This is an excerpt from a new editorial report, part of Enterprise IoT Insights’ new Digital Industry Solutions series. The report, called Smart Lighting as a Platform – for Buildings and Cities’ – is available to download in full (for free) – click here.

Lighting networks are mapped to human activity, wherever it goes – to urban centres, residential neighbourhoods, working spaces, industrial parks, and along traffic routes in between. They have a ready supply of power and are out of reach of theft and vandalism. Their elevated positions and grid-like layouts, both indoors and outdoors, make them ideal fixing-points for other smart devices.

The case to connect lighting is clear enough. The arithmetic for cities says remote control of lighting affords about 25 percent energy savings, just from “dimming and trimming” of the constant light output. Additional savings can be achieved from operational costs, with early warnings to central control rooms about faulty fixtures, and reduced scouting by maintenance staff.

This kind of knowledge and control appeals to cities, of course, but the savings are somewhat variable, related to the size of the lighting network. An easier calculation, and a surer gamble, comes with the shift from traditional incandescent and halogen lighting to semiconductor-based LEDs (light-emitting diodes). The same maths says LED bulbs will save customers, whether council departments or building managers, closer to 50 percent on their power bills.

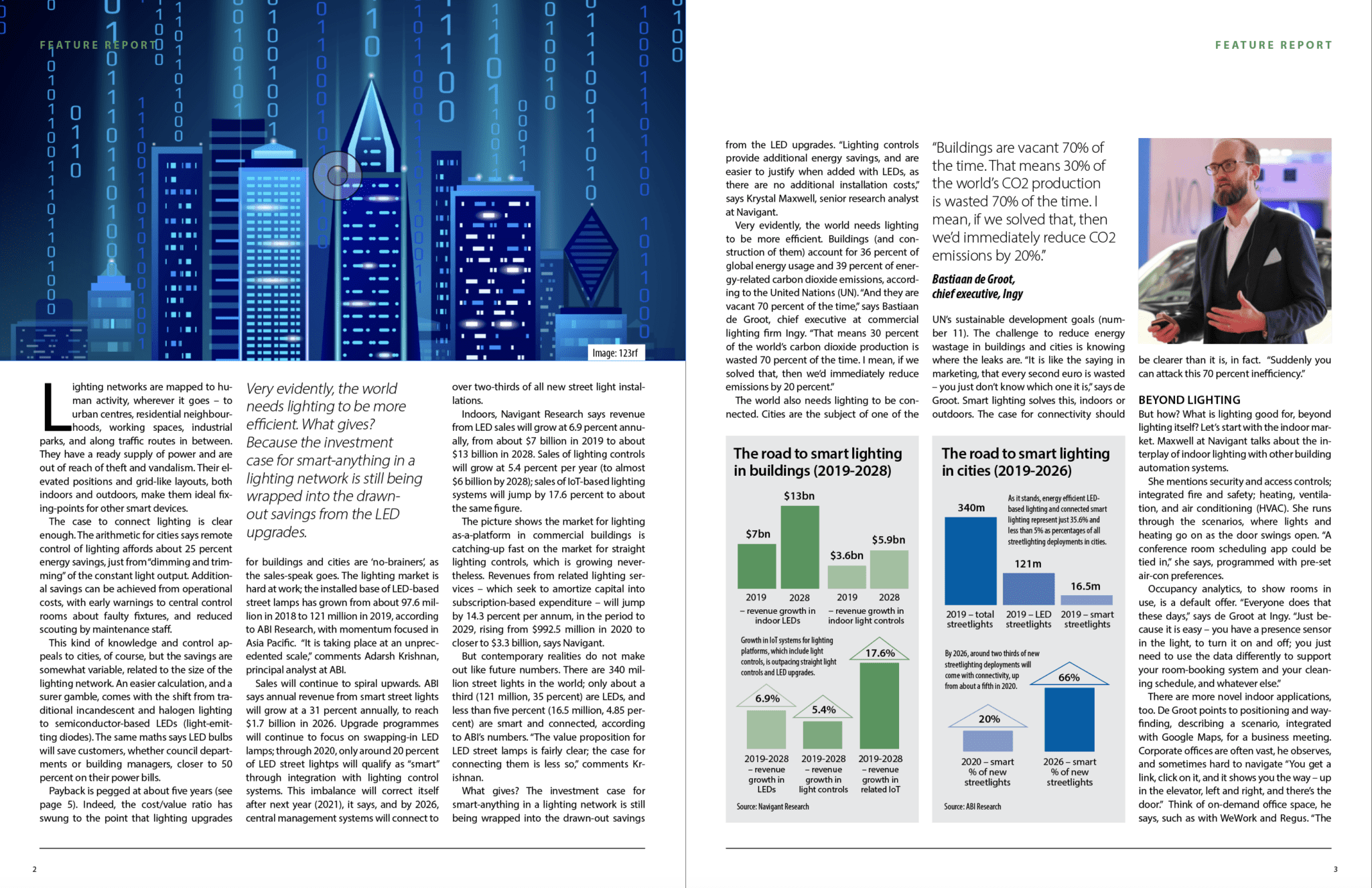

Payback is pegged at about five years (see page 5 of report). Indeed, the cost/value ratio has swung to the point that lighting upgrades for buildings and cities are ‘no-brainers’, as the sales-speak goes. The lighting market is hard at work; the installed base of LED-based street lamps has grown from about 97.6 million in 2018 to 121 million in 2019, according to ABI Research, with momentum focused in Asia Pacific. “It is taking place at an unprecedented scale,” comments Adarsh Krishnan, principal analyst at ABI.

Sales will continue to spiral upwards. ABI says annual revenue from smart street lights will grow at a 31 percent annually, to reach $1.7 billion in 2026. Upgrade programmes will continue to focus on swapping-in LED lamps; through 2020, only around 20 percent of LED street lightps will qualify as “smart” through integration with lighting control systems. This imbalance will correct itself after next year (2021), it says, and by 2026, central management systems will connect to over two-thirds of all new street light installations.

Indoors, Navigant Research says revenue from LED sales will grow at 6.9 percent annually, from about $7 billion in 2019 to about $13 billion in 2028. Sales of lighting controls will grow at 5.4 percent per year (to almost $6 billion by 2028); sales of IoT-based lighting systems will jump by 17.6 percent to about the same figure.

Indoors, Navigant Research says revenue from LED sales will grow at 6.9 percent annually, from about $7 billion in 2019 to about $13 billion in 2028. Sales of lighting controls will grow at 5.4 percent per year (to almost $6 billion by 2028); sales of IoT-based lighting systems will jump by 17.6 percent to about the same figure.

The picture shows the market for lighting as-a-platform in commercial buildings is catching-up fast on the market for straight lighting controls, which is growing nevertheless. Revenues from related lighting services – which seek to amortize capital into subscription-based expenditure – will jump by 14.3 percent per annum, in the period to 2029, rising from $992.5 million in 2020 to closer to $3.3 billion, says Navigant.

But contemporary realities do not make out like future numbers. There are 340 million street lights in the world; only about a third (121 million, 35 percent) are LEDs, and less than five percent (16.5 million, 4.85 percent) are smart and connected, according to ABI’s numbers. “The value proposition for LED street lamps is fairly clear; the case for connecting them is less so,” comments Krishnan.

What gives? The investment case for smart-anything in a lighting network is still being wrapped into the drawn-out savings from the LED upgrades. “Lighting controls provide additional energy savings, and are easier to justify when added with LEDs, as there are no additional installation costs,” says Krystal Maxwell, senior research analyst at Navigant.

Very evidently, the world needs lighting to be more efficient. Buildings (and construction of them) account for 36 percent of global energy usage and 39 percent of energy-related carbon dioxide emissions, according to the United Nations (UN). “And they are vacant 70 percent of the time,” says Bastiaan de Groot, chief executive at commercial lighting firm Ingy.

“That means 30 percent of the world’s carbon dioxide production is wasted 70 percent of the time. I mean, if we solved that, then we’d immediately reduce emissions by 20 percent.”

The world also needs lighting to be connected. Cities are the subject of one of the UN’s sustainable development goals (number 11). The challenge to reduce energy wastage in buildings and cities is knowing where the leaks are. “It is like the saying in marketing, that every second euro is wasted – you just don’t know which one it is,” says de Groot.

Smart lighting solves this, indoors or outdoors. The case for connectivity should be clearer than it is, in fact. “Suddenly you can attack this 70 percent inefficiency.” But how? What is lighting good for, beyond lighting itself?

This is an excerpt from a new editorial report, part of Enterprise IoT Insights’ new Digital Industry Solutions series. The report, called Smart Lighting as a Platform – for Buildings and Cities’ – is available to download in full (for free) – click here.