Note, this article is taken from an editorial report on industrial AR, called Industrial AR – and the rise of the workers. The report is available to download here.

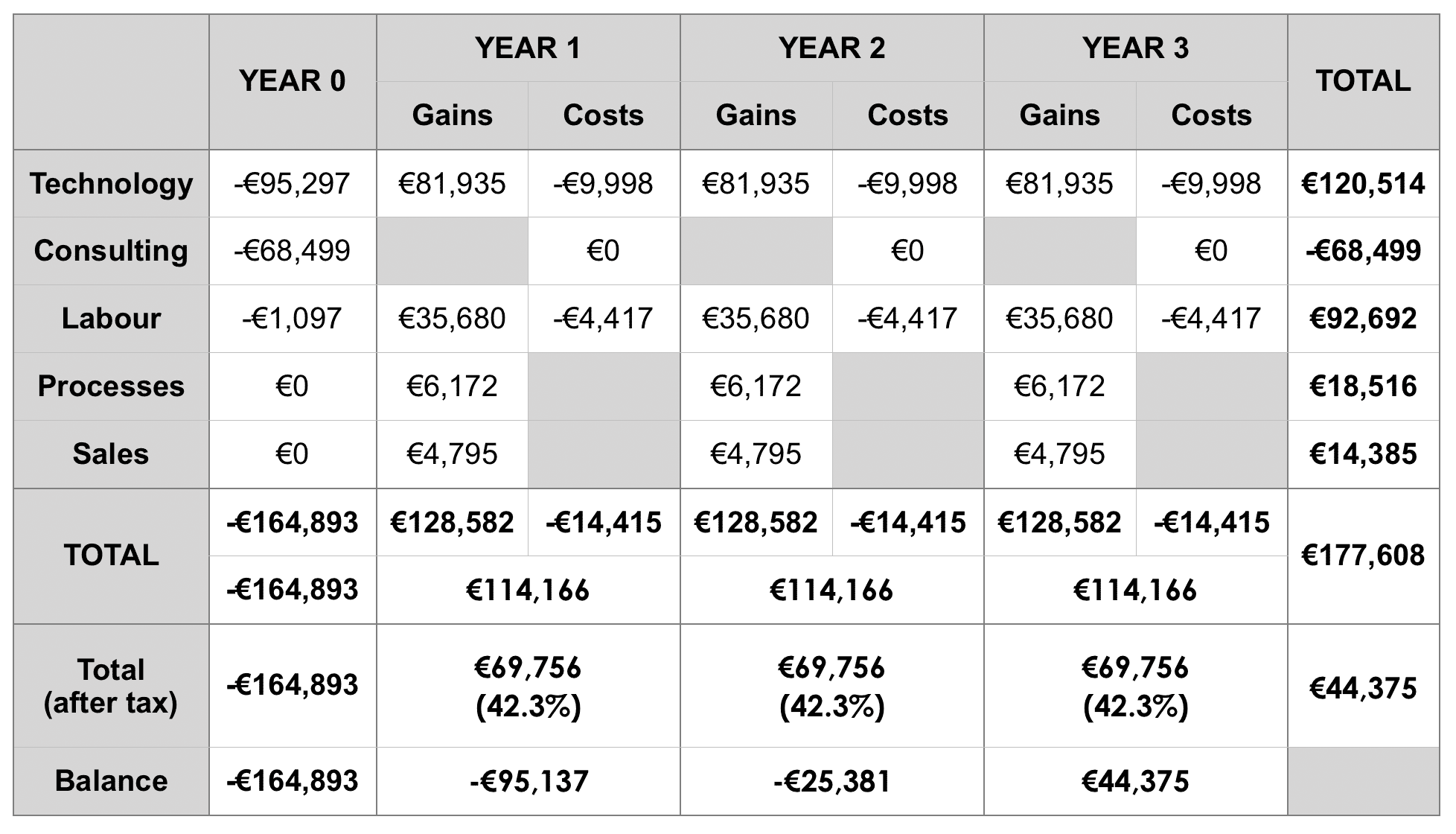

Research firm Strategy Analytics has worked through a detailed example of an industrial maintenance and repair operation that leverages augmented reality (AR) technology. The result is impressive: a return of 42.3 percent on the initial investment, and payback in a little over three years.

The exercise makes use of an ROI calculator tool, developed by the Augmented Reality for Enterprise Alliance (AREA), and made available for AREA members to estimate the ROI of AR projects. Strategy Analytics was commissioned to run the math around a fictitious manufacturer selling sterilisation equipment and maintenance services to healthcare companies.

(Click here to go to the ROI calculator and the 16-page Strategy Analytics report.)

Various parameters were set, according to the calculator inputs: the firm works with hundreds of customers, each with several dozen sterilisers, potentially; it has 10 technicians of its own, who travel to service and repair the sterilisers. The example considers how head-worn AR, offering visual assistance, helps field-based technicians with maintenance and repair jobs.

Increased efficiency

With AR, a typical maintenance and repair task goes from over three hours (188 minutes) to closer two hours (130 minutes), it says, with a third of time slashed from both the inspection (20 minutes) and repair processes (15 minutes). The example cascades the savings to the dispatch manager, who gains 60 minutes from shorter calls with the technician, and the customer service rep, who gains 50 minutes because the AR system automates the completion order.

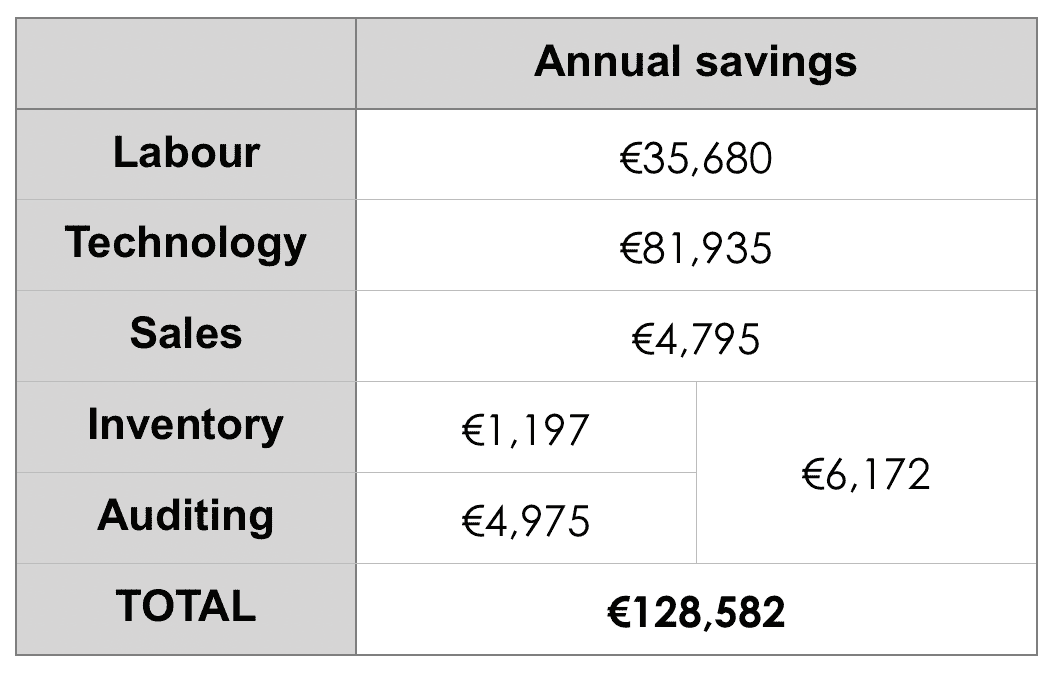

In the example, AR-based instructions reduce average repair times by 45 percent (58 minutes), compared with using physical manuals. The total productivity gain – for a fictitious manufacturer with just thousands of products and only 10 service technicians in the field – is put at 2,932.5 hours and €35,680 per annum.

On top, certain supplementary costs are eliminated: a number of ‘loaner’ devices, available in case repairs take longer than expected, can be removed from circulation; a third-party maintenance contract, for support in busy periods, can be cancelled; dated software for fielding and managing orders can also be scrapped.

In the example, annual savings are bumped up by a further €81,935 for removal of obsolete technology from the business.

Increased sales

Strategy Analytics also attempts to work in projected financial gains from increased sales, as the steriliser firm’s workforce becomes more efficient. But factors like customer churn and satisfaction, it notes, are hard to grasp, and harder to predict. Even so, it suggests further parameters: the company’s churn, of 2.5 percent of sales, reduces to two percent (by 20 percent) with the new AR strategy.

This is a “conservative” estimate, says Strategy Analytics. It translates to €27,400 per annum in new sales, on an annual turnover of €5.48 million, and to €4,795 in new profit.

There are further savings, too: a 90 percent reduction in inventory of parts (€1,197 per year), with more accurate diagnosis and repair, and automated order fulfilment; a corresponding 25 percent reduction in accounting costs (€4,975 per year), with the integration of maintenance order processing with the ERP system.

Deployment costs

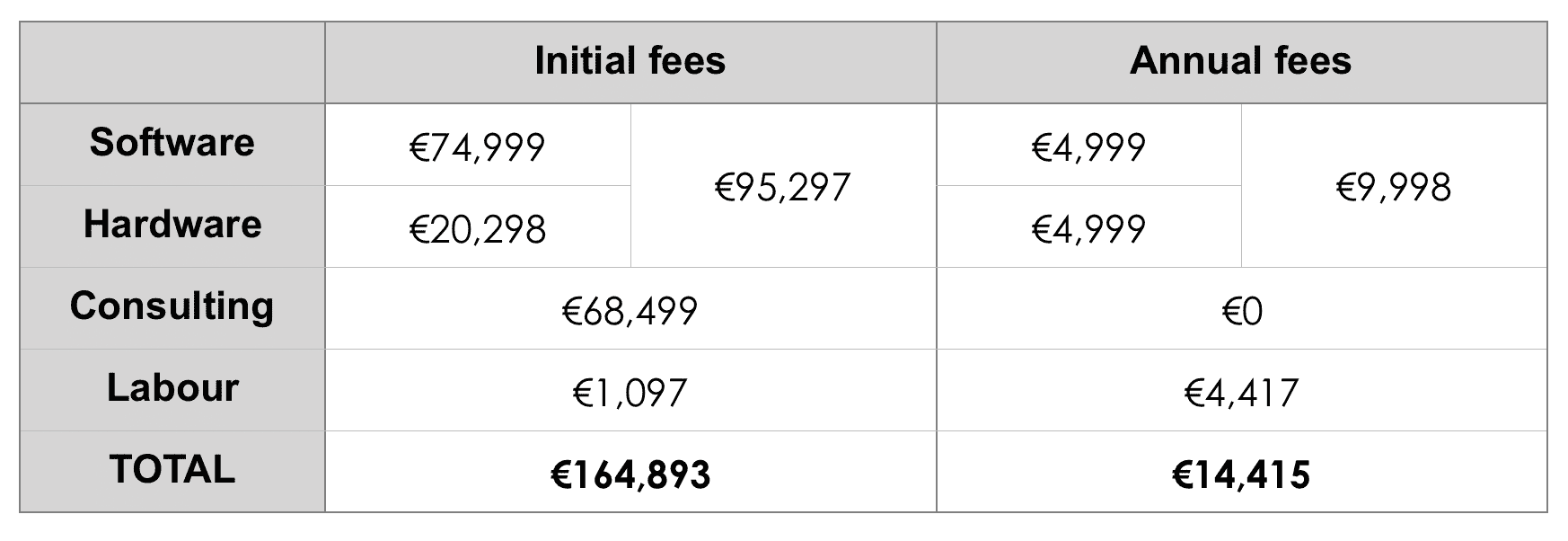

But what about the fees on the other side – for software licenses and subscriptions, plus the shiny new hardware, and all the consulting? Strategy Analytics assumes the steriliser firm has already made headway with its cloud and networking strategy; these should be considered as a part of a broader corporate digitisation strategy, anyway, it says.

On the other hand, software and hardware gets expensive. In the steriliser fiction, €74,999 goes on software licenses, which is expensed, rather than capitalised. In addition, the firm pays €6,000 for six AR head-wear, €12,999 for networking gear, and another €1,299 for additional hardware.

All of this (€20,298) is paid for at the outset. Maintenance fees for software and hardware are based on an annual subscription, and charged at €4,999 per annum in each case.

A significant upfront sum (€68,499) also goes on application and content development m(filed as ‘consulting’). This includes significant fees for creation of digital manuals, component lists, and images. In the example, Strategy Analytics puts this at €174,000, but says the content will be reused in other processes, and should be discounted by 75 percent in its ROI calculation (to just €43,500).

A significant upfront sum (€68,499) also goes on application and content development m(filed as ‘consulting’). This includes significant fees for creation of digital manuals, component lists, and images. In the example, Strategy Analytics puts this at €174,000, but says the content will be reused in other processes, and should be discounted by 75 percent in its ROI calculation (to just €43,500).

There are labour costs, as well, for time spent planning and deploying the solution (€3,690, written-off in the calculation), as well as in initial training (€1,097). Annual fees go on some minor ongoing training (€686 per annum) and undefined integration costs (€3,731 per annum).

Bottom line

In the example of the steriliser company, Strategy Analytics proposes a corporate tax rate of 39 percent, acknowledging rates vary significantly according to the country. As such, the annual benefit from the AR pilot of €114,166 – annual savings of €128,582, minus annual costs of €14,415 – is reduced to €69,756 after tax.

In balance (see table below), Strategy Analytics calculates the annual rate of return for the maintenance project at 42.3 percent (a €69,756 return on a €164,893 upfront investment), giving payback in a little over three years. It calls it an “outstanding” rate of return, noting minimum rates for IT projects range from 10 to 15 percent, depending on the industry.