New 5G technologies will generate $17 trillion in economic growth in the period to 2035, with the initial stimulus coming from smart-city applications piggybacking on urban 5G rollouts. But operators’ revenues from industrial 5G, hyped as the will not outpace revenues from consumer 5G for more than a decade.

These are the conclusions of a new report, into urban 5G deployments, by ABI Research, which says cities will be at the heart of the 5G story, and the incubation sector for new services and models to spring off next-generation mobile networks.

The rollout of 5G services in urban centres, where user densities are highest, will boost the smart city ecosystem, says ABI, and establish a new connectivity platform for consumer services and industrial actors in urban environments.

Dimitris Mavrakis from ABI Research commented: “The creation of new types of services, especially in cities and smart cities, will likely come faster when 5G becomes a consistent connectivity and processing platform. This will create a new wave of use case innovation and will allow B2B application developers to create many new applications that we cannot yet imagine.”

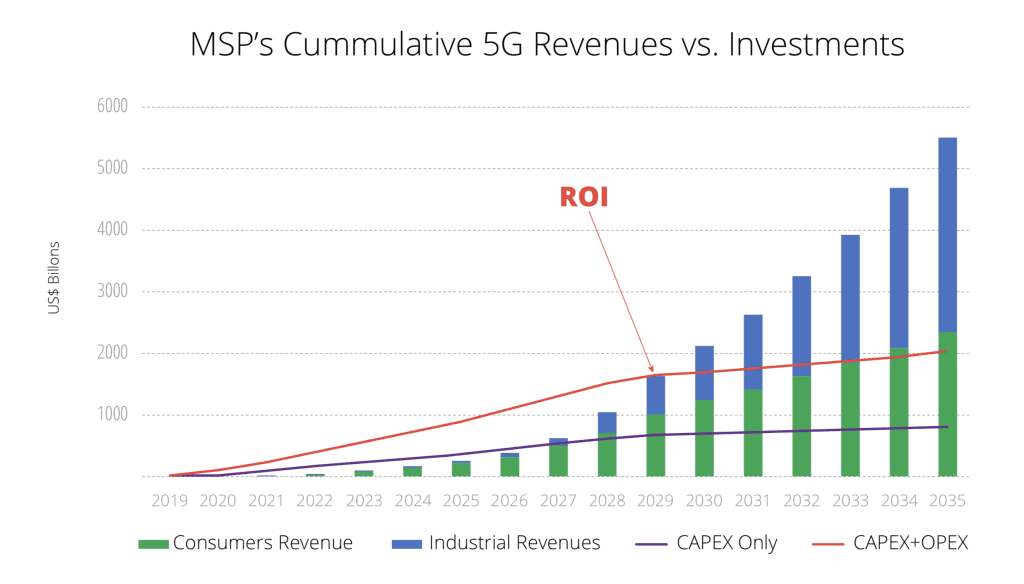

Operators’ revenues from industrial 5G services, spurred by urban 5G deployments in the first place, will start to outstrip revenue from consumer 5G services from around 2032 (see below), and hardly register until 2025.

5G is starting to be deployed in the United States, China, Japan, South Korea, and the United Kingdom. Initial 5G use cases are being fuelled by enhanced mobile broadband (eMBB). Technologies like private cellular, millimeter wave (mmWave), small cells, fixed wireless access, and telco cloud/edge are also contributing, noted ABI.

More advanced 5G features such as ultra-reliable low-latency communications (URLLC) and massive machine type communications (MMTC), contained in the 3GPP Release 15 specifications, will start to appear from 2020.

Mavrakis said: “5G will be what 4G was for consumer services: a platform for the creation of new applications and new types of experiences. 5G is currently being deployed for eMBB in cities, which will enhance the consumer experience and allow operators to deploy faster and more efficient radio networks. However, the true revolution will come with Release 16, when URLLC is enabled, allowing deterministic and reliable networking for many different verticals. It is this phase that will create an explosion in enterprise applications and holds the potential to transform many different verticals.”

ABI highlights increased revenue opportunities in the next decade in both direct and indirect contributions, as well as in productivity gains. In the period through 2028, it calculates direct contributions from 5G deployments will amount to $2.4 trillion, mostly driven by end-user subscriptions for connectivity services, as 5G is rolled out in cities first. This compares with $1.1 trillion with 4G.

Besides, $866 billion will come from indirect contributions, including increases in the supply chain from devices, infrastructure, applications, advertising and other products or services. This compares with $500 billion in 2018 from indirect contributions via 4G networks.

In terms of productivity gains, ABI reckons 5G connectivity in urban centres will see $3.2 trillion economic growth.

The report, called ‘5G urban deployment: debunking the capex myth and unlocking new growth’, was commissioned by InterDigital.

Henry Tirri, chief technology offier at InterDigital, said: “We expect 5G deployment to begin to place huge pressures on mobile operators over the next couple of years as they look to compete to capitalise on its revenue potential. Many are trying to understand how they will monetise this next generation of wireless technology, and most importantly, how they’ll deliver ROI from it.

“But while there may still be several questions and doubts surrounding 5G monetisation, these findings clearly demonstrate the growth opportunities that 5G is set to bring about. While CAPEX and OPEX investments will be high, it is evident that 5G technology will radically change our ability to deliver new and innovative consumer and enterprise services, and help dictate the trajectory of our future global economy.”

The city-first strategy for network deployment is plain, based on the ROI brought by the density of users in urban locales. “This common strategy has created tremendous productivity gains for previous network generations, especially for 4G,” said Mavrakis. “The same will happen with 5G: it will be rolled out in dense urban environments in 2019 and 2020 and it will later be expanded to other areas.”

He said: “We have reached a critical point today where our global economy is heavily reliant on our ability to deliver new technological services. 5G has the potential to completely change our every day lives, but only if mobile service providers can roll out 5G in a way that makes economical and logical sense – that is, to start with mobile broadband connectivity deployments in urban areas to create the right use cases that will justify investments in CAPEX and OPEX.”

He continued: “These first years will be vital for 5G to show consumers and business what can be achieved and to lay the foundation for the more advanced, service-based improvements that will be introduced after 2022, including edge computing and network slicing. These will unleash the true power of 5G and will likely enhance several enterprise verticals well beyond the current reach of telco networks, which focus on connectivity.

“Regulators should position spectrum auctions to stimulate the deployment of 5G, especially in dense urban areas. The new generation could be positioned as a catalyst for many new advancements in cities, leading to the evolution of a smart city. Mobile operators should also take bold steps to deploy 5G more aggressively in cities, to make consumers familiar with the new technology and lay the foundation for new applications.

“Infrastructure vendors should make their equipment as interoperable and open as possible, while aiming to migrate to cloud- and edge-based architectures as soon as possible, in order to ease the transition to distributed and intelligent networks that 5G requires.”