Over three quarters of projected economic growth from 5G in the UK will be driven by just three sectors: manufacturing, construction, and agriculture. These industries, considered to be linchpin ‘verticals’ of the broad Industry 4.0 movement, will contribute £5.2 billion, £4.2 billion, and £2.2 billion, respectively, reckons research firm Analysys Mason – nearly 80 percent, in fact, of the £14.8 billion total Analysys Mason has pegged for 5G-related economic gains in the UK.

The research has been commissioned by Ericsson and Qualcomm, in the business of 5G networks and devices. It estimates a five-time return for companies investing in 5G as an ‘open innovation platform’. Industrial growth from 5G, everywhere, will come “over and above” the benefits from enhanced mobile broadband, said Ericsson.

The forecast period for the research is unclear in the press note; but Erisson said the gains are based on “assumed” 5G deployments in Europe in 2025. At the same time, the Swedish vendor has just issued its own calculation that 5G could drive $31 trillion in cumulative consumer revenue globally by 2030 – with operators taking an extra $3.7 trillion in the timeframe, and augmented reality (AR) responsible for over half of consumer spending “on immersive media”.

In June, Ericsson-backed figures by ABI Research said incoming 5G technologies will generate $17 trillion in economic growth in the period to 2035, with the initial stimulus coming from smart-city applications piggybacking on urban 5G rollouts – but that operators’ revenues from industrial 5G, hyped as the real ‘game-changer’ in the new telecoms arsenal, will not outpace revenues from consumer 5G for more than a decade.

Meanwhile, rival vendor Nokia issued its own bombastic-sounding projections last month, suggesting a so-called 5G+ combination of edge computing, data analytics, and private networking will drive the global economy upwards by seven percent, potentially, or $8 trillion, in 2030. Nokia said spending on private 5G, in service of the Industry 4.0 movement, will outrun investment in traditional ‘public’ 5G cellular in the period.

All of which leaves us with a bunch of numbers, and a lack of meaning, ultimately. More importantly than the guesswork around future 5G bounties, perhaps, the new Analysys Mason report looks to restate the case for industrial 5G by reviewing the pubescent use cases most-likely-to-succeed – even if it is only in a line or two in the press release, which runs as below.

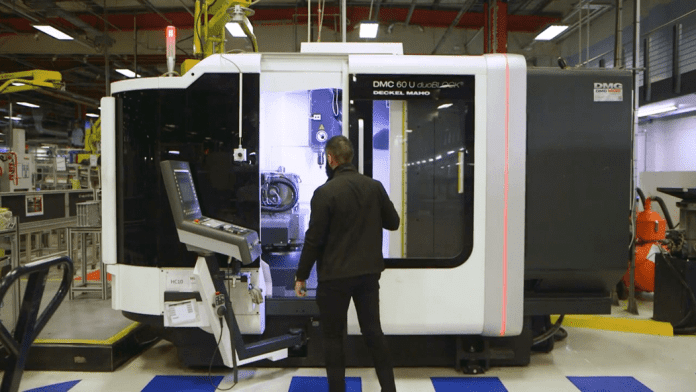

“The report provides a glimpse of what the UK’s future powerhouse industries might look like. Use cases include thousands of connected sensors to allow for unprecedented monitoring of factories, crops, and construction sites; remotely controlled and autonomous vehicles such as forklifts and tractors; extended reality (XR) to enhance worker capabilities and advanced collaborative robotics, such as drones, for surveillance of livestock or building sites.”

But it takes a swipe as well at the slow-paced – in fact, markedly average-paced – rollout of 5G networks in the UK, as a potential impediment to the country’s new industrial future. It might, arguably, be read as a warning from tech sellers to tech buyers to up their buying games, and issued across every European market. The UK’s consumer 5G rollout is currently “rated ‘average’” among European countries, said Ericsson.

The press statement reads: “Despite being an early leader in launching 5G networks, the estimated 5G population coverage in the UK was most recently circa 30 per cent, placing it around the average for European countries where 5G has been launched. This places the UK well behind leaders Switzerland and Finland, and level with countries such as Denmark and Sweden.”

Was it not ever thus? Note, the comparisons are not with Germany and France, or other similar and equivalent telecoms environments and industrial markets. But then, much of the tech industry and most of the cellular market presents 5G as a cornucopia for industrial change, and the reality is its impact will be more significant for enterprises than for consumers – as a springboard, in combination with cloud-to-edge processing, for analytics-based acrobatics.

The Analysys Mason report makes the case, as well, for 5G to underpin ‘green recovery’ in the UK – if the buying is done, and the networks are deployed. “The areas in which 5G is expected to have the most significant positive environmental impact for the UK are in more efficient and lower-carbon farming, reducing unnecessary waste or excessive use of fertiliser, and in freight by facilitating ’just-in-time’ supply chains and more efficient transport.”

John Griffin, head of Ericsson in the UK and Ireland, commented: “As an open innovation platform, 5G will accelerate digital transformation and help the UK establish a truly global leadership position in the industries and technologies of the future. Ericsson is already leading the deployment of 5G in the UK and is committed to developing the early use cases that will deliver the economic, social and environmental returns to build a sustainable and resilient infrastructure for future generations.”

The UK’s first 5G factory, at the Worcester Bosch factory and Malvern Hills Science Park, is demonstrating certain industrial 5G use cases with real-time machine sensors to reduce downtime and increase product safety, while Ford and Siemens are adding 5G-powered low latency connectivity and private networks to help improve productivity and efficiency within existing factory systems.

BT has been appointed as the lead technology partner for the project; Ericsson is supplying the 5G infrastructure. BT, which runs the EE mobile network in the UK, said “private 5G” is the only way to deliver flexible and smart manufacturing. The company has been involved since the inception of the project two years ago; it called its new appointment an “acceleration” of the UK’s Industry 4.0 agenda. The 5G network is now live said, said BT, and under its stewardship.