Nokia said it deployed private LTE and 5G networks with 79 new customers in the final quarter of 2020, finishing the year with 260 enterprises on its books for private wireless solutions. The company’s enterprise division saw net sales rise one percent in the quarter and 11 percent in the year, compared with the same periods a year ago, against an overall revenue-slide of five percent (to €6.57 billion) and six percent (to €21.87 billion), respectively.

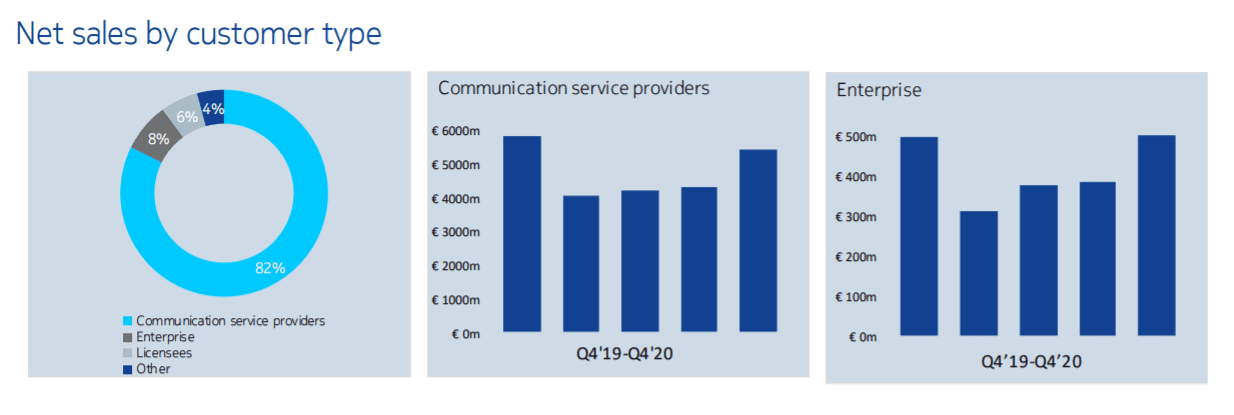

Enterprise sales make up about four percent of Nokia’s business; its Q4 enterprise performance was about 30 percent up in the second and third quarters in 2020 (see image, below). Enterprise sales broadly followed in line with the pattern of total group sales.

Overall group profit in the fourth quarter was €811 million, down one percent, and €1.46 billion, up 19 percent in the year; the Finnish vendor did not provide breakout numbers for its enterprise division. Reported gross margin was 39.2 percent in the quarter and 37.6 percent in the year, compared to 38.5 percent and 35.4 percent a year ago.

Pekka Lundmark, president and chief executive at Nokia, said the enterprise division’s performance was down to its “leadership position in many areas, including in private wireless”. He referenced distribution deals with AT&T and Verizon at the end of last year for its Digital Automation Cloud (DAC) product, an as-a-service edge networking solution for on-premise private LTE and 5G.

He also referenced Nokia’s contract win in late January with the US government’s National Cybersecurity Center of Excellence (NCCoE), as part of its 5G Cybersecurity Project, to work with government and industry, plus other vendors, to “ensure the transition from 4G to 5G networks is secure”. Nokia said the project will “demonstrate how… 5G can provide security capabilities to mitigate identified risks and meet industry sectors’ compliance requirements”.

He commented: “The growth in net sales to enterprise customers was primarily driven by increased demand for mission-critical networking solutions in industries including utilities and the public sector, with continued momentum in private wireless solutions.”

Nokia expects 2021 sales to be between €20.6 billion and €21.8 billion compared with €21.9 billion in 2020. “We expect 2021 to be challenging, a year of transition, with meaningful headwinds due to market share loss and price erosion in North America,” said Lundmark.

He added: “We will sacrifice some short-term margin to ensure leadership in 5G… Considering these elements, we maintain our comparable operating margin outlook for 2021… We know we have our work cut out in 2021, but the new leadership team has hit the ground running.”