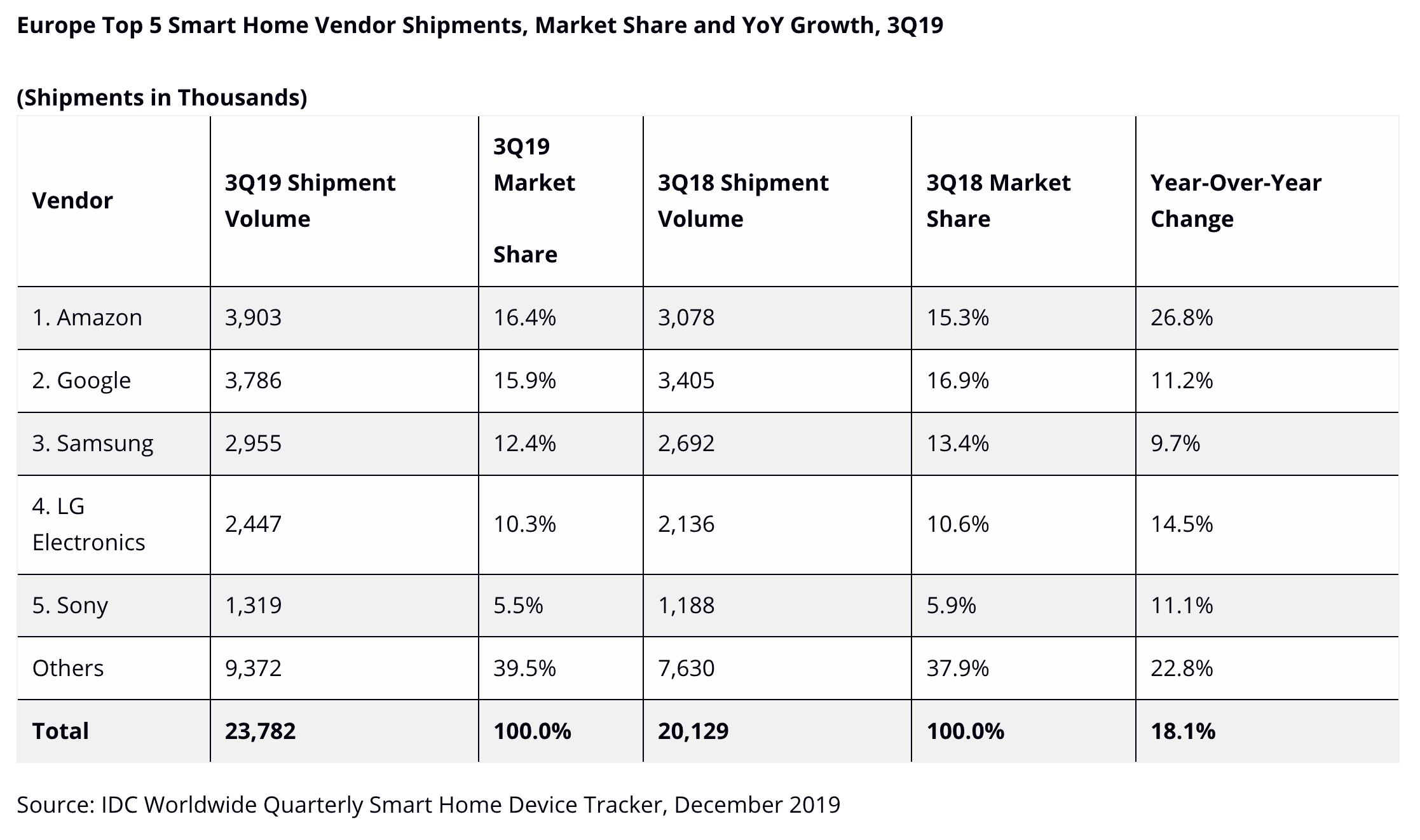

The smart home market in Europe continued to grow in the third quarter of 2019, reaching almost 23.8 million units, an increase of 18.1 per cent compared to the same quarter a year ago. Amazon usurped Google in the period as the top tech brand in the space, with 16.4 per cent of sales.

Analyst house IDC calculates Amazon shipped 3.903 million units in the quarter, up by around 26.8 per cent and 815,000 units (from 3.078 million) in the equivalent period a year ago. It dominated the smart speaker market, with its Alexa/Echo-lines, with 58.2 per cent of the total smart speaker market and 13.8 million units.

Google posted a jump of 11.2 per cent in quarterly sales, compared with a year ago, to 3.786 million, trailing Amazon by around 177,000. Google has 15.9 per cent of smart home sales in Europe, reckons IDC.

Further back, Samsung held a 12.4 per cent share of sales (shipments), with LG Electronics and Sony on 10.3 per cent and 5.5 per cent, respectively. All of these vendors saw growth edging into double digits (see chart below).

Meanwhile, other assorted brands took 39.5 per cent of sales, accounting for 7.63 millon units. This was also up on the third quarter of 2018, both in terms of total volume (up 22.8 per cent) and in terms of percentage share (up by 1.6 points).

IDC said more than 4.5 million of smart speakers were shipped to Europe in the quarter, growing 36.6 per cent compared to the same quarter in 2018 and representing 19 per cent of total shipments of smart home products. Video entertainment was still the number one product category, responsible for 58.2 per cent of the market and 13.8 million units.

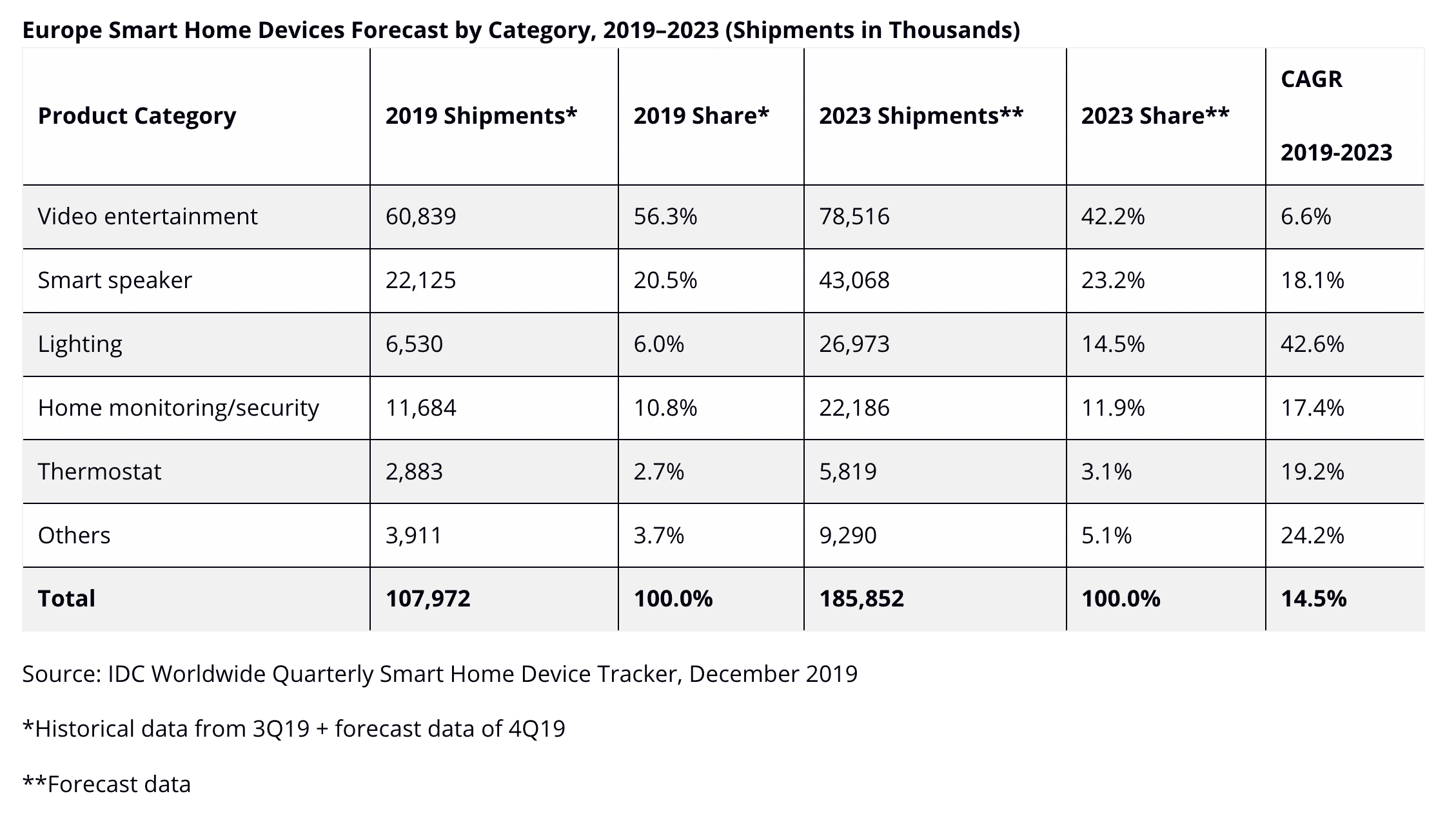

Full-year figures for 2019, adjusted with final-quarter estimates, show video entertainment contributed 56.3 per cent of shipments in 2019 (reaching 60.839 million units), smart speakers contributed 20.5 per cent (reaching 22.125 million), home security contributed 10.8 per cent (reaching 11.684 million), and lighting contributed six per cent (reaching 6.53 million).

IDC has set five year forecasts, as well, which suggest the total market for smart home devices in Europe will reach 185.9 million units in 2023, growing at a compound annual rate (CAGR) of 14.5 per cent.

Lighting will be the fastest-growing segment in the period to the end of 2023, it said, with a compound annual rise (CAGR) of 42.6 per cent, and a projected 2023-end share of 14.5 per cent and 26.973 million units. Lighting will replace home security as the third biggest device segment.

The two biggest – video entertainment and smart speakers – will stay the same, with the first growing at 6.6 per cent per year in the period to 78.516 million units in 2023 (a 42.2 per cent share, down from 56.3 per cent in 2019), and the second growing at 18.1 per cent per annum to 43.068 million units (a 23.2 per cent share, up from 20.5 per centr in 2019).

Antonio Arantes, senior research analyst for smart home devices in Western Europe, said: “Amazon had a stellar quarter and was responsible for more than half of the smart speakers shipped to Europe in the third quarter of 2019. In the digital media adapter space, the Fire TV continues to prove the strength of the product, leading in the United Kingdom and German markets.”

Jan Prenosil, senior research analyst for smart home devices in Central and Eastern Europe, commented: “The lighting category recorded a solid growth thanks to affordable devices with direct connectivity options, not having the necessity of connecting to a hub. It is the simple way for consumers try the basic smart device.”

Arantes added: “Even though video entertainment is already a mature market, we are still seeing some novelties in this space. In the last months of 2019, Fire OS and Roku entered the TV market in the UK as two new operating systems for smart TVs and we expect them to grow to new countries and new partners.”

Prenosil said: “Increased demand for Smart TVs is expected in the coming quarters as the DVB-T standard signal is turned off between the end of 2019 and 2020 in some CEE countries, and many costumers leave the purchase of the new equipment to the last minute.”