This interview is taken from a new Enterprise IoT Insights report on Industrial 5G SLAs. The full article, including additional sections, along with the rest of the report – with commentary from the likes of Accenture, Appledore Research, EXFO, Nokia, Lufthansa Industry Solutions, Vodafone and VoltDB – is available to download here.

The biggest revelation in this investigation (see report) about the ownership and authorship of industrial 5G service-level agreements (SLAs) comes from core networking provider Metaswitch, acquired by Microsoft a year ago, and assimilated into the Azure family last month (March). And the word is that mobile operators are using enterprise-based LTE and 5G installations to extend their own national coverage footprints.

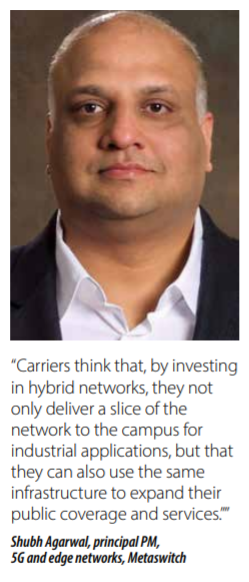

Shubh Agarwal, in charge of 5G and edge networks at Metaswitch, says the “default” approach for carriers, including in North America and Europe, is to offer enterprises a hybrid network infrastructure, typically with new edge-based radio infrastructure and a share of their public core network, and to make use of the installation to bolster their own general-purpose coverage.

It has set alarm bells ringing in enterprises, he suggests; he has seen evidence of a backlash in the rush of requests-for-proposal (RFPs) across his desk, from enterprises looking to kick the tyres on industrial 5G. These make clear carrier respondents should forget about pitching these hybrid-style ‘campus’ networks.

Indeed, for Metaswitch, like a number of others in this publication (see report), the operator set has misjudged the market. “Enterprises are smarter than telcos,” says Agarwal. They know what they want from 5G, already, and are “pragmatic” about extracting value from it, even as more complex use cases remain out of view.

The business of SLA-writing is, to a greater extent, an easy one for now, as others also testify in these pages (see report). Metaswitch, with 850 staff and 500 customers, and a new role as the in-house 5G pipe for Azure, is going to the “early adopter” market through specialist ‘vertical’ channels, and not ‘horizontal’ telco operations.

Together with these consultants and integrators, plus the wider industrial IoT and AI “ecosystem”, pulled along by the Azure juggernaut, the firm will scope industrial 5G-proper for the “mass market”, and define the SLAs to underwrite it. That, or something like it, is its manifesto; written-out and explained-over in the interview below.

…

Explain how Metaswitch fits into the Azure family, with Affirmed Networks (acquired by Microsoft at the same time) as well?

“The strategy is simple. Microsoft believes telcos are ready for the cloud, and these acquisitions bring telco domain expertise into Microsoft – to offer Azure workloads for both telcos and enterprises. There is work to merge the R&D functions, but both portfolios will be retained. The go-to-market strategy is that Affirmed Networks is focused on telco networks for operators and Metaswitch is focused on packet core solutions for enterprises.

“So Azure, which offers cloud and edge solutions, and a vast range of applications, now has packet core solutions optimised for operators and packet core solutions optimised for enterprises. At the same time, Azure is founded on a strong partner ecosystem, which means that, even though it has its own workloads and network functions, it will continue to work with partners, offering competing workloads. That is how the roles have been divided up. My focus for the last six months has been to figure out how to serve the enterprise market with 5G.“

So how do you do that? And what do you make of attempts by carriers to do the same?

“The thing is… when [carriers] try to solve this for enterprises, they [fall at the] first hurdle. They want to deliver voice services. And this market is not about that at all. The reason enterprises want 4G and 5G is to grasp digital transformation – to change how they produce goods and make decisions. And there are three drivers for that: automation, telemetry, and AI – for connecting machines and sensors, and taking smarter business decisions.

“I tell sales that this is not for telcos; this is not a telco market. This is not about expanding voice and video coverage so staff can access TikTok in their lunch breaks. This is a different set of use cases, outside of normal telco stuff. Telcos don’t understand this, and that’s a big issue. You can’t just extend a telco network into the enterprise. Enterprises are clear about this; they write explicitly in their RFPs that they don’t want that.

“They want a private network inside their facilities, connected to their back-end IT and business processes, and managed by their own people. That is what the RFPs stipulate: control, seclusion, security, and integration into backend systems. The only practical way to do that is to package 5G networks as standalone black boxes that go directly into the enterprise.”

What about SMEs? Will they engage with the telcos – whether in some hybrid setup, or on a slice of a public network?

“It is an early-adopter market; the only ones playing right now are the big guys – the defence industry, big healthcare, university campuses. SMEs have not started looking at this yet; a handful, maybe, but the easiest thing for them to understand is a standalone network. Because that already exists; it is the only thing they’ve ever known.

“They have been buying connectivity forever, right? Ethernet, Wi-Fi, Zigbee and LoRa – it is all private. Enterprises already expect complete control and isolation. They don’t understand the value operators bring by slicing networks. In fact, they are paranoid; they want to know how their data is going to be shared, and how to provision devices. ‘Am I going to be able to add policies? Am I going to be subject to external regulatory requirements?’

“We talk to a lot of telcos, and they ask about these split architectures with centralised control planes and edge-based radios. The answer is always: ‘Yes, we can do it, but why would the customer want it?’ And they can never say what a slice of a shared telco network provides that an edge network does not.”

So, if enterprises want their own standalone networks, with localised control over the connectivity and compute, is there even a conversation about whether to let the telcos in? Or have they been excluded already?

“That is the billion dollar question. Because operators have two things: one is the domain expertise, the network management expertise; and the other is spectrum, which they own in most cases – the majority of it, anyway, if not all of it. So enterprises see the value, but the most telcos – 95 percent of them – insist the only way to deliver and operate these networks is through a shared common infrastructure, and not by delivering edge-based standalone networks.

“That is the billion dollar question. Because operators have two things: one is the domain expertise, the network management expertise; and the other is spectrum, which they own in most cases – the majority of it, anyway, if not all of it. So enterprises see the value, but the most telcos – 95 percent of them – insist the only way to deliver and operate these networks is through a shared common infrastructure, and not by delivering edge-based standalone networks.

“In many cases they go as far as saying the edge-based radio network and user-plane function (UPF) should be a shared resource. They think that by investing in campus networks in that hybrid manner they not only deliver a slice of the network to the campus for industrial applications, but they can use the same infrastructure to expand their public coverage and services.”

I have not heard of that. Are carriers in the US and Europe approaching it that way?

“Yes. That is pretty much their default position. Because of their investments in these networks. Which is why these RFPs make it very explicit that enterprises want a complete standalone network, which they control. They want help with the management of it, but they want to control what goes into it – how many devices go on the network, the policies attached to them, and how the network is sliced. ‘Because we are paying for it’. Like I said, telcos forget that connectivity is not a new thing for them.”

What about the management side? Will enterprises go to the traditional operators or or systems specialists in their own sectors?

“Both. But even the telcos in most cases do not have the expertise to deploy and manage these networks, actually. The telcos serve seven billion connections on the planet, with common services and device management. They can’t scale-down to cater to individual requirements. They just can’t.

“We have seen it in the unified comms market, where they have been very interested in taking our solution. But guess what: they subcontract the work to systems integrators. They know how to run big networks, serving hundreds of millions, but they can’t chase after small-scale network planning and deployment. They are using system integrators to deliver private networks. Which is our preferred route to market, as well.”

How does your offer overlap with the likes of Nokia and Ericsson? It seems Azure is going from the core upwards, to cover compute and applications, and they are going from the core network down, to cover the RAN.

“Yes. We are bringing the back-end network, which starts with the edge compute and the edge core [network], and covers the edge applications, all backed by a cloud managed service – including things like SIM and spectrum management. What’s left is the radio network (RAN) – plus all the services associated with deploying, managing, and building applications, which is what the managed service providers offer. Nokia and Ericsson are focused on the network elements, which covers the core and the RAN. We are completely agnostic. We are working with every RAN vendor in the world.

“But they lack the compute and the applications. And no company can serve the global market – with different spectrum frequencies, different indoor-outdoor combinations, different power requirements – on just the radio side. Whereas we are building this common stack which is globally relevant, and we believe a global ecosystem of radio partners will serve this market based on region, customer reach, and portfolio. [Because] enterprises are not buying the network; they are buying the applications.”

You said earlier, it is a different discipline to serve many different customers with many different networks. Does that mean this is a ‘team sport’,and is the only way to conquer this fragmented Industry 4.0 market to pull together? In the end, is the tightest-knit supply chain the one that will succeed?

“Exactly. And operators are going through that realisation that this market is different. I am not trying to challenge their ability to deliver smartphones to business users. I am a business guy, and if I need a phone, I will go to AT&T and Verizon. Same if I need nationwide asset tracking or smart metering.

“They have the spectrum, the assets, the capability to deliver connectivity across a whole nation. Enterprises are being served by the telcos, too; no one challenges that. But private 5G has got nothing to do with those use cases. It is all about industrial applications and data processing, real-time and on-premise.”

What about network performance? Clearly, we are at an early stage, and each case is different. But the question, and the point of this article, is: what happens to that production line when the 5G network, guaranteed at five or six nines, fails? Because at some point it will, if steps are not taken.

“Yes, you can deviate very quickly with these super advanced use cases, and then wonder if, actually, any of it is real. But enterprises are smarter than telcos with 5G. I’ve seen 20 RFPs, maybe, and the use cases in them are [pragmatic]. The trend is to upgrade things that cannot survive and will not scale with Wi-Fi. We had one last week to migrate handheld scanners onto 5G to negate Wi-Fi interference in a factory; we had another to port mission control data from planes and ships when they dock – instead of manually pulling hardware from the vehicle.

“These are practical applications, to solve real pain points. Enterprises are not asking for AR or VR [as primary use cases]; they just want to move stuff that isn’t working on to cellular. Because they have the network and the spectrum, and these RFPs are asking for ways to solve problems; they will move on to the other stuff when they see it works.

“I’ve been in the telco game for 25 years, and it’s humbling. Because you read about their requirements, and it’s like, ‘Oh, I didn’t even think of that’. So, yes, enterprises know their businesses better than we do. Of course they do, and they know exactly what they want 5G for. I can’t pretend to know about healthcare, or manufacturing. Enterprises know exactly what will add value.”

What about future applications that will be sprung by URLLC, with Releases 17/18? What will be running on 5G, then, and what SLAs will go against them?

“The whole reason for URLLC is for machine communications – so the factory floor does not come to a stop just because of a compute failure or a software glitch. Those kinds of use cases will rely on that ultra reliability. The early-adopter market is doing lots of proofs-of-concept, and it might take time. But we are not just selling this technology off-the-shelf because it works. We’re all figuring out what else to do with it, and we will bring the rest of the mass market up to speed eventually. But the technology is not proven; it will take two to three years.”

Are enterprises asking for guaranteed performance in these RFPs – around latency and availability, and for support if any of these metrics fall below certain levels?

“Yes, the RFPs ask for that. That is the dialogue in the market – around what we can deliver, under what circumstances. Automotive manufacturing, for instance, wants five-nines reliability. But for that, you don’t just need compute at the edge; you need two loads of it, with redundant backups, and power backups, and network redundancies. All of which has a cost. Just because it says ‘5G ‘does not mean it is totally reliable.

“In its simplest form, on its own, 5G won’t get you to six-nines. That kind of reliability has to be scoped out, and budgeted for – and justified. The market is trying to see if 5G will deliver on its promise, and the answer will have nothing to do with 5G, actually. Because if you don’t have transport redundancy between the radio and the core, then that becomes your single point of failure. It is the same for your local and wide-area (LAN and WAN) networks, and your backend systems. It has nothing to do with 5G, itself.

“The manufacturing and defence industries want ‘survivability’. Which is one of the reasons the whole split-hybrid architecture doesn’t make sense. If an element of the transport plane is in the cloud, and there’s a thunderstorm or tornado and the cloud connection goes out, then is the factory floor still connected? That is a fundamental requirement, which justifies the need for a standalone network on the edge. The question of reliability is not just about 5G, but all the other stuff under and behind it.”

Does the introduction of redundant infrastructure impact the flexibility of 5G – for fold-up/fold-down manufacturing?

“Not necessarily. The scale is small enough that the flexibility doesn’t really go away. Even factories of a million square feet only require a hundred base stations, or so. Which means you still have the flexibility. The systems integrators managing the networks can provide flexibility at that scale.

“I sit in a 35-seat office in the Dallas area, with people in and out all of the time, and the local system integrator tunes the Wi-Fi on a regular basis. That’s what telcos can’t do; they can’t manage that kind of flexibility for smaller networks, at that scale and volume. Which is why many are relying on system integrators to take their solutions to market. But the flexibility doesn’t go away; these networks are small enough to be managed.”

So how do we sum up? In terms of the SLAs being set down by enterprises, it seems the networks are over-delivering, and the KPIs are easy to deliver. How do these change as networks become more complex?

“The KPIs are separated around delivery and management of the network, and system integrators are handling both. Because they have the reach and they are already doing this; it’s no different from an enterprise Wi-Fi network or a local-area network. That’s a key point. The mobile industry thinks 5G is the only technology for enterprises, and that’s just not true. Enterprises already know the KPIs for 5G delivery and management.

“They know 5G is superior to Wi-Fi. What they don’t know is the KPIs for all the new apps. Which is where slicing will come into play. But KPIs have to be defined case-by-case, and we are working that out. You can’t supply one set of KPIs for everything. Some industries want extreme reliability and will pay for it. But 80 percent of the network will have good enough reliability and coverage for 80 percent of use cases.

“It is the classic 80/20 rule. But the focus for now is on delivery and management KPIs – who can deliver the network, who will let me manage it. The system integrators are best for that.”

This interview is taken from a new Enterprise IoT Insights report on Industrial 5G SLAs. The full article, including additional sections, along with the rest of the report – with commentary from the likes of Accenture, Appledore Research, EXFO, Nokia, Lufthansa Industry Solutions, Vodafone and VoltDB – is available to download here.