Note, this article is serialised from a broad-ranging report on the statre of the smart energy market. It continues from a previous post, entitled ‘Why the home is the heart of the new energy internet’. Go here for the last post; go here for the full report.

Metering infrastructure allows utilities to rig the system with incentives in order to match the demand for power with supply. A tech-enabled model for voluntary rationing of the electric supply has emerged, called ‘demand response’, where lower pricing is offered in exchange for reduced consumption in peak periods. “Utilities are not just energy suppliers, anymore, but energy advisory companies,” comments Adarsh Krishnan, principal analyst at ABI Research.

The way to bring order to such a dynamic power-chain is to micro-manage its components, and to build supply by forecasting demand. But it was ever thus; production has always been based on ‘guesstimates’ about demand, notes Krishnan – “big estimates based on small samples” – where average household voltages are multiplied out for a regional sum.

The maths is screwy, however. “Those estimates are not very accurate, and you see oversupply, and imbalance in the system.” Base-load power plants, providing a consistent supply of electricity, have been augmented by ‘peaker’ plants, using gas engines and selling at higher rates, to cope with drainage on the system – a music festival might see localised electricity demand jump 130 per cent, says Krishnan.

“You need a temporary supply to provide that capacity, and it typically draws on fossil fuels at peak rates.” Smart meters, cheap sensors, two-way connectivity, distribution automation, localised power generation, and battery storage have made energy forecasting more precise and energy distribution more intelligent, and peaker plants have been gradually decommissioned.

A major test for demand planning, and a fast-emerging demand-side topic, comes with the electrification of road transport. Although take-up has been slower than expected, around two million electric vehicles (EVs) were sold in 2018, up from just a few thousand in 2010, according to Bloomberg New Energy Finance.

Annual sales will rise to 10 million in 2025, 28 million in 2030, and 56 million in 2040, it says. Sales of internal combustion vehicles (ICEs) have already peaked; price parity between EVs and ICEs will come by the mid-2020s. The need for new EV charge stations, and electric capacity to supply them, is growing, even as targets for carbon-zero energy loom, and old supplies are switched off.

Two-way charging systems allow electric vehicles to become part of the smart power grid. Car maker Renault has been running a 20-vehicle testbed project on the sunny Portuguese island of Porto Santo for the last 15 months. Since February 2018, islanders have been driving a fleet of Renault Zoes and Kangoo vans with access to a network of 40 charge points around the island.

Using two-way vehicle-to-grid (V2G) charging technology, the vehicles recharge when plugged in with cheap, abundant electricity, but at times of peak demand, they release electricity back into the grid.

The scheme, part of the island’s Sustainable Porto Santo project, initiated by the island’s autonomous government with the aim to turn the 42 km2 island into Europe’s first zero-carbon territory. Currently, 15 per cent of Porto Santo’s electricity comes from solar and wind generation because there has been no easy way to store excess energy generated on the sunniest and windiest days. It is hoped that the project will help increase this to 19 per cent.

Krishnan comments: “EV charging stations have meters communicating with the utility. They know exactly the patterns – which stations are being used, how much energy they require. That granular data from meters supports all of that demand planning.”

LOAD BALANCING

So just how complex is the task of load balancing to manage distributed power generation and fluctuating supply from renewables? “Very,” remarks Ingo Schönberg, chief executive at Power Plus Communications (PPC), a Germany-based communications provider for smart metering and smart grids, and a pioneer in broadband powerline communications.

“In order not to overload the grid, it is necessary [at times] to shed power and switch off generation. When only intermittent signals and limited control systems are in place, this process is often less subtle – just switching off half the turbines for an hour. A lot of the work being done is to streamline that,” he says.

“We rejected the ‘easy’ option of nuclear chosen by France, for example – easy because the supply of power is constant and predictable. We have encouraged local renewable generation more than any other country”

Ingo Schönberg, chief executive, Power Plus Communications

Germany has a good model for the adoption of renewable energy resources. The country has an aggressive decarbonisation agenda as part of its Energiewende (‘energy transition’). It shut down seven reactors after the nuclear disaster at Japan’s Fukushima Daiichi plant in 2011, has since closed two more, and will phase out the rest, along with coal-fired generation, in the next years.

“We rejected the ‘easy’ option of nuclear chosen by France, for example – easy because the supply of power is constant and predictable. We have encouraged local renewable generation more than any other country,” says Schönberg.

Renewables will contribute 50 per cent of Germany’s electricity mix by 2030 and 100 per cent by 2050. That is the target, as of 2015 – which should be considered remarkable, even, compared with the UK’s (June 2019) plan for “net-zero” carbon emissions by 2050, which includes capacity for nuclear, and balances remaining carbon emissions in the small print with “carbon removal strategies”.

Germany is already at around 30 per cent, with long periods running entirely on renewables. Half of renewable power capacity in Germany has been citizen-owned for at least five years; about 20 million Germans lived in 100-per-cent renewable energy regions. “We have hundreds of utilities – about 800-900 in total. Most are in small municipalities, and hire out their grid infrastructures to the big players,” says Schönberg.

As of 2013, the German government has spent €1.5 billion per year on research to solve technical issues raised by energy transition. These investments have gone into a number of pilot projects, as part of various funding cycles, which have tested mechanisms such as low-voltage last-mile capacity, smart domestic appliances, EVs for energy storage, and ways to further divide the grid to help with load balancing.

The latest funding programme, called SINTEG (declined and translated as Smart Energy Showcases – Digital Agenda for the Energy Transition), aims to set up large-scale showcase regions for balancing supply from volatile energy sources, such as wind or solar. The project is being funded with €200 million from the German Ministry of Economics and Technology (BMWi) and €500 million from the private sector.

“The projects seek to develop blueprints for a smart renewables-based electricity supply that can then be rolled out on a wider scale,” says BMWi. Through all of its experimentation, Germans distribution grid has remained stable. “In spite of our complex generation issues, outages are pretty rare and the grid is highly efficient – among the most reliable in the world,” says Schönberg.

STIMULUS FUNDS

In the US, the American Recovery and Reinvestment Act of 2009 provided the Department of Energy with $3.4 billion to invest in 99 ‘smart grid investment grant’ (SGIG) projects to strengthen cybersecurity, improve interoperability, and redouble data collection in the grid.

Electricity industry recipients matched the federal investment dollar-for-dollar, at least, bringing the total SGIG sum to $7.9 billion. Two-thirds went on deployment of AMI components, including connectivity, data management, and customer systems. Filings detail 16.3 million smart meters, 250,000 connected thermostats, 400,000 load control devices, and 417,000 participants in rate programmes, as part of the first run.

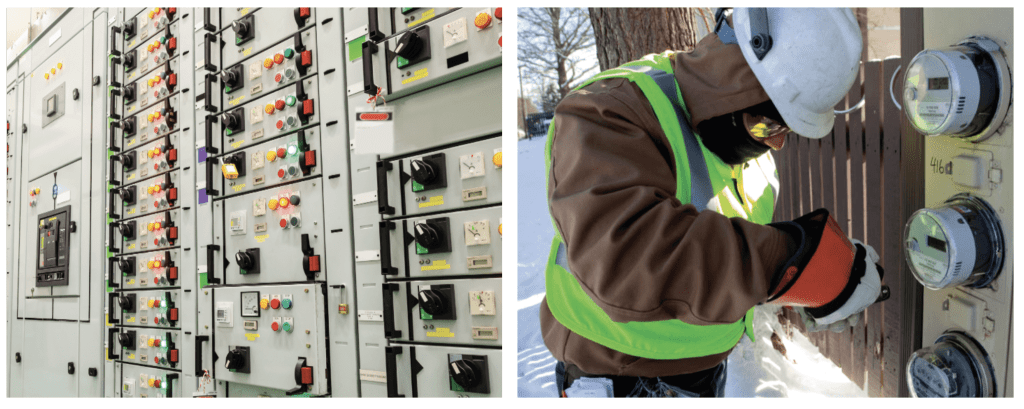

Electric utilities Kansas City Power & Light (KCP&L) and Westar Energy were recipients of SGIG stimulus funds; both have deployed “end-to-end smart grid projects”, in Kansas City, in the state of Missouri (not Kansas), and in Lawrence, Douglas County, in the state of Kansas, respectively.

The pair merged last year, and will trade shortly under a new brand, Evergy. As a combined business, KCP&L and Westar is one of the largest providers of wind energy in the land. It wants to meet “nearly half” of energy needs from zero-emission power sources in the near-term. Two new wind facilities have just been opened in Kansas, providing an additional 444 megawatts (MW) of power, enough to power 160,000 homes, it says.

“Those funds started back in 2009, so we’re coming up on 10 years. But those projects sparked innovation in the rest of the business; they’ve kicked off a myriad of different things,” says Matt Bult, senior manager for technology operations at KCP&L and Westar.

“We are being as innovative as we can be. We’re trying new technology, new engineering applications all the time. We’re constantly trying to challenge ourselves with what the grid of the future may look like. And we’re trying to run more and more pilots to get a better handle of the future so we can adjust to that impact.”

KCP&L’s original demo area in midtown Kansas City consists of 10 circuits served by one major substation, co-located with wind and solar generators, and fitted with a local distributed control system based on IEC 61850 control processors and automation protocols.

After trial of GOOSE messaging, a subset of the GSE control model, it selected DNP3 (distributed network protocol) for its substation data transfers, allied to a “myriad of communication backhauls”, before settling on a combination of (DNP-over) fibre and encrypted cellular.

“We have well over 5,000 devices in the distribution network – outside of the substation, communicating with some SCADA component, ranging from re-closers to regulators to capacitors to faulted circuit indicators.”

Matt Bult, senior manager for technology operations, KCP&L and Westar

The KCP&L setup serves 14,000 commercial and residential customers, and a ‘green impact zone’ of 150 inner-city blocks with high rates of unemployment and crime. The project has provided live information about electricity supply and demand, and knowledge about demand-side infrastructure like battery storage. It has sought, says Bult, to engage both sides in demand-response programmes to manage and reduce energy usage.

Meanwhile, Westar’s project in Lawrence has deployed an AMI system, new connectivity (DNP-3 for the substation, again, with a 3G / 4G backhaul), a meter data management system, a customer web portal, and distribution automation gear on 15 circuits. The idea was to improve system reliability and reduce energy losses, by adding automated fault location, isolation, and service restoration (FLISR), as well as voltage and reactive power (volt/VAR) control.

“Both projects focused on customer impact, but the focus was different – the Lawrence project was about autonomously reconfiguring the grid whenever there was a fault,” explains Bult. The system has handled multiple faults since, and run automated reconfiguration on at least four occasions, with savings of 288,000 ‘customer minutes of interruption’.

“When you aggregate both of the projects together, we’ve looked at advanced renewable generation, grid-scale storage resources, substation and distribution automation, how to bring in smarter controls, smart meters, energy management interfaces, and then innovative customer programmes and rate structures,” he adds.

“As a combined company, we have well over 5,000 devices in the distribution network – outside of the substation, communicating with some SCADA component, ranging from re-closers to regulators to capacitors to faulted circuit indicators. From an operations technology perspective, our main concern is distribution grid modernisation, but the technology subset we have will also influence our substation and transmission networks.”

CONDITION MONITORING

Another quick-fire example (fleshed out here), where sensors are connected to assets in the grid for condition monitoring, in order to establish some semblance of auto-detection and self-healing, comes with Finnish transmission operator Fingrid, which will rollout novel industrial IoT solutions to 10 substations, at least, by the end of 2019.

The stakes are high, explains Marcus Stenstrand, the company’s digitalisation manager. “This business is very conservative – because there is such a responsibility that goes with it. The grid is arguably the most important infrastructure for a country, today. And so some conservatism is a good thing – because you have to keep the lights on.”

Fingrid runs a tight ship in terms of the reliability of its network and the cost of its service, and Stenstrand’s team has been required to conjure a business case out of the slimmest of margins. It scoured the market for cheap (“cheap, not affordable”) sensor-based grid solutions, came up with nothing, and so put it to the local startup community as a development contest with the promise of a customer at the end.

It will deploy whatever technologies work, with little preference; but its final solutions must work together – it does not want off-the-shelf services, which cannot be moulded to its requirements. “It’s difficult to buy a sensor, today, that’s not selling a service. We don’t want to buy a service. If we buy 30 solutions, we don’t want 30 different clouds, 30 different environments,” explains Stenstrand.

“We want a mix-up; we want lots of providers. This project will build into a very large-scale concept, multiplied out to every substation in a few years. By 2022, we will probably have double the number of sensors, as we come up with new things to measure. We want to be able to gather everything into our own platform.”

It is a bold approach, especially considering power networks loom largest in the realms of ‘critical infrastructure’. The massive power outage in Argentina and Uruguay in June, from the failure of a single line, makes this clear. Fingrid is putting its sensor solutions through their paces, and has structured deals with startups so it retains the intellectual property in the event their circumstances change.

“There is a risk, of course. But we have recognised it, and we have to take time now to ensure everything is reliable – so there is high trust in the whole system. Yes, The sensors are cheap, but they work and they’re secure – you find that value threshold,” says Stenstrand.

To be continued…

This is a serialised excerpt from a new editorial report from Enterprise IoT Insights, called Keeping The Lights On – With Green Power, which looks at development of IoT technologies in the energy market. The full report, free to download, can be found here.