This article is taken from a new Enterprise IoT Insights report on Industrial 5G SLAs. The full article, including additional sections, along with the rest of the report – with commentary from the likes of Accenture, Appledore Research, EXFO, Nokia, Lufthansa Industry Solutions, and Vodafone – is available to download here.

It is like that old C. S. Lewis quote, that ‘integrity is doing the right thing even when no one is watching’. If the success of industrial 5G comes down to the speed and reliability of data across the network, the integrity of the data is also about what goes on behind the scenes, in the obscure recesses of back-office business support systems (BSS).

Because this is where the battle to deliver ultra-reliable low-latency comms (URLLC) and intelligence is won and lost. So says US software company VoltDB, offering an in-memory NewSQL database to help 5G operators stay sharp.

“All this investment in infrastructure is going to be moot if you’re using old software to provide the service,” comments Dheeraj Remella, chief product officer at the Massachusetts firm. “Half a millisecond is half a millisecond, but what’s happening between those two half-milliseconds? If there’s a whole second in there, then you’ve undermined the whole URLLC premise. That’s the value we bring to the table.”

VoltDB has been offering an ACID-compliant relational database system, using ‘shared-nothing’ architecture, since 2010. It reckons 5G has “changed the game” for telcos; a new way of managing data, is needed, it says, for “businesses to survive and thrive in the age of 5G, IoT, and whatever comes next”.

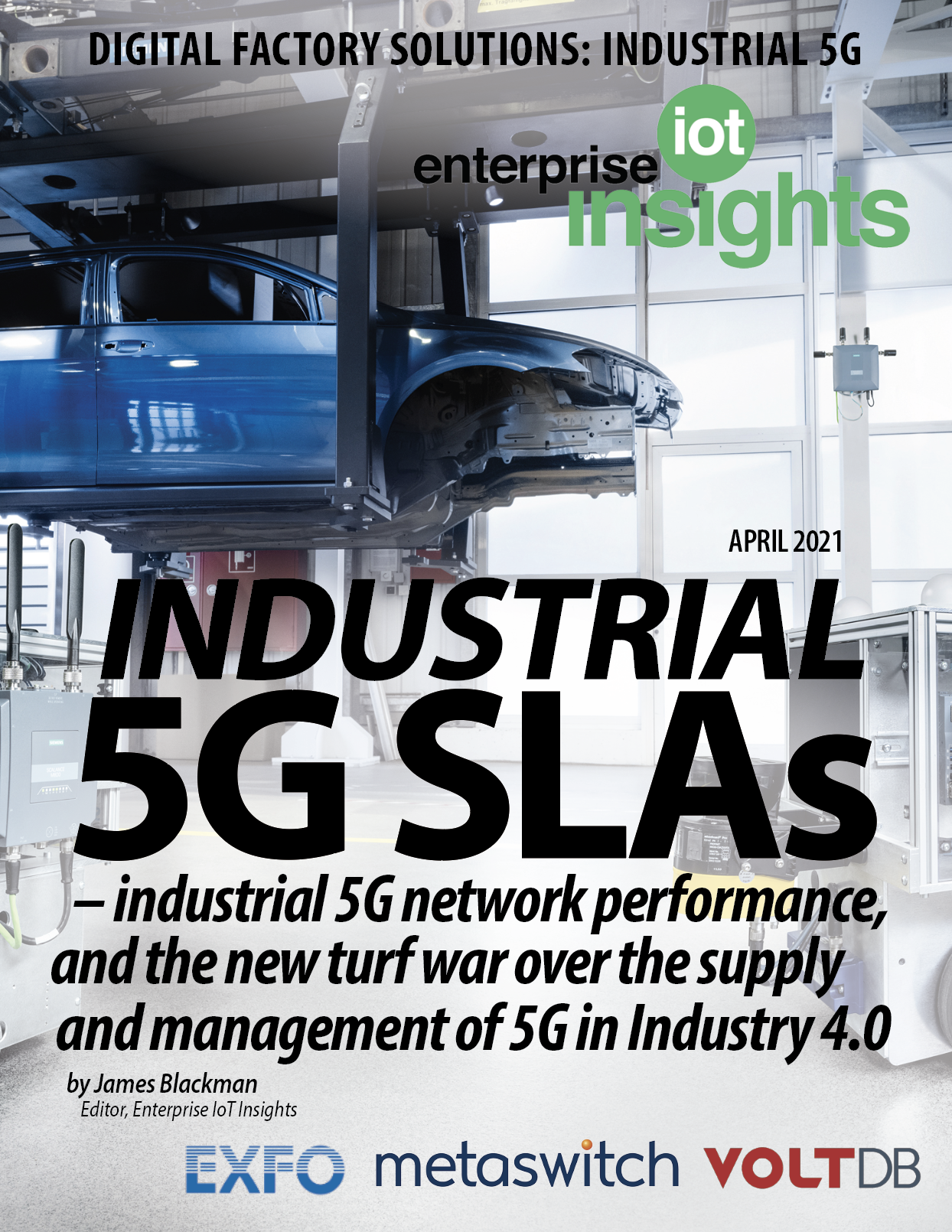

A typical 5G setup requires multiple technologies to come together to solve one problem: real-time intelligence (“ultra-reliable low-latency decisioning, or ‘URLLD’, as we call it). Remella comments: “Because data is useless if you can’t use it for intelligent decisions – to drive action. It is just baggage, otherwise.”

…

Why do carriers need another in-memory database?

Remella: “A lot of NoSQL databases came up when internet-scale operations started, and scale became a problem. And they threw out everything that traditional databases had established – which is consistency of data, correctness of decisions, resiliency and immediacy. All of that went out the window.

“We are bringing all the goodness back into internet-scale operations. We are bringing together the ability to scale and the ability to be immediately correct. Because if you are taking actions based on data that is only nearly correct, at scale, then it is not good enough – certainly for the Industry 4.0 market.”

Talk about this 10-millisecond latency metric – where it comes from, what it means?

Remella: “Yes, so VoltDB brings together a set of capabilities that are necessary to complete this value-extraction, in the first 10 milliseconds of any network event, lifecycle event, subscriber event – whatever. Ten milliseconds is not a statistical measure, but one customers tend to use as a yardstick for making decisions from event genesis – the time to decide on the best corresponding action. That’s where they make a difference.

“For example, Mahindra Comviva, selling software to operators to monetise the network, has a total budget of 250 milliseconds from the point an subscriber presses on a call to the point a next-best offer is made. Which requires VoltDB to make a decision in the first four-to-seven milliseconds – whether it is about any kind of fraud, or intrusion prevention, or DDoS detection. All of those things require a decision in under 10 milliseconds.”

What are some of the standard use cases?

Remella: “We offer the foundational platform in OEM products. Openet and HPE have charging and policy, for example, which is our bread and butter. There are areas like monetisation and revenue leakage prevention, or revenue insurance. In all these cases, the accuracy of decisions and the correctness of data is mandatory.

“And those things are compromised with other database technologies. Ours is becoming the standard platform for charging and policy in the BSS space. And although we could be considered a horizontal platform, we are focused on 5G, and the 5G-enabled world.”

How does that BSS-capability transfer into Industry 4.0? How will carriers, via OEMs, make use of your database in this market?

Remella: “The last three operators that purchased solutions running our software have all done so to manage industrial IoT – two in Europe and one in the US. I can’t reveal names, but the thing with Industry 4.0 is you can’t have any downtime. It is not permissive, like in the consumer market, where a subscriber can just retry the connection.

“If you can’t connect in a mission critical environment, it becomes inoperable. There is massive revenue leakage. We see ourselves as an active digital-twin hub, collecting and combining incoming data, machine-learned intelligence, to enable active digital twins and drive actions – to create a closed feedback loop of telemetry.”

Talk about how your database plays with network data and enterprise data?

Remella: “It brings IT and OT together. You have to bring network data and enterprise together to assure quality-of-service. Which is exactly where we play. Because [our product allows carriers] to unify multiple streams of data to create a complete picture, which is required with network slicing and Industry 4.0 – where service quality and assurance is monitored and optimised based on policies per slice, or per customer, or per use case or application.

“Release 16 [of the 5G standard in 3GPP] has made a ton of enhancements to policies to address Industry 4.0. These charging and policy systems are moving closer to the things they are managing – subscribers in a nationwide deployment or devices in a concentrated industrial IoT deployment.”

Just put these two key elements – policy and charging – into context, in Industry 4.0, as the network and compute functions move to the mobile edge and the enterprise edge.

Remella: “Yes, so the first is about doing the work, and ensuring the quality-of-service – that is where policy comes into play. The second thing is that operators are not charities. They need to monetise what they’re offering. Which is where charging becomes essential.

“Seven or eight years ago (when VoltDB was still new in the market), operators were actually losing money because they couldn’t track charging in real-time. Now, with Industry 4.0, the density and velocity of data is going up all the time. You can’t have centralised charging that requires periodic sync-up. All of this computation and management needs to happen very fast. And we are moving closer and closer to the edge.

“None of these three [new operator] contracts are centralised deployments – all are MEC deployments, which is where resiliency becomes super important. Because you cannot have a single edge data centre serving a single setup, [and yet] you need a resiliency model for cross-data centre replication and highly-available data infrastructure. So it’s not just about moving to the edge, but also enhancing the reliability and resiliency of these platforms at the edge. That’s the trend we are seeing in general.”

Let’s bring the conversation around to 5G SLAs, which is the point of the piece. What is VoltDB doing to help network operators with these performance guarantees?

Remella: “Operators need to monetise their 5G investments, and monetisation comes in two flavours – how to make money, and how not to lose money. When you consider the volume and velocity of data being generated as things go live in standalone 5G environments, you need to know what the data is telling you and make intelligent decisions in response to it.

“That is coming up in charging first, and policy now. By protecting network resources, operators can handle fraud prevention and intrusion prevention. They need to operationalise intelligence on all the new data coming into the network – whether to present the best offer, or to reject a connection request in a DDoS attack, or just to ensure the charging is correct.

“And charging is not just bean counting; the value of charging comes with enabling operators to define and deliver new products with high agility. When charging is done right, those launches will be accelerated – going from several months to days or weeks. “

Are enterprises, which will in many cases run these private 5G networks themselves, mindful of these aspects of network management? Or does this remain a telco-discipline , really for carriers?

Remella: “The awareness trickles down. It is already there in the OEM space. Awareness of the need for low-latency decisioning is increasing within the carrier space. And enterprises, yes, they have these needs, as well. As a business, we will focus on the telecoms space, at least for 202.

“Enterprises are still trying to figure out how to put together a variety of open source technologies, and just to skim by. Until they actually see there is a genuine difference in moving to immediately consistent, ultra-reliable, resilient decision-making, we don’t want to waste time there.”

Does your proposition have a bearing beyond network management? Does it rollover into sweating the production line and industrial assets, and getting operational data coming from those machines?

Remella: “Yes, we see that. But industry participants need to move beyond SCADA to systems that are more intelligent than just data collection. That is a transition that needs to take place, and the sense of urgency will develop once the latency promises of standalone 5G get delivered. Today, we are looking at charging, policy, real-time mediation for rating and billing, customer management, and revenue assurance. And those things will enable digital twins, industrial automation, process automation.

“More industries will start to participate in this never-before IoT revolution. When that happens, you are minimising human exposure and maximising automation. At that juncture what we have been offering in these five spaces is going to be a key. So we see ourselves as highly relevant in Industry 4.0 – but Industry 4.0 is waiting on 5G SA to come to fruition.”

Does it impact how you approach the Industry 4.0 market, as hardware opens up, complexity is stripped out, and enterprises manage these networks themselves?

Remella: “Maybe, maybe not. But even the most advanced of these implementations – in Germany, by Lufthansa [Technik] and Daimler – have not required the enterprise to build software components themselves. All they have wanted is the spectrum, to be independent from the public network.

“But they are still engaging with operators. Lufthansa Technik worked with Vodafone on one of its installations. Daimler used Telefónica in Germany as a system integrator to implement everything, and then move on – so no more Telefónica. All these operators did was set up infrastructure, feed them with software vendors, and then leave the picture.

“So I don’t see the operators or integrators, depending on who the enterprise engages with, taken out of the picture. Because Daimler is not in the business of building and maintaining networks. It is in the business of using then to optimise its manufacturing processes.

“So enterprises will still engage with the regular players in a consultative mode, rather than in a subscription model so to speak.”