Note, this article is continued from a previous post, entitled ‘IoT is not about LoRa vs Sigfox anymore; it is about Design Process X vs Design Process Y’. Click here to see the previous instalment.

Picking up the thread again, we hear that the cost-sensitive low-power end of the ‘massive’ IoT market has spent way too long scrimping on hardware costs just to get deals over the line. It is not enough for the system to scale, and scale is the only way for the system to work. The picture is of a frontier IoT community, struggling to make it all add up; like a ragtag of prospectors in the Old West.

There has to be another way to strike gold, reflects Wienke Giezeman, co-founder of The Things Network (TTN), speaking with Enterprise IoT Insights last month at The Things Conference, a kind of campfire cook-out for anyone digging with LoRaWAN in them IoT hills. It does not make sense, he explains, to carry on slashing IoT hardware costs, and devaluing IoT solutions, when savings stretch out over longer periods in sometimes unknowable ways.

His firm, with its volunteer patchwork of public LoRaWAN infrastructure, plus a pipe of private LoRaWAN solutions from The Things Industries (TTI), has lit a blaze for the whole IoT developer community; his event, with its “festival” appeal, affords a time to sit by the fire and tell about some tech-style promised land. So rug-up; Giezeman is stirring the pot. His story says the IoT market is missing a trick.

“That chip might cost a dollar, and yet it squeezes an extra 30 percent out of the battery, which might extend the lifetime of the device by a year – which might save $70, say, in the third or fourth year. These solutions and impacts are linked. We are trying to educate the market, to move away from just squeezing every penny out of hardware costs, to think about the knock-on impact on the TCO,” he explains.

It is worth pausing a moment just to consider the whole TTN jamboree, beamed out of a studio somewhere in Amsterdam last month, and established as a fixture in the LoRaWAN calendar and a base-camp on this ‘massive’ IoT hillside – before we consider all the little explosions it is setting off to bring the hill tumbling down. “The whole event, the whole brand – it is a bit like a festival,” reflects Giezeman. It sounds naff, but he has a point.

A timing clash means, on this day in January, Enterprise IoT Insights is running between two rooms, and two laptops tuned into two events; on the other side, on Microsoft Teams, there is a day-long private LTE / 5G agenda, hosted by core network provider Athonet. It’s a great event, no question; packed with quality content. Everyone who is anyone in the private networking game is here, it seems, and most are presenting..

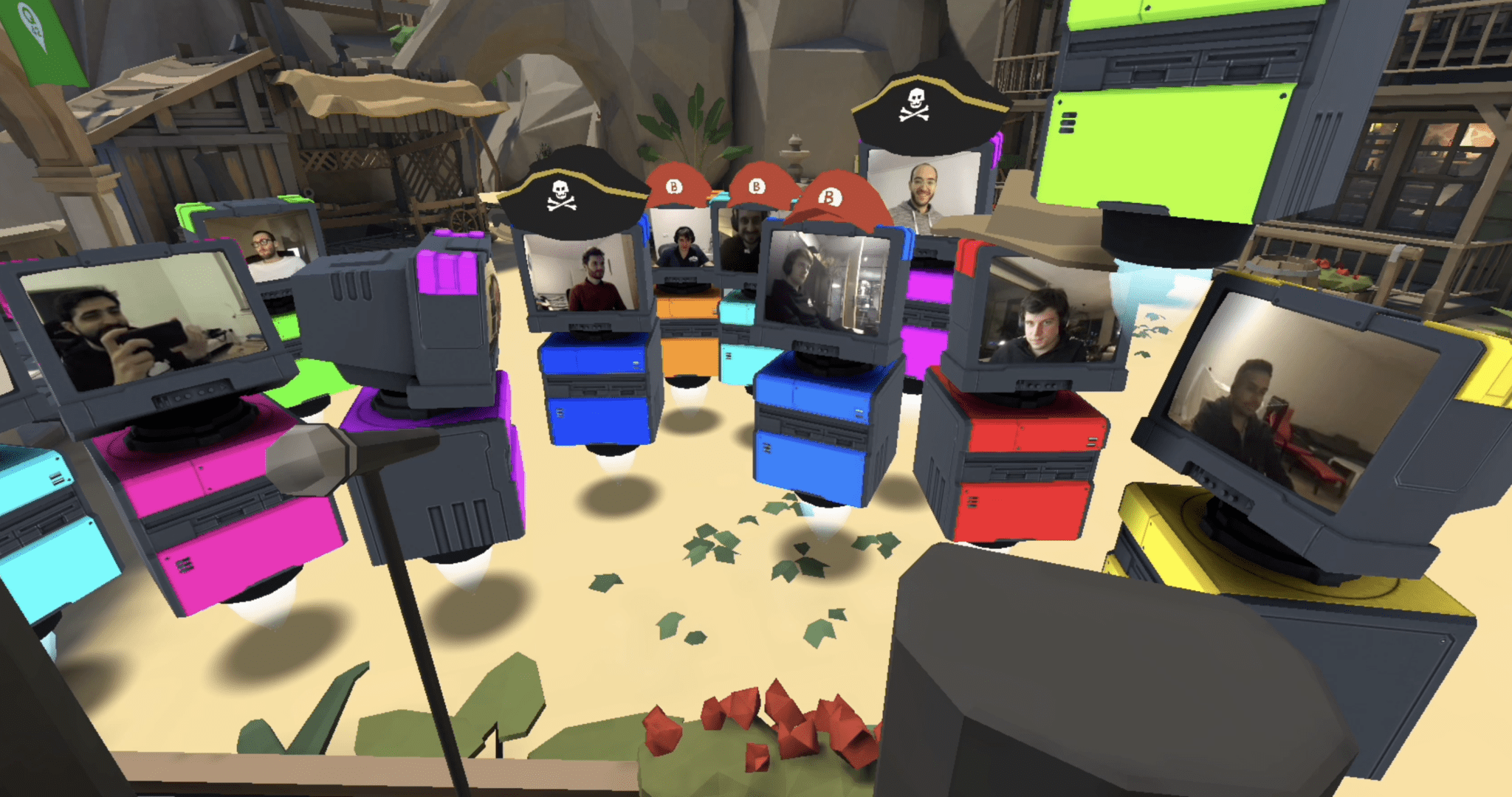

But it is an entirely different experience. The Things Conference is running all week, by contrast, with a mixed bag of blue-sky keynotes and down-and-dirty workshops; the chat function, running on a bespoke conferencing platform, is busy. Like at no other online event we’ve been to. Greetings from London; greetings from Lagos; greetings from L.A. – everyone checks-in, and chatters through, and most presenters chip-in as well.

Plus, there’s a nifty late-afternoon networking platform, which gets fairly lively – and almost works as a substitute for a round of Amstel and a catchup over pastries. (Late lockdown; we’ll take anything.) Look; here comes Giezeman, in some kind of retro-PC arrangement (see image). Who else could make this work? Not Semtech, not the LoRa Alliance; no one from the traditional cellular industry, certainly; maybe no one at all.

Giezeman explains, on Zoom, the TTN setup and philosophy: the business remains ‘independent’, he says, with private investors that recognise “IoT is a team sport”, and freedom in its relationship with Semtech and the LoRa Alliance, as vested interests in the LoRa ecosystem, to be critical and take criticism. “It makes us stronger. Which is important in this many-to-many relationship,” he comments.

“This hype about future profit has invited a lot of investment into the market. But we always knew it wasn’t a high-margin game, and that it would be hard to scale. Our mantra is to build together, which is not the way the private equity market works. They will tell you: ‘What, build it together? No way – we want it all.’ But this is not a zero-sum game, and if you’re wired to think that way then you are going to have a lot of bad nights.”

The concept of ‘co-creation’, which is struggling to find root in IT / OT crossover in industrial IoT (and lately in telecoms / industry crossover in private cellular), has been a tenet of community-based open-source IoT development from the start. To an extent, TTN / TTI reflects the LoRa ecosystem and the LoRa ecosystem reflects it back, insofar as it is driven by top-down standards and development but is also shaping the technology and community itself.

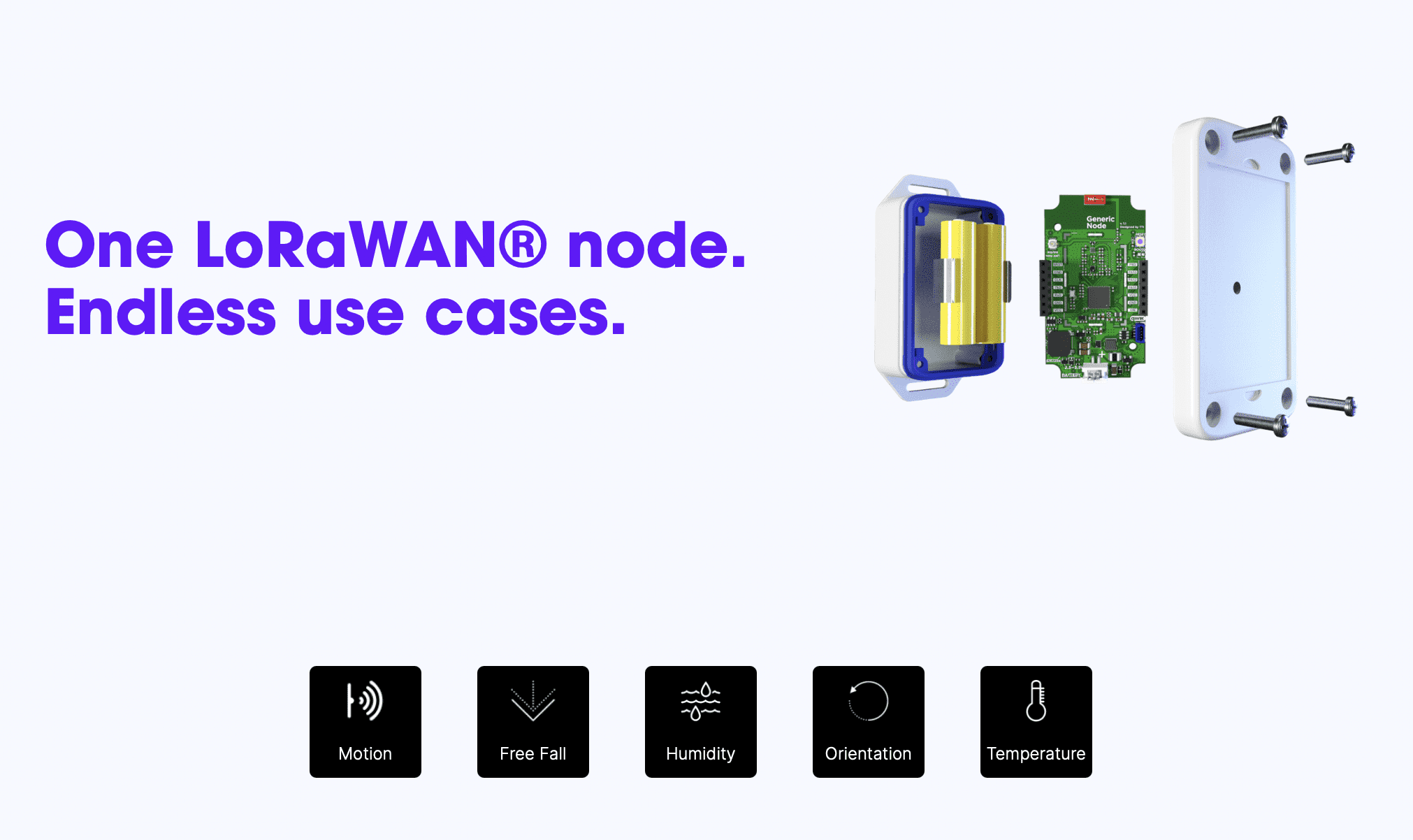

Which gets back to this discussion about how, exactly, the LoRaWAN brigade can educate the market about the TCO of their various low-power IoT wizardry. Let’s start with Exhibit A, a multi-purpose multi-sensor IoT unit called the Generic Node, unveiled at The Things Conference, which can be configured in software for a range of IoT use cases over-the-air. It is being offered by TTI, and features the work of Fractus Antennas, Microchip, Richo, and ST Micro, among others.

The point is the engineering is finished and the supply chain is compressed before the unit is even specified for work. Whatever the discipline, whatever the sector, the hardware is ready-to-go and the software can be provisioned, over and again, in the field “on any LoRaWAN network in the world”. It removes complexity and risk (and associated cost) from hardware development, the story goes.

The momentum shifts, instead, to focus onto the slide-rule balance between software and application. Which, in turn, “drives a narrative” about “how the device’s behaviour impacts the TCO”, he says, and “where everybody starts to talk about the TCO”. Semtech called it “an important step forward that lets developers focus on what they are best at – building innovative ways to deliver value to their customers.”

As well as damping-down hardware development, to make the discussion about the value of the solution, itself, Giezeman’s group is also looking to demystify the business case for the bottom-layer private networks. TTI is offering network installation and maintenance services to large providers in 50-odd countries, covering connectivity and device management and monitoring, plus equipment swaps, logistics and warehousing, and e-waste disposal.

A five-year wholesale contract for a single starter-network, based on one gateway and six devices, costs about €45 per month. The offer will allow IoT solution providers to “deliver the last mile of IoT without the headache”, and to “drastically” lower the TCO for large sensor deployments. Giezeman comments: “We are putting our money where our mouth is, to say, ‘Okay, we have this concrete TCO, covering both the network and the sensor part’.”

It is the same logic, to remove network-level IoT headaches, behind the group’s collaboration on a hybrid IoT gateway solution with Deutsche Telekom. The German carrier has developed a dual-mode LoRaWAN / LTE-M gateway, from manufacturer Mikrotik, with LoRa 2.4GHz compatibility for global deployments, as well. The unit comes with “no-touch” provisioning and connects to TTI’s device and data platform.

The solution is pitched for enterprise-based smart building controls, as a “smart building starter kit”. Giezeman says: “LTE-M is just a very nice technology for deep indoor penetration, to make sure the gateway has backhaul. If you have pre-provisioned LoRaWAN gateways that just need switching on, then you can save massive amounts of time during installation. And at scale, with 500-plus sites, you will see all the benefits in terms of TCO.”

But TTN / TTI is reflecting back, too; the drive to simplify IoT design processes and value creation, to multiply the explosions and direct the gold-digging in the IoT hillside, goes across the whole sector, and innovations are coming down from the top, as well. Notably, the LoRa Alliance has introduced regional “frequency hopping” performance parameters and roaming capabilities, plus geolocation features and zero-touch device identification and onboarding.

Giezeman rejoins, still stirring the pot, as if his compadres are huddled around the fire, hunching forward to hear the climax: “Everybody is trying to lower the barrier to entry and scalability. That’s the strength of the ecosystem. If the industry is more focused on TCO, some projects will fail faster because they won’t suck up resources, and the others will be allocated more budget because the business case is clearer. Both ways, it’s good for the IoT market.”

Note, this article is continued from a previous post, entitled ‘IoT is not about LoRa vs Sigfox anymore; it is about Design Process X vs Design Process Y’. Click here to see the previous instalment.