Spending on private and shared enterprise networks will surpass spending on public cellular networks in about 15 years. The traditional operator community has a fight on its hands to guarantee a place at the table, as the new Industry 4.0 networking feast unfolds over the next decade.

This is the view of ABI Research, presenting this week on the private networking market at the company’s online 5G Technology Summit – timed, like major sessions from the likes of Bosch and Siemens, to coincide with Hannover Messe when the industrial set would have descended on Lower Saxony to debate the future of the Industry 4.0 movement.

In an excellent presentation, taking a high-level view of market dynamics around spectrum, standards, and service provision for enterprise-grade cellular, ABI Research director Dimitris Mavrakis said the balance between spending on consumer and enterprise infrastructure, weighted entirely towards public networks as it stands, will shift decisively towards enterprises in about 2036.

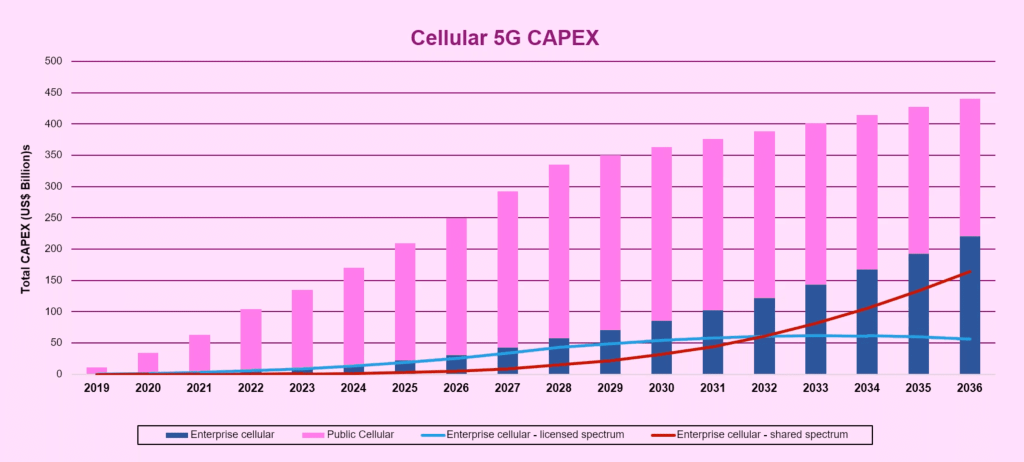

The forecast period (see graph, below) goes into the long-term, covering the tail-end of 4G-LTE, the rise of 5G-NR, and probably the emergence of an entirely new (6G) generation of cellular. But it describes a seismic shift in the core sales and investment strategy for network building in the cellular market.

Mavrakis commented: “By 2036, what is spent on enterprise cellular will be more than [what goes] public cellular. Enterprise use cases will be more important than consumer use cases.”

Interestingly as well, the balance between investment in traditional licensed spectrum for enterprise cellular (covering dedicated network slices and private local allocations of publicly-licensed cellular, as well as conventional usage) and investment in ‘shared’ spectrum (covering shared-access spectrum, plus new tranches licensed directly to enterprises) will shift towards non-traditional access by about 2032, four years sooner, and rise rapidly in the years following.

Mavrakis said: “The market is starting with licensed spectrum, meaning operators will mostly likely deploy these enterprise business models. But as time goes by, shared and private spectrum will increase in usage, which means either carriers will deploy using shared spectrum or new entrants will come into the market, including even companies like Amazon or Microsoft.”

The ecosystem for cellular network provision, restricted to a handful of companies with expensive public spectrum licences in each market until now, is suddenly expanding, he noted, with the development of carrier-grade cellular, alongside the liberalisation of spectrum, disaggregation of network hardware, and virtualisation of network functions.

Mavrakis listed new challengers to the old guard in cellular network operations. These include: the traditional vendor set (Nokia, Ericsson, Huawei et al), now selling networking gear directly to enterprises where they can; a tier-two group of small-cell vendors (the likes of Airspan, Ruckus Wireless, Sercomm), most of which have been strong in CBRS re-farming for enterprises in the US; and a bunch of open-RAN players (including Altiostar, Mavenir, Parallel Wireless) that can tackle the enterprise 5G market with greater agility.

On top, he drew attention to the likes of Edzcom (formerly Ukkoverkot) in Finland, Tampnet in Finland, and Citymesh in Belgium, all of which hold slivers of vertical spectrum in their home markets, and specialist expertise in certain industrial sectors. This ‘vertical’ know-how is a key part of the offer for industry, he said, and most be combined in systems integration with the kind of horizontal networking and platform technologies offered by cellular operators and cloud-system providers.

He might also have pointed to the likes of Athonet and Druid Software, which are making core LTE and 5G networking functions for industrial sectors, and are frequently being selected ahead of more established kit vendors in private networking setups.

But the message was clear. “Enterprise cellular [is] a new opportunity, with the foundation to surpass consumer spending on networks. But it is a competitive environment; carriers do not have a guaranteed place tin it. Because we see web-scalers and new entrants and vendors all competing for this market.

“The pain point is that each vertical has different requirements. Manufacturing has completely different requirements and models to healthcare. The common denominator is carrier-grade networks, which cellular can provide – which means it has consistent appeal [across sectors].”

Particularly with the delivery of 3GPP Release 16 (frozen last week / early July 2020) and Release 17 (scheduled for mid-2021), 5G will gain new industrial-grade capabilities, said Mavrakis, notably with the arrival of ultra-reliable low-latency communications (URLLC) and time-sensitive networking (TSN), and be raised above other wireless technologies, notably Wi-Fi, as a connectivity workhorse for Industry 4.0.

Mavrakis said: “Why not Wi-Fi? Because cellular can provide additional features. And if we are talking business critical, mission critical, life critical communications, then cellular can provide the kind of reliability that Wi-Fi cannot.”

He explained: “The unique selling point for cellular is it is governed by global standard. Wi-Fi does not include the same carrier-grade features, and mostly introduces reliability by proprietary extensions, which mean enterprises cannot take advantage of global economies-of-scale, and have to utilise specific vendors for reliable communications. This is something cellular has a distinct advantage on.”