Inside the factory of the future, everything will be fluid, except for the floors, walls, and ceilings. Industrial assets – machines, devices, and vehicles – will be animated by 5G technologies, and made intelligent by edge and cloud analytics, enabling factory owners to swap-around their production lines to meet changeable demand.

So says German industrial giant Bosch. The concept is plain, of course: factory operations have come full circle, from craft production in the first industrial age, through mass production in the global age, and a new compulsion towards hyper-customisation and the idea of a ‘lot-size of one’.

“That’s the vision – that the customer tells us what to produce, whether it’s more umbrellas because it’s raining, or a new shampoo, because some celebrity’s using it,” comments Stefan Bastian, global director sales and marketing at Bosch.

The idea is the whole supply chain – from the sales channel, through production, and back to source – wags in response to demand, whether for a sudden surge or a single SKU. But this contradictory trend towards both greater individualisation and greater productivity pulls production in two directions at once.

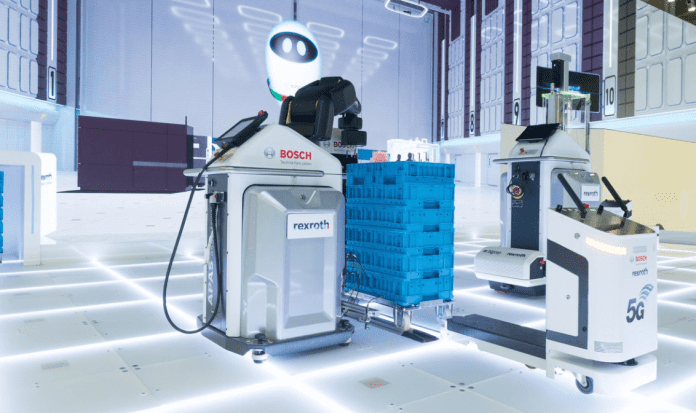

How can manufacturers respond? Bosch is betting on 5G as a means to connect reconfigurable production systems, which can be torn up and down according to real-time analysis of demand, driven by LTE and 5G systems in combination with edge compute functions and machine learning techniques.

But, actually, this concept of a fold-away 5G factory is just one version, taken to an extreme. Car maker Audi is pursuing a variant of it, which hinges on an equivalent principle of “modular assembly”. After more than 100 years, the assembly line is dead, it reckons. “You need to think in extremes to make technology possible,” comments Henning Löser, head of the company’s production lab.

Audi wants production islands, instead of lines. Increasing model diversity is hard to master in a rigid process, it reasons; a fixed tempo leads to inactivity on certain sections of the line, typically engaged for ‘optional extras’ on a small proportion of cars. These losses accumulate, especially as factories engage in more heterogeneous production.

Its concept breaks the line into production stages, attended by a couple of workers and served by automated guided vehicles (AGVs), which bring the car pieces to the relevant stations in an orchestrated loop – so AGVs arrive in and out of sequence, so long as the build allows and the space is available.

The conveyor belt vanishes from the assembly, and the ‘line’ concept goes with it. Unlike with Bosch’s vision, the work stations are fixed, and wired with ethernet. It is a nearer-term view, which is in practical development; Audi has been testing it at a battery plant in Brussels, in Belgium, and an engine plant in Győr, in Hungary.

At the same time, it is a staging post on a rapid innovation path. 5G is required to make it work. “We can’t run lots of AGVs on wi-fi – that’s where cellular will help,” says Löser. It may yet mutate into a free-form Bosch-style arrangement, he says. “Once the wireless network is there, with the right availability and throughput, then we don’t need the cabling anymore.”

Nokia offers a third vision, and a wider-screen view, which considers the broader economic impacts of smart industry, imagined in the factory scenarios described above, and ties-in with other functions in the industrial supply chain, as per the umbrella / shampoo example. The point is faster production will bring manufacturing home again.

Rapid-transit cellular networks and beefy edge-compute functions create a new digital platform for efficiency and innnovation in manufacturing, and mesh-in with smartly-orchestrated supply chains to cascade benefits up and down the line. “The idea is to be more productive, more efficient – to have better services,” says Manish Gulyani, vice president of enterprise marketing at Nokia.

The dream is to reverse the generation-long migration of industrial work to cheaper labour markets, and to make businesses distinguished and profitable because of the innovation of both their products and manufacturing. “If I can bring technology into play, and be really productive and differentiated, then it is less about labour arbitrage and more about tech innovation,” says Gulyani.

“That’s the big story, here; that’s what this is supposed to spur – so we can go beyond how we’ve done it for 30 years, and do it smarter.”

This is an excerpt from an editorial report, called ‘Digital Factory Solutions: Industrial LTE and 5G’. To view / download the report, click here.