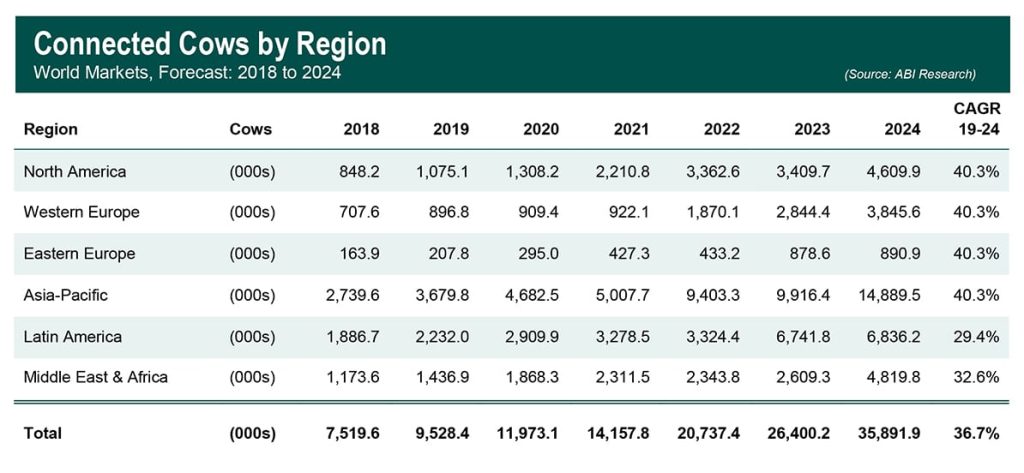

Two million farms and 36 million cattle will be connected to the internet by low-power wide-area (LPWA) networks, and other technologies, by 2024. This is the calculation from analyst house ABI Research, in a new report that considers the opportunity for internet-of-things (IoT) technologies in field crops, tree crops, and livestock.

For field and tree crops, the primary driver for connectivity is to irrigate sufficiently and efficienctly at the same time, align with government regulation on water usage. For livestock, it is about collecting data relating to the health of animals, including birthing activities, as well as knowledge of their whereabouts.

In general, ABI said higher yields, higher quality products, and greater farming insights are the chief considerations for all agricultural sectors. A new feature report from Enterprise IoT Insights, called Connecting Agriculture, which includes commentery from ABI Research, considers the promise of smart farming and the challenge of connectivity in the space.

Harriet Sumnall, research analyst at ABI Research, said: “Hi-tech systems involving drones are sometimes referenced when discussing the future of farming, but a drone’s primary function is to provide high-level aerial imagery, including strategic analysis of large areas to provide analytics on indices like chlorophyll content.

“While this is useful, it is time-consuming and can lack granular information. Ground-based sensor-based systems are more insightful and cost-effective for focusing solely on monitoring soil under the crops and animal behavior. This is exactly the information farmers need to map out their plan of action to secure the optimum yield.”

The farming sector will rely heavily on LPWA gateways and products to take data from crops and livestock, said ABI. “LoRa is increasing finding preference in supplier solutions, particularly for sensor-to-node connections,” it said, noting the pricing strategies of solutions vendors in the space, which hinge on the number of sensors.

ABI noted vendor pricing goes from a single upfront fee and inclusive subscription to a data management platform, as with Sensoterra, which is covered by Enterprise IoT Insights here, to a zero upfront cost with a data subscription-only model, as with CropX, an Israeli company also developing agricultural technologies. The former may be preferable for large farms, and the latter better for smaller ones, it said.

Sumnall said: “The reasons for adopting IoT in agriculture are universal – cost reduction, improved productivity, and better profit margins – but the specific prompts in terms of readiness to adopt can be more pragmatic and localized.

“For example, in North America, the political climate is proving challenging for the immigrant workforce required by the agricultural sector, and more automation could make up for this lack of manual labour.

“And, in Europe, farmers are notably younger than elsewhere in the world and are more naturally receptive to adopting new technology. In general, however, there is a lack of education among farmers about the benefits of connected agriculture. This is a vital issue that vendors must continue to be active in remedying if agricultural IoT is to succeed.”

An editorial report from Enterprise IoT Insights, called Connecting Agriculture – the promise of smart farming and the challenge of connectivity’, looks at development of IoT technologies in the farming and agricultural sectors. The report, free to download, can be found here. It is the second in the new Making Industry Smarter report series from Enterprise IoT Insights. For a full schedule of editorial reports, see back page of the Connecting Agriculture report.