IT firm Fujitsu has revealed a portfolio of private 5G products and services to serve the Industry 4.0 movement. It has also set a revenue target of ¥100 billion (about $9.5 billion) from private 5G-related sales by the end of fiscal 2025, ending (March 31, 2026). Ericsson, Intel, Keysight Technologies, and Qualcomm are providing the networking gear, chipsets, and testing behind the proposition.

Fujitsu said it will focus, initially at least, on selling private LTE and 5G equipment and services in its home market, in Japan; it is unclear whether the 2025 target is a domestic one or, as seems likely, stretches to cover global expansion of its new Industry 4.0 networking offer.

Japan has made available localised portions of ‘vertical’ spectrum at 2575–2595 MHz and 4.6-4.9 GHz, for industry to license at a significantly reduced fee compared with spectrum used for public mobile networks, sold to the highest bidders at auction. Fujitsu took the first commercial private 5G license in Japan, back in March.

The company also has a license for private 5G at its Oyama plant in Tochigi Prefecture, which serves as a manufacturing base for network equipment, operated by its telecoms networks business. Fujitsu has a stated aim to make the Oyama plant a ‘smart factory’.

The company noted 4.7 GHz band standalone-5G base stations are scheduled for release early in 2021. The Japanese regulation follows in line with moves by regulators in Europe, notably Germany and the UK, and follows on from the momentum built up by the auction of CBRS spectrum in the US.

The company noted 4.7 GHz band standalone-5G base stations are scheduled for release early in 2021. The Japanese regulation follows in line with moves by regulators in Europe, notably Germany and the UK, and follows on from the momentum built up by the auction of CBRS spectrum in the US.

Fujitsu’s comprehensive-looking private 5G bundle covers managed services, including the design, build, and management of private cellular systems in Japan. The design stage incorporates a proof of concept, license application, and network optimisation. Management includes continued maintenance and development, and integration of evolving industrial IoT edge and analytics systems on top.

As well, Fujitsu is offering cloud services into the deal, available on a monthly subscription. Fujitsu said it is offering cloud-based management of base stations, core networks, devices, and applications. These will bring remote monitoring of operations, and primary response in case of failure,

Besides, Fujitsu has introduced a private 5G partnership programme, billed as a co-creation initiative with the likes of Acuity, Canon, Sharp, Trend Micro, Microsoft, and Murata, among others. Atmark Techno, Amnimo, Silex Technology, TAIYO YUDEN, Macnica, METAWATER, and YE DIGITAL are also listed as partners in the initiative. The programme will explore a wide variety of industrial use cases and solutions for private 5G.

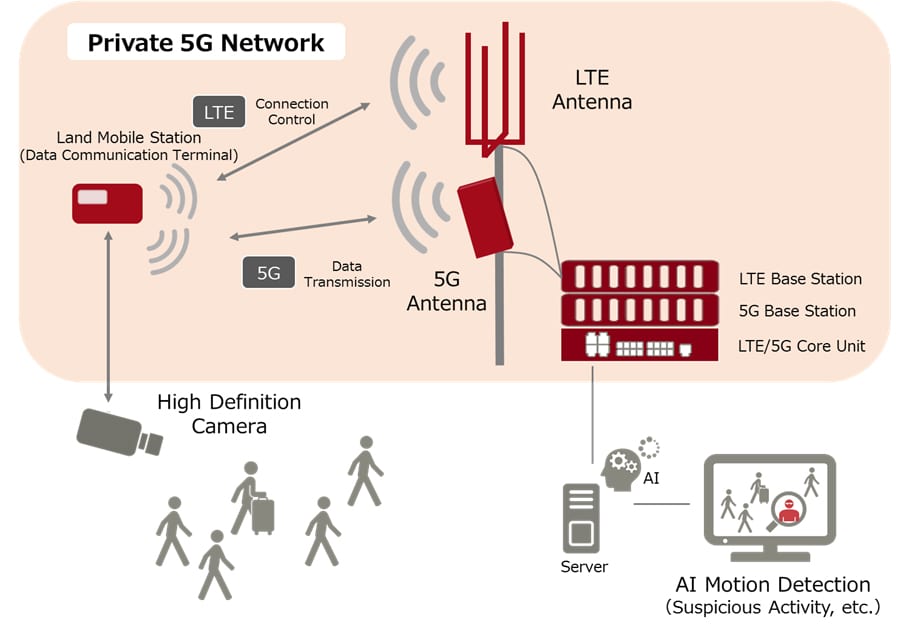

Fujitsu said it has been promoting the use of private 5G through in-house verification of security systems utilising high-definition video. It has opened a ‘collaboration lab’, as a verification facility, for connecting devices and integrating services from partner companies, it said. The lab will use Fujitsu’s own private 5G setup.

The company has also established a new division, called the 5G Vertical Service Office, in Kawasaki City, in the Kanagawa Prefecture, to strengthen “vertically integrated” services, and to expand its lineup of private 5G solutions. “This will help solve problems faced by customers, and bring about customers’ business innovation utilizing private 5G and co-creation of advanced solutions to solve various issues,” it said.

The company said in a statement: “When deploying a private wireless system, such as a private 5G system and private LTE, a high level of technical knowledge and expertise in implementation and operation is essential; not only as it relates to wireless technology, but also in areas including IoT technology for capturing and processing data from various devices on-site.”