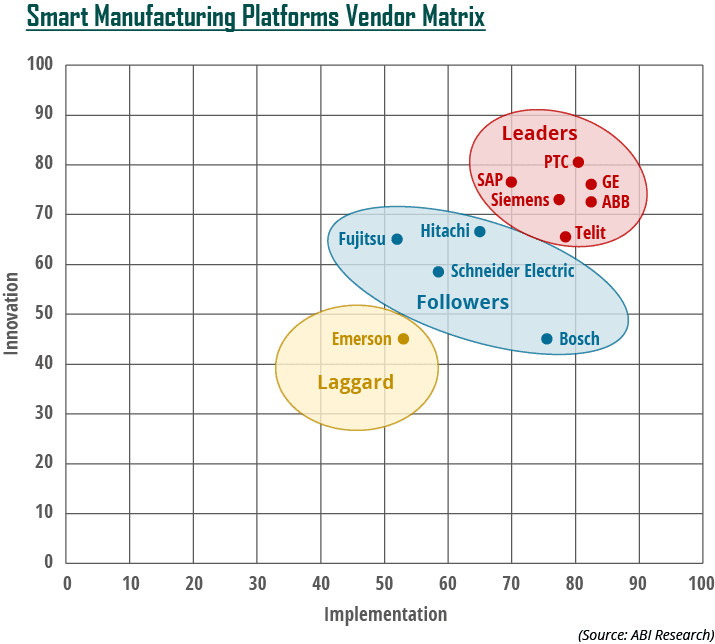

A new investigation by analyst house ABI Research has ranked the top smart manufacturing platforms, and placed PTC’s ThingWorx top of the pile. PTC has ranked at the top consistently in recent research into the leading digital factory platforms.

ThingWorx scored highest for augmented reality (AR) and mixed reality (MR), as well as for ‘overall innovation’. It led a field of 11 major vendors, in total. GE’s Predix, ABB’s Ability, SAP’s Leonardo, Siemens’ MindSphere and Telit’s deviceWISE also ranked as ‘leaders’, just off the pace set by PTC.

Among a secondary group of ‘followers’, Hitachi’s Lumada platform rated highest. Hitachi came second in Gartner’s inaugural ‘magic quadrant’ for industrial IoT platforms (IIoT) in May, leading IBM, Software AG and Accenture, among others. PTC also topped the Gartner measure.

Needham-based PTC has come top in a series of parallel reviews of IIoT platform offerings in recent months. Rockwell Automation announced a $1 billion equity investment and strategic partnership with PTC in June.

Needham-based PTC has come top in a series of parallel reviews of IIoT platform offerings in recent months. Rockwell Automation announced a $1 billion equity investment and strategic partnership with PTC in June.

Schneider Electric’s EcoStruxure, Fujitsu’s Colmina and Bosch’s IoT Suite were also ranked as ‘followers’ in the ABI scoring. Emerson’s Plantweb rated as a ‘laggard’ in the review.

Each platform was analysed according to its innovation, ‘out-of-the-box thinking’, and plans to deploy and support technologies such as AR/MR, digital twins, edge intelligence, protocol adaptability and connectivity, robotics integration, artificial intelligence (AI) and blockchain.

Vendors were ranked according to their progress in establishing partnerships, connecting assets, integrating with enterprise and cloud systems, regional coverage, and security as well as their upfront costs and business model.

ABI said PTC, SAP, Schneider Electric and Siemens tied for the highest score in digital twins, and PTC, GE, and Telit tied for highest in protocol adaptability and connectivity.

PTC focuses on AR with Vuforia, protocol adaptability and connectivity with Kepware, and digital twins with its combination of technologies on ThingWorx.

Pierce Owen, principal analyst of smart manufacturing at ABI Research, said: “PTC emerged as the leader, excelling with its innovative initiatives across transformative technologies, and GE Predix came in second.”

ABI noted GE’s mixed fortunes in the space, despite its high ranking for Predix. The Boston based conglomerate has put its GE Digital business up for sale, according to reports. “GE has ridden a roller-coaster of expectations and disappointment over the last few years, especially with GE Digital, its software subsidiary,” commented Owen.

“GE Digital led the way out of the gate in this fourth industrial revolution, launching Predix back in 2013 and making grandiose promises about improving asset utilisation and operations optimisation. It largely failed to deliver on those promises with a quite slow rollout, but since then, it has built up its technological capabilities and partnerships and now offers a legitimate platform with many solutions.”

ABB’s placed third because of its business model. ABB offers its Ability platform free of charge, even despite its well regarded innovation, charging for apps and solutions instead. ABB tied first for implementation, along with GE.

Siemens MindSphere ranked fourth. “Siemens had developed quite advanced capabilities around the MindSphere platform, but up until now, it has struggled to connect devices and equipment from other manufacturers without OPC UA,” said Owen.

Siemens has partnered with Telit deviceWISE, which ranked sixth in the ABI assessment, for data extraction and edge intelligence. It has also announced general availability on Microsoft Azure. ABI expects these moves to spur adoption, “much like the Rockwell investment will spur adoption for PTC”.

Owen said: “To its credit, it has taken steps that could lead to a jump to the top spot within a year.”

- ThingWorx (PTC)

- Predix (GE)

- Ability (ABB)

- Leonardo (SAP)

- MindSphere (Siemens)

- deviceWISE (Telit)

- Lumada (Hitachi)

- EcoStruxure (Schneider Electric)

- Colmina (Fujitsu)

- IoT Suite (Bosch)

- Emerson Plantweb

The industrial sector is one of the last to undergo digital transformation. But the next industrial revolution will be like nothing we have seen before, worth $6.8 trillion to the global economy, more than the value of the entire consumer internet market, according to the World Economic Forum. The manufacturing sector will contribute a major share.

Enterprise IoT Insights is hosting a webinar on August 22, 2018, about the role of digital technologies in industrial transformation. Register / listen here to experts from ABI Research, Hitachi and PTC, among others, to discuss seminal use cases and best practices that are setting the digital agenda for the industrial sector.