Note this is a serialised version of an editorial report, called LPWA connectivity in IoT – who is winning what?’. It is continued from a previous instalment, which can be found here. The full report, including additional content, is available for download here.

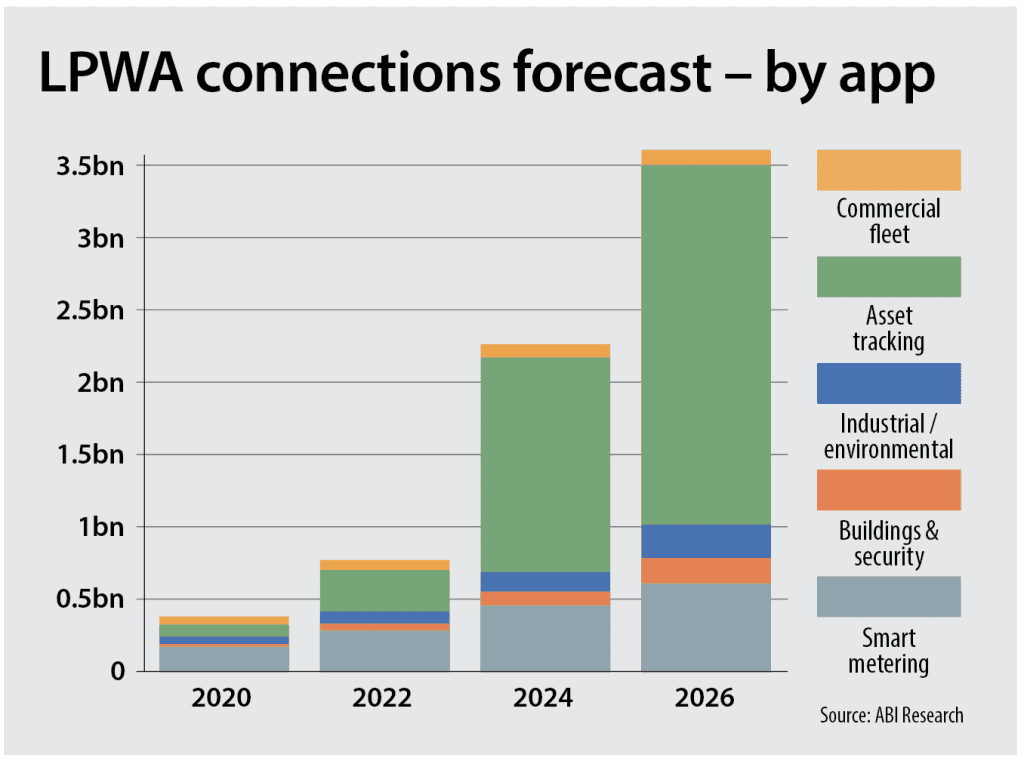

A billion, by 2023? ABI has Sigfox down for 431 million by 2026. “It’s just a target, right,” reasons Krishnan of the IB23 plan. “It is shooting for the stars, to get to the moon.” The company has missed targets before – even its latest count, of 6.7 million connections, is a way short of its 2018/19 year-end target of eight million.

Quant at MultiTech thinks even the ABI forecast for Sigfox is pie-in-the-sky. “If it wasn’t for Sigfox, the LPWA market wouldn’t be where it is today. It showed operators and enterprises what was possible – you saw what happened in 3GPP. And technologies like LoRa were accelerated on the back of it, as well. But I will eat my hat if Sigfox has 431 million connections by 2026.”

He adds: “It is a two-horse race, for me: licensed-band using cellular, and unlicensed using LoRaWAN. There will be some Sigfox, for sure – there’ll always be another something, because it’s an industrial market, with specific and multiple requirements. But it won’t be 431 million devices.”

Of course, even if MultiTech claims balance on the NB-IoT-versus-LoRaWAN debate, as a business selling both, its position on Sigfox is less partial. Sigfox, which can seem hounded in the LPWA segment, should be heard out. But a billion? How is that even a forecast – even in a market that Cisco (infamously) predicted a decade ago would reach 50 billion devices by 2020 (in just six months’ time)?

It sounds outrageous, even as a show of ambition. Not so, says Sigfox; the company’s sales pipe for tracking solutions is backed-up, and demand for it as a fall-back for wideband cellular is bursting. “That is our corporate vision. We are putting together all possible means to achieve that,” says Jay.

“We’ve had quite steady and sustained growth. But we’ve got a huge backlog. The ramp-up comes now. We will grow quite quickly in the next two years, as massive deals start to rollout.” She references the recent contract with DHL to connect 250,000 roll containers in Germany. (DHL, for one, does not consider cellular and non-cellular LPWA to be mutually exclusive.)

All 250,000 DHL trolleys will be retrofitted with Sigfox trackers within six months, according to the parties involved. “Our deals are not in the 10,000-range, but in the six-digit range,” she says. Asset tracking is the key for Sigfox; it signed with Dachser, Getrak, Michelin, NEC, Netstar, Groupe PSA and Total in 2018. Sigfox is “100 per cent a viable solution to digitalise industrial patrimony,” it crows.

Much of its new business is around tracking containers in the automotive sector – and not just tracking the autoparts they carry. New “six-digit” arrangements in the next months and years will bring annual growth of about 30 per cent, it calculates.

But 30 per cent does not get you to 1B23, as the target is defined. “There is a mid-term objective of 100 million objects, which should be reached by 2021,” says Jay. Sigfox’s work to open up new use cases by forcing down costs, should be acknowledged, says Krishnan at ABI.

“You have to give it credit. Sigfox has broken some big barriers when it comes to hardware costs – for connecting low-to-medium level assets, like the DHL roll containers,” he says.

“These were never supposed to be assets you could connect – they are so cheap it didn’t make sense before. By breaking the cost barrier – and the device cost is less than $15 – Sigfox has made it feasible for DHL to connect a $150-$200 roll container with a $15 hardware tracker. It’s a huge leap. It’s been done with RFID and barcodes and things like, but mostly with campus networks. Here, they’re actually going wide-area.”

SCREWY MATHS

But something is awry, either in its maths or our figuring. Compound growth of 30 per cent, from 6.7 million connections today, does not get you to 100 million by 2021. And if it did, it would leave just three years (2021-2023, inclusive) to get to the billion target. Jay explains it away. “There are two aspects of it,” she says, returning to this twin strategy of asset tracking and backup connectivity.

“We have a huge number of customers that will start commercial deployment this year, with a fast ramp-up of devices. The focus has been on the automotive sector, to help with supply-chain management. The volume of assets is huge – and it’s just one use case in one industrial sector. There’s a lot of traction in other industry sectors, as well – because they have the same types of issues.”

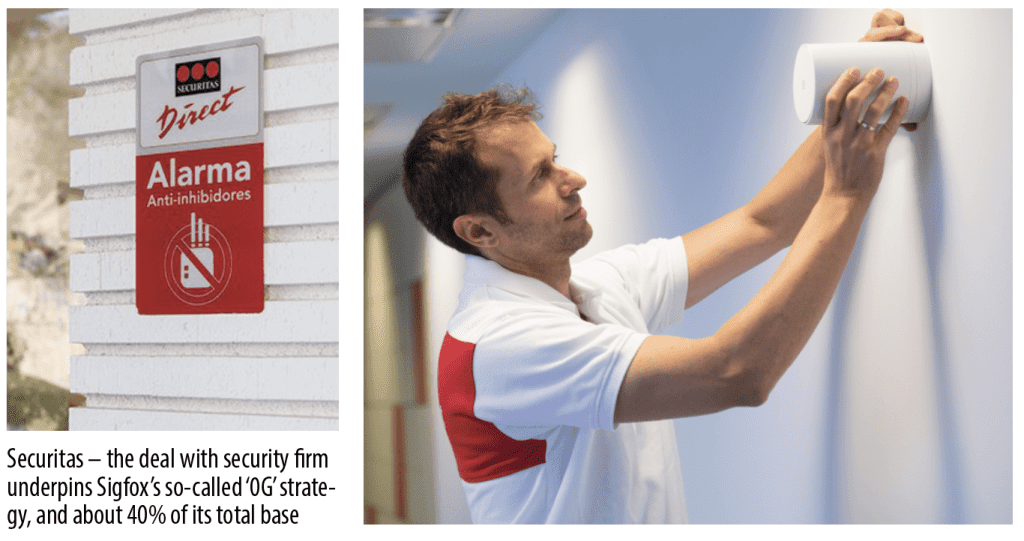

She says: “That’s the first thing. The second is this ‘0G’ aspect, where we are a complement to other technologies.” The 0G (Zero-G) concept is that Sigfox provides last-ditch comms pulse for any generation of cellular (through to latest 5G networks) to fall back-on in the event of failure, as well as an alarm system and a safe-guard for IoT providers offering assurances about service reliability.

It is a branded proposition that has grown out of its cornerstone deal with Securitas Direct in Spain, Portugal, and France, where Sigfox affords a reliable alternative in case its ADSL and 3G connections are compromised by burglars. “You can buy $20 jammers on the internet,” says Bertrand Ramé, the company’s senior vice president of international operations. “Securitas has added Sigfox as a third backup.”

Over the last five years, 2.9 million Securitas alarms have been linked to the Sigfox network – a major chunk of its total base, however it is counted. Sigfox has a new 0G-style deal with French operator Free Mobile, part of the Iliad group, which has Sigfox as backup connectivity in its new Freebox Delta, a set-top fibre-box that bundles in Devialet speakers, Amazon Alexa, ZigBee connectivity, and a Netflix subscription.

Jay suggests any head-scratching at its target numbers might be because Sigfox counts differently. “The projection volumes from analysts count the shipments of devices, modules, and silicon. We count existing devices, as well,” she says.

The point is Sigfox connectivity can be downloaded into devices that have shipped, and been counted into the market already. “As soon as these devices have the proper hardware – sub 1 GHz radios – then it is possible; you can do anything. You can transform anything, any sub 1 GHz component, into a Sigfox device.”

Its 0G run-rate (2.9 million connections from Securitas, plus growth and new sales, out of a base of 6.7 million) will remain constant, Jay implies. When Sigfox gets to one billion connections, what proportion will be as a backup network and what percentage will be the primary carrier? “Thirty-to-forty per cent will be backup connections.”

BUBBLE BLOWING

But a billion still seems absurdly high. We’ve missed something, in fact. Jay splits-out her first point, about the levee breaking under a flood of new deals for supply-chain trackers in the automotive sector, spilling over into parallel markets. There is another aspect to it, she says. Sigfox has forced-down the price of tracking devices during the past 18 months, and forced-open new use cases.

It is one thing to make the business case for attaching trackers to $10,000 shipping containers, carrying finished cargoes; it is another to connect them to $150-$200 roll containers, carrying just their component parts, as Krishnan has implied. But Sigfox is going even lower.

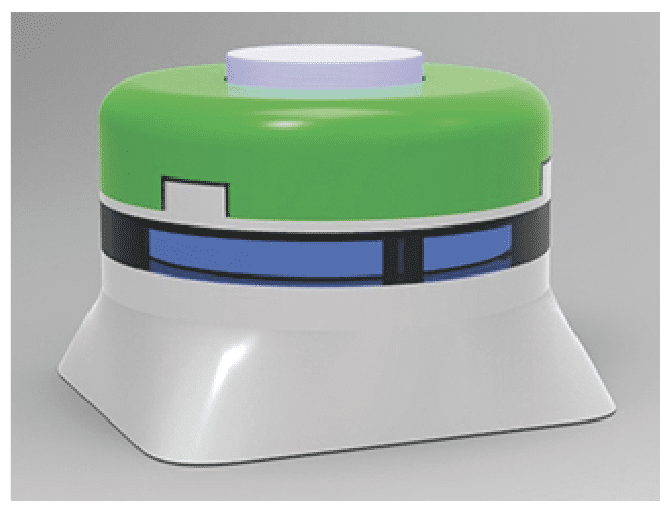

Its so-called Bubble device, a beaconing solution offering indoor and outdoor geo-positioning with 1-10 metre accuracy, is available for less than $5. Meanwhile, Sigfox has been drafted in to work on a sub-$2 micro-tracker with CEA Leti, a nano-tech lab within French research organisation CEA Tech, and Oscaro, an online trading platform for new and used autoparts.

CEA Leti came up with the design, a single-chip, sub-GHz transceiver, called ‘Foxy’ (see image, page 10), which marries “marginal cost, event-based, massive-scale IoT applications” with long-battery life. It is designed for tracking parcels. Oscaro, like the Amazon of the car-parts market, is developing the solution, and testing it out; Sigfox is providing the pulse to the hardware/software stack.

“We’re working with our ecosystem to have specific use case where you’ve got a single usage, like luggage tracking, like RFID tags,” says Jay. “That’s where we’re going to have this explosion in the number of devices.”

Market watchers question the ability of a $2 tracker to automatically switch between at least three sub-GHz ISM bands – 868 MHz in Europe, 915 MHz in North America, and 433 MHz in Asia – to enable global tracking. “You can only do global tracking using 2.4 GHz because it is arguably the only global ISM-band,” commented one reader after the IB23 story went live online.

But this is the method is the madness of its forecasting, to get to one billion ultra-narrowband IoT connections by 2023. Krishnan doubts the billion target, but he holds steady at 431 million, by 2026. “What Sigfox is doing is breaking that cost barrier down even further, and opening new business cases,” he says.

This article is continued here. A full version of the editorial report, including additional content, is available for download here.