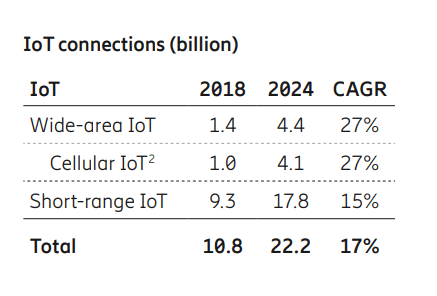

The number of cellular IoT connections, mostly to machines, will continue to outrun the number of 5G connections, mostly to people, for at least five years. Ericsson predicts cellular IoT connections will reach 4.1 billion by 2024, compared with 1.9 billion 5G connections.

According to the Swedish vendor’s latest Mobility Report, its six-monthly state-of-the-market summary, NB-IoT and LTE-M technologies, serving what it refers to as Massive IoT use cases, will account for around 45 per cent of cellular IoT connections in 2024.

These twin cellular technologies are more commonly grouped under the low-power wide-area (LPWA) banner, alongside non-cellular alternatives like LoRaWAN and Sigfox. Ericsson makes no estimates about these.

The rest of its cellular IoT forecast comprises legacy 2G and 3G M2M connections, tending to switch over to NB-IoT and LTE-M with upgrades, plus IoT devices connected to LTE and new 5G networks.

Ericsson defines these latter categories as Broadband IoT, requiring wide area, higher capacity networks, and Critical IoT, demanding ultra-reliable low-latency (URLLC) communications, as set out in 3GPP’s Release 16 for the 5G standard. It has another IoT category too, Industrial Automation IoT, for specialised industrial use cases.

Nearly 35 per cent of cellular IoT connections will be Broadband IoT, with 4G connecting the majority, it said. The first modules supporting Critical IoT use cases are expected in 2020. Only a small fraction of total cellular IoT connections will be Critical IoT in 2024.

However, its new five-year forecast says the volume of 5G connections has gained on the number of cellular IoT connections since its November edition of the report. Its expectation of 4.1 billion cellular IoT devices is consistent with six months ago; it forecast of 1.9 billion 5G devices is an advance on its 1.5 billion forecast from November.

Meanwhile, analyst firm Berg Insight has said shipments of cellular IoT modules reached 221 million units in 2018, up 16 per cent in the year. Annual revenues grew faster at 24 per cent, it said, reversing the previous trend of decreasing module prices.

It said LTE-M and NB-IoT will contribute “substantially” to growth in the next five years, as their low complexity, cost, and power demands brings costs of modules down.

Several vendors have also announced 5G NR modules in the first half of 2019, available to developers in the second half of the year. The four largest module vendors – Sierra Wireless, Sunsea AIoT, Gemalto, and Telit – have 61 per cent of the market in terms of revenues, an increase of 13 per cent, said Berg Insight.

Ericsson said ‘vertical’ markets making use of Massive IoT (cellular LPWA technologies) include “utilities with smart metering, healthcare in the form of medical wearables, and transport with tracking sensors.”

The market for Broadband IoT (LTE based machine communications), with peak data rates in the multi-Gbps range and radio interface latency as low as 10ms, is thriving also, it said, highlighting connected cars and smart watches.

Critical IoT, including both wide-area and local-area deployments, making use of URLLC-flavoured 5G networks, will serve complex use cases such as interactive transport systems in the automotive industry, smart grids with real-time control and distribution of renewable energy in the utilities industry, and real-time control of manufacturing robots in the manufacturing industry.

Ericsson’s closely related Industrial Automation IoT segment comprises very specific use cases, with the most demanding requirements, including for time-sensitive networking (TSN) and industrial interoperability, coming from the manufacturing and industrial sites. It will be a 5G-specific segment valid for local area use cases and private network deployments, Ericsson noted.

As standardisation is ongoing, Ericsson did not include a forecast for this segment, it explained.

However, it charted the appetite for private networks in the report, noting the need to modernise land-mobile radio systems, felt keenly in the public safety segment, and digital transformation, felt by industrialists, as causes for this hunger in the market.

This desire is reflected, also, in the regulatory environment, it noted, which has moved to liberate spectrum, as with the three-tiered sharing model for wireless carriers and enterprises using the old 3550MHz-3700MHz CBRS spectrum in the US.

A key challenge for private networks deployments is how to access spectrum, it noted. There are three alternatives: via service providers, direct allocation by regulators to industries, or by using shared licensed spectrum with local allocation.

Ericsson said: “Which option is best will depend on the conditions in each market. The mobile broadband communication needs of industries and governments, where network connectivity requirements are common throughout, are set to lead to more private network deployments over the coming years.

“The early adopters in this market, including major public safety and utility organisations, have chosen 3GPP LTE (and by inference 5G), and are now in the process of implementing these solutions globally. Many more industries are expected to follow shortly, all of which will drive the wider market adoption of 3GPP cellular technologies.”