Firstly, that headline: too much? Perhaps, but let us make the case – and draw breath, for this may take some time. Industrial 5G is the only version of 5G that should be considered to be ‘game-changing’. It is a phrase that is overused, to the point of cliché, but it is probably correct here.

Every other version offers evolution, and no more. Digital transformation has reached most of society already with 4G / LTE; 5G will take that change further in these parts, but it will not bring revolution. But industry has remained apart from this digitalization of society, except for portable spreadsheets and bring-your-own solutions.

It remains entrenched and disconnected; wedded to legacy machinery and walled gardens. 5G will change this by performing the trick of connecting machinery and reinforcing security at the same time. It will bring laser-like control and responsiveness that propels 30 years of automation into a brand new era.

But the idea 5G will change our lives, as consumers, is wrongheaded; it will develop our digital experiences, but the donkey work has been done with LTE. The game, as it were, won’t change, really. There will be new social media crazes, and new ways to bring services closer, and perhaps even make them bespoke – if there isn’t push-back on hyper personalization.

What about 4K videos on the move? Who cares, really? Immersive stadium experiences, with live streaming and some alternative-realty trickery? Yeah, okay. 3D gaming, VR porn? Augmented reality goggles might be the exception that proves the rule. But these are generally unwieldy experiences, which will not travel (!) well – at bus stops and chip shops, waiting for service.

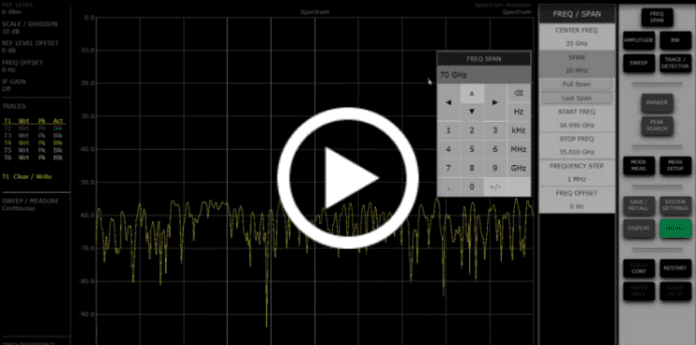

5G brings considerably greater and cheaper capacity for operators, so they will load their networks. But this new capacity will also come from the availability of ever-higher frequency bands, with much of its pegged in so-called millimeter wave spectrum at higher than 20 GHz, where bandwidth broadens but propagation diminishes – to the point coverage is patchy, propped up by small cells attached to buildings.

In real terms, 5G will never actually reach speeds of 100 mbps or latencies of sub-10 ms on general-purpose networks, covering public spaces and private properties as well; for consumers, 5G will be like a go-fast stripe down the side of an old XR3i (for children of the 1980s).

Super-fast wi-fi, sprung from gigabit fibre in buildings, will carry these services, in most cases. 5G will only provide fixed-wireless access for home connectivity in certain other cases, where fibre is out of reach. But this is hardly game-changing – it just goes a way to put right past failures, which have created a digital divide between the urban ‘haves’ and the rural ‘have-nots’.

What about cars? Well, firstly the connectivity and compute ecosystem that is growing-up around the mobility sector will only touch punters at its periphery; mobility is an Industry 4.0 (or Society 5.0?) movement, which will revolve around the tech industry’s engagement with manufacturing companies, city authorities and highways networks.

Most of the connectivity revolution in the mobility space, as it touches road users, is working just fine with LTE – ‘infotainment’, navigation, ride-hailing. Level five autonomy will be achieved without 5G, or any G, just multiple high-fidelity sensors and massive on-board compute power. In-car connectivity is on a linear path, backwards to 2G-era M2M and forwards to 5G-era LTE-M, for mapping and media, and measures like engine diagnostics.

Secondly, the road ahead is unclear. Vehicle-to-vehicle (V2V) communications – extending to ‘anything’, including road furniture (V2X) – is presented as a key use case for 5G, and a subject for considerable investments and trials. It seems likely some version of 5G – sliced away from the public network, bolstered by industrial-grade reliability and control mechanisms – will serve, here, to ensure vehicles are integrated in ‘real time’ into smart traffic systems.

But the mind-bending (actually) reality of autonomous cars is a generation away, in terms of 10-year 3GPP cycles at least. The logic goes that, if 1G dates from 1979, 2G from 1991, 3G from 2002, 4G from 2009, and 5G from 2019, then fully autonomous vehicles – scheduled for the 2030s, realistically – will be connected by another G entirely. Even if the foundation work is done in 5G.

The point is there are major technical (and ethical) challenges that need to be unravelled first, which put autonomous transport off the commercial 5G radar, effectively.

All of which means 5G is a bluff for consumers, and consumer services. Its role in the enterprise space – and most specifically, in the industrial space – is more convincing by far. It is important to note the seeds are being sewn already, as every function of industry is ploughed with cheap sensors. The entire supply chain – from source material, via manufacturing and distribution, through to final product usage – is ‘wired’ for sound, and the industrial set is listening in.

Their processes and systems are being streamlined, and their products are getting better. The next releases (16 and 17) of the 5G NR standard, developing it for massive machine-type communications (mMTC), will extend this work – which has inched forwards in recent years with the low-power wide-area (LPWA) pairing of NB-IoT and LTE-M, but is far from a 3GPP-only affair.

But the real story of 5G – and its only ‘game-changing’ function, this article proposes – is its industrial get-up. What does this even mean? As well as bringing LTE-based mMTC into the 5G plane, Release 16 and 17 of the 5G NR standard, scheduled for mid-2020 and late-2021, respectively, will set down technical rules for ultra-reliable low-latency (URLLC) communications.

The key word here is ‘reliability’. Ultra-low latencies can be achieved, almost (10ms, on paper), with private LTE and the correct on-prem compute setup, and are already supporting a range of industrial applications in factories, ports, and mines, where wireless automation of heavy machinery brings advantage.

5G will bring these latencies down, further (to under 1ms, in theory). But reliability – and control – are the killer aspects. URLLC promises ‘six-nines’ (99.999 per cent) reliability, and deterministic time bounds on packet delivery. It is a heady brew for companies that see value in running mission critical and business critical systems, in high volume, over wireless networks.

Smart cities and smart grids have real interest, but the most concentrated sector for URLLC-geared use cases is manufacturing, extending to any production-based industry, from mining and metals to oil and gas. 5G will change the game here, on the ‘shop floor’, as a platform to bring flexibility, order and insight.

This is why the vendor community is pushing so hard on private LTE, augmented with localised edge compute functions, to isolate their connected systems and afford some of the security and control of standalone 5G.

It is why governments have moved to liberalize spectrum in most major industrialized nations, with prime chunks of the mid-band being made available in the US, Germany, Japan, and the UK, notably. They want new growth from industry and their industrial engines want total control. Siemens and Bosch have it in the bag, already.

It is why, against these shifting dynamics, the operator community is pivoting, dramatically, around connectivity and analytics as a means to selling industrial change. Check out the recent moves by Telefónica and Orange to drive new growth in Europe. Because they know industrial 5G is the only game in town.

But industrial revolution, sprung by industrial 5G, will take time – until 2023, at the earliest, as operators upgrade their core networks and offer standalone 5G.

Note, this article riffs on a blog post by Benedict Evans, at Silicon Valley venture capital firm Andreessen Horowitz, called ‘5G: if you build it, we will fill it’, which is highly recommended.