’ movement at large. For BICS, which offers cellular roaming of various sorts via 700 mobile operators in 30 countries, NB-IoT is the growth engine for the company – without comparison. About 20 percent of the SIMs BICS sells today go into modules that support NB-IoT, from virtually nothing a year ago.

These episodes say more, perhaps, about the short-term priorities of the protagonists than the long-term prospects of the technology, or of the so-called ‘massive IoT’ movement at large. For BICS, which offers cellular roaming of various sorts via 700 mobile operators in 30 countries, NB-IoT is the growth engine for the company – without comparison. About 20 percent of the SIMs BICS sells today go into modules that support NB-IoT, from virtually nothing a year ago.

“This has [all] happened this year; last year, [the percentage] was really very small,” says Luc Vidal-Madjar, head of M2M and IoT at BICS. He zooms out, and offers some context, explaining the shift with NB-IoT. “The market needs NB-IoT for massive IoT. And even if it has taken some time to take off, things are starting to progress for a number of reasons. Mainly just that the technology is more mature; there are more NB-IoT networks, and there is more roaming between them,” he says.

For the record, he explains that another 20 percent of SIMs from BICS go into LTE-M capable modules, and the rest go into standard cellular fare. Interestingly – and contrastingly with chipmakers Sequans and Nordic Semiconductor, which sell dual-mode NB-IoT/LTE-M units, and which will join BICS on the October 7 webinar – Vidal-Madjar reckons there is not much hardware crossover between these two technologies; enterprises are choosing one or the other for global IoT deployments.

“It is very rare to have modules that do both NB-IoT and LTE-M… If the enterprise wants to have as much global coverage as possible with a single module, then that is a way forward. That is correct. But so far as we see, enterprises are making the choice between them; they don’t combine both. That is the choice we see,” he explains. It probably reflects more on BICS’ distribution channels; certainly Sequans and Nordic maintain their dual-mode strategies are appropriate and correct.

Either way, some of the angst in the cellular IoT market has eased, and the message is that NB-IoT is starting to bubble up. At the end of last year, speaking on a BICS-hosted webinar session, US electronics distributor Avnet said 70 percent of “cellular requests” from IoT solutions vendors are now for NB-IoT coverage. The big network operators are starting to sign sizable deals; at least one is talking – privately for now, coming soon – about multi-million sized volume-deployments, across markets.

No other LPWA technology has ever reached such a scale in single contract deployments, and massive IoT will never make good on its grand promise without them – and without such deals falling, suddenly, like dominoes. The sense is the run is about to topple. Vidal-Madjar says: “We are convinced NB-IoT will play a fundamental role to drive massive IoT. Many use cases need extremely long battery life, which NB-IoT brings – especially large-scale IoT deployments with no power access.”

Global IoT roaming is the thing that will make IoT massive, reckons BICS. Of course it does; it is hawking a global IoT SIM, connecting to NB-IoT or LTE-M, plus traditional cellular for fall-back machine-to-machine comms. But the market agrees, as well, and recognises the work by smaller MVNO-style providers, such as BICS, to offer backend technical integration between carrier infrastructure – on top of increasing roaming deals being struck by the likes of BICS and by operators themselves.

Vidal-Madjar says: “Mobile operators have worked at roaming, and reinvented the business model for billing. It has taken time. But it now works. At BICS, we have 12 roaming agreements on NB-IoT already, and we expect to have more than 20 by the end of the year. So things are moving. International connectivity is important for IoT to take off. Because IoT will only be successful if it is simple for the enterprises to deploy in global markets. They want one SIM card that works everywhere.”

He continues: “Roaming is complicated for NB-IoT on the technical side; additional core network elements have to be interconnected. It is complicated on the commercial side, as well, because traditional inter-operator billing charges per megabyte of data, and NB-IoT is carrying only kilobytes of data – so that model won’t fly.” Generally, billing is better; BICS is offering a monthly NB-IoT subscription, for less than $1 per month for the top-end plan, or a single downpayment for the life of the product.

But its message is about simplicity. He says: “We have simplified global IoT deployments for enterprises, so they don’t need a local partner in every country. They don’t need to do local integration and they don’t need commercial agreements with each operator’s connectivity platform in each different country. But it is more than just that, actually. It also makes global deployments manageable. The connectivity is one part of it but it needs to be as simple as possible, as easy as possible – everywhere.”

Sign up here for the Enterprise IoT Insights webinar on the state of the NB-IoT market (what has gone wrong, and when will it go right?) on October 7, featuring panellists from BICS, Nordic Semiconductor, and Sequans.