German industrial giant Bosch has set out a vision for a 5G-enabled factory where every part of the production environment is fluid, except for the floors, walls, and ceilings. Industrial machines, devices, and vehicles will be made mobile by 5G and made intelligent by edge and cloud based analytics, enabling factory owners to change their production lines according to demand.

Bosch is coming at the Industry 4.0 game from two angles: as a provider of connected components and software solutions, and as a manufacturing behemoth in its own right, with 280 production sites and 700 warehouses across the globe. “We have lots of potential to use this technology, and try it out before rolling it out,” said Gunther May, head of technology and innovation in Bosch Rexrouth’s automation and electrification business.

Bosch has raised more than €1.5 billion in revenue from the implementation of Industry 4.0 techniques in its own factories, as well as its customers’ factories, during the past four years. The company has set an incremental revenue target of €1 billion per annum by 2022 from selling the Industry 4.0 dream, and a further €1 billion from making it real in its own plants. “It is not a theory. We know it is working,” said May, during a presentation at Hannover Messe 2019.

The company has led the industrial cheer-leading of 5G at Hannover Messe. It has cited its combination with OPC-UA and time-sensitive networking (TSN) as the key to making digital change achievable in the industrial space.

The vision of the ‘factory of the future’, as Bosch describes it, is plain, of course. Factory operations have come full circle, from craft production in the first industrial age, through mass production in the global age, and a new compulsion towards hyper-customisation and this idea of a ‘lot-size of one’, driven by consumer demand and industrial digitisation.

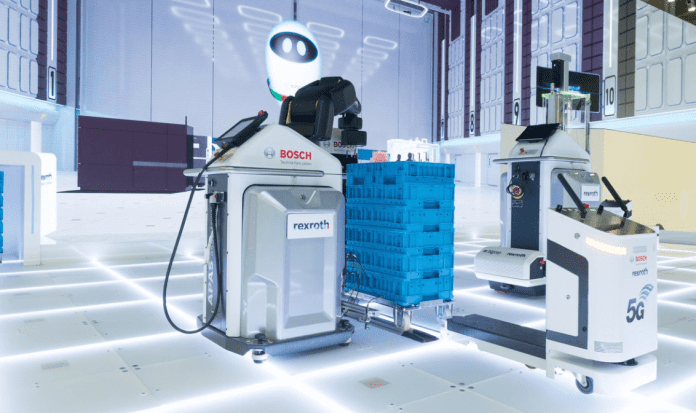

“It’s a contradiction – this trend towards individualisation, and this drive to retain productivity,” remarked May. Bosch is betting on 5G as a means to deploy reconfigurable production systems, which can be torn up and down according to real-time demand. “If we move things all time, we don’t want to mess with cables,” he said.

He explained: “Our solution will have very few fixed elements, and even these elements will be intelligent. The building will be static, but flexible. The floor floor will provide electricity – a wireless power supply to all the equipment.” Every piece equipment in these new plants will be wireless, and mapped as a digital twin. Private LTE and 5G networks will liberate factories from their fixed production lines.

May presented a number of industrial 5G use cases, which he described as tangible already. These included the orchestration of multiple autonomous guided vehicles (AGVs), typically operated on Wi-Fi systems today. Wireless is a given, he said. “You don’t want 100 metres of cable trailing behind these things.” But Wi-Fi handover tends to fail between access points, and bandwidth is constrained, he said.

He also cited IoT gateways to organise retrofitted connectivity, to enable analytical applications like predictive maintenance even in old machines. “We need to live with existing plants and add value to them.” 5G enabled gateways bring this value.

Conversely, he suggested the rise of edge computing, wedded to 5G, gives machine builders, producing equipment for the production line, confidence that their products will be able to handle future data traffic loads. “It means as well they can make extra money during lifetime of these machines, and the customer gets ever more value from them [in use].”

A third use case was also presented: 5G connected work-spaces can bring real-time intelligence and orchestration capabilities to help humans handle more changeable production routines, he said. The idea is the work-space “guides the workers” – from where to take parts and tools, and how to apply them, for example, in order to get to grips with highly-customised jobs.

Challenges remain, however, around reliability, security, and the “transparency of real-time behaviours”. But Bosch, like other leading lights among the industrial set, is engaged with 3GPP on Releases 16 and 17 of 5G NR, and the emergence of ultra-reliable low-latency communications (URLLC) post-2020.

“The chances are greater than the challenges,” he said. Most of these will be dealt with in the URLLC-strand of 5G, in combination with OPC-UA and TSN. Positioning of wireless assets was another ‘challenge’, cited by May, also resolvable with URLLC.

Beyond this, Bosch addressed the developing intrigue around private networks, and the question of their operation. “The operators are just starting to go into this industrial business. It is a challenge to find a way through all these different roles,” said May.

German regulator BNetzA has already set aside 100MHz of spectrum (3.7G-3.8GHz) for German industrialists. May commended its approach to industrial 5G, and said telecoms regulators elsewhere in Europe will ape the German model. “It is a trendsetter; this this use of 3.7-3.8 GHz frequency for local installations is great, and is being looked at by other countries.”

But he rounded up by saying industrial 5G will make room for everyone, including the traditional network operator community. “There is a chance for everyone. It is a really big cake, and anyone can have apiece. The opportunity is so huge that everyone can profit.”