IoT device management platform Pelion, previously a unit within Arm, has been spun-out as a standalone business, wholly-owned by the UK chip design firm. At the same time, it has integrated its connectivity management and device management engines, and bundled a new application management function into the bargain.

Buoyed by its role in the breakthrough new ‘smart label’ innovation from pharmaceuticals firm Bayer – alongside sister-company Kigen, spun out of Arm at the same time – Pelion said this week it is ready at last to serve the broad IoT market under its own steam. (Separately, Treasure Data has also quit the Arm roost.)

Hima Mukkamala, who takes the role of chief executive at Pelion with the company’s new solo status, told Enterprise IoT Insights the move was deliberate for Pelion, and not dictated only by parent-company Softbank’s toing-and-froing on the stewardship of Arm’s IoT and AI businesses, nor its pending $40 billion sale to US chip-maker Nvidia.

The company’s new independence suits it well, he said, responding to a question about the driving logic behind the rejig. “It is a deliberate strategy to stand on our own, knowing where the market is going and what it needs from a heterogeneity standpoint. So, yes, it is a deliberate move by us,” he commented.

“We still have a partnership to drive conversation with silicon partners. But, really, there isn’t such an affinity [with Arm] for the kinds of OEMs we target – just because they are a few steps removed from the silicon layer in the value chain. So it doesn’t hurt [to be apart]. And we will continue to leverage its strength, as a subsidiary anyway.”

So, what’s new with the company’s new status? It has devised a new logo, and imagined something about the human-value of ‘things’, described in a strapline to “connect a world where life and device thrive together”. More importantly, it has linked its IoT management functions by threading-in a common ID for the devices they manage.

This new linkage between its connectivity and ‘device’ (software) management platforms extends now to a third management platform, as well, for edge-based IoT apps. This is where the action is in the IoT space, the company has concluded.

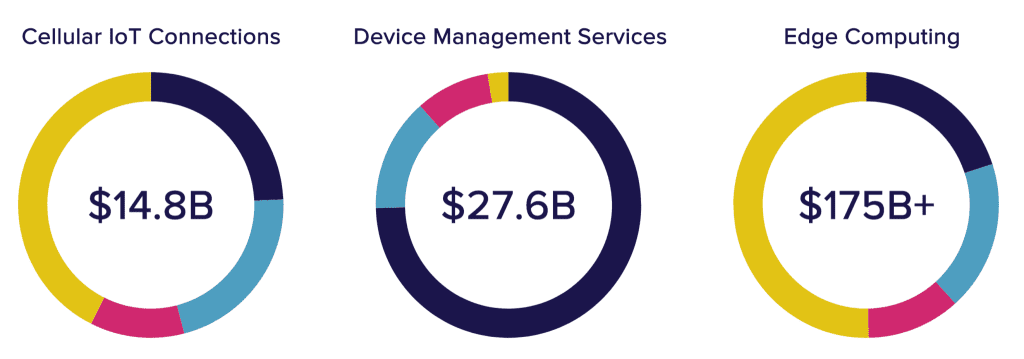

Mixing-up five-year forecast stats from Berg Insight, ABI Research, and McKinsey & Company, it says the markets for cellular IoT connectivity, IoT device management services, and edge computing will be worth $14.8 billion, $27.7 billion, and $175 billion, respectively.

Each of Pelion’s trio of management engines affords IoT device makers a way to martial – and extend management to end-user clients’ – of aspects of their IoT devices: airtime, software, and applications.

The introduction of a common device ID across the suite is being tested with “early customers”, and promises customers a way to manage the full-stack functionality and ‘lifecycle’ of their devices from a single ‘Connected Device Platform’. A slide deck says they get ‘holistic security’, a ‘unified operational view’, and ‘combined analytics’.

Mukkamala said: “The edge-app management is new, launched in the last months at scale with a buildings management customer. The Connected Device Platform, where we have a single identity for devices, and a unified view and combined analytics, is also new; it is piloting with early customers and will be road-mapped soon.”

The point for Pelion, as with most platform providers in the space, is that too many IoT projects get buried because of the complexity of the landscape, and the challenge to gear solutions on focused ROIs. But complexity is inevitable, implied Mukkamala, because of the number and variety of technology layers in the solution stack.

Through its management platform, and the solution-side relationships, Pelion claims to offer simplicity without compromising the inherent complexity required to make IoT work for industry. “IoT is an ecosystem-play; that is one of the things Arm taught us. You look at the value chain – across chips, modules, devices, connectivity, software, cloud. And device makers need choices across these things, and we enable that choice” said Mukkamala.

The new NB-IoT tracking label from Bayer, which has turned the whole industry’s head, is a good example, with Bayer, via Vodafone, corralling together chip-company Sony Altair and module maker Murata, alongside Pelion and Kigen from the Arm stable – to provide the device management and iSIM technology, respectively.

The innovation is seismic, potentially, for various reasons, and mainly because it is cheap, at about €5, nominally. But for that, it offers cellular connectivity, international roaming, and a bunch of sensors; everything is printable and recyclable. A major part of the trickery is in the iSIM, from Kigen, and the management of the setup, by Pelion.

Mukkamala reflected: “Bayer is building the solution, but IoT is never about a single vendor; it is about a system enabling it. We provide the connectivity and device management – so it can go from market to market, across multiple networks, and so the firmware can be upgraded at any time, if a vulnerability is discovered, for example.

And, yet, neither appear among the race-car branding at the bottom of the label (see image); everything goes under Arm’s name. That will change as Pelion and Kigen (along with Treasure Data), come-of-age, are plopped down to make their own way in the world. “Yes, absolutely. Arm will still be there to bring the silicon partners into the mix. But as a technology provider, now Pelion and Kigen will have their own voices. That will start to change.”

As a division within Arm, Pelion focused primarily on the utilities and buildings market, providing IoT management to meter makers and sundry buildings devices and control systems. It has built up an international staff of 300, interfacing with 150-odd partners in service of 500-odd customers.

“We have built [this business] with support and investment from Arm, and learned a lot. But the technology has matured, and we are starting to diversify into new markets. Because the technology base tends to be common. Now it is about going to market, and… [what] can be achieved as an independent company.”

Mukkamala said: “We are betting on edge analytics, and management of edge applications, as well as a big uptick in eSIM and iSIM, as cellular gets embedded increasingly into the silicon, and in our ability to manage all of that. Those are the trends for IoT in 2021, and we are the market leader for those technologies and expect to see great traction around them.”