Transportation and logistics sector seeing benefit of IIoT

The Industrial Internet of Things (IIoT) could be good for cash flow according to a new report by Inmarsat, who have found that businesses can boost their revenues by $154 million. The study analyses IoT adoption across transportation and logistics, agriculture, maritime, mining, and energy.

Conducted with Vanson Bourne, 750 businesses were surveyed from around the globe, with a combined turnover of $1.16 trillion to establish the key trends, challenges and expected benefits around their current and planned adoption of IoT. The transport and logistics sector was one of the sectors to really reap the benefits of IIoT in the future, increasing revenues by approximately $210 million (over 12%) by 2023.

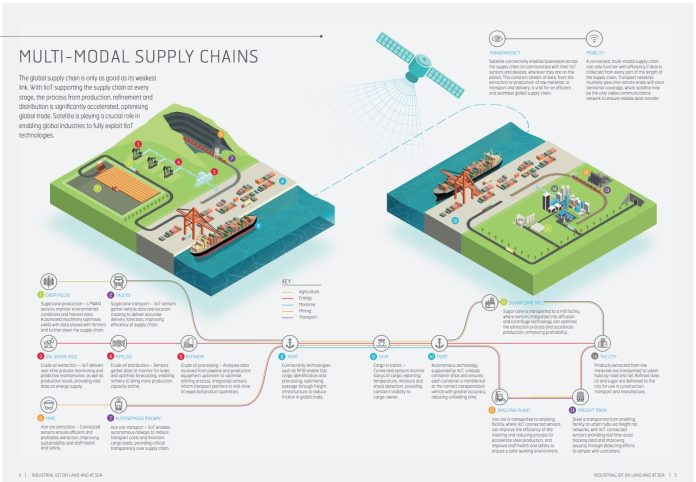

“IIoT is emerging as a major force in modern enterprise and it’s clear that businesses are prioritizing satellite technology to transform their operations and achieve competitive advantage,” says Inmarsat Enterprise President, Paul Gudonis. “Data generated by IIoT infrastructure is expected particularly to bring greater transparency to the global supply chain, allowing businesses to automate processes, reduce operational waste and speed up the rate of production, leading to higher revenues and lower costs”.

However, the report also discovered that while IIoT is set to revolutionize how businesses function, access to reliable and resilient connectivity, particularly in remote regions or at sea, is scarce due to terrestrial networks not being available. However, satellite communications might be able to solve the problem of IIoT deployments in these areas.

The satellite industry has recently been busy trying to move its move into the IoT space, with several companies such as Cox Communications, Comcast, and even satellite TV provider Dish Networks actively providing services. Usually, IoT deployments have adopted LPWAN networks to help with connectivity, but there seems to be a gap in the market for the satellite industry to take advantage of.

“34% of businesses don’t yet have access to the connectivity they need,” continued Gudonis. “For global businesses that require a global communications network, satellite connectivity will play a key role, guaranteeing constant secure data transmission wherever their IIoT infrastructure is located.”

The report also found that businesses are investing more of their resources into the development of IIoT solutions, with just under 10% of IT budgets earmarked for IIoT over the next three years. The findings show that enterprises within IIoT sectors expect a 10% reduction in costs and a 5% life in turnovers expected at the end of the period.

However, the research also shows that the varying levels of investment seen across the sector puts the potential for IIoT to revolutionize the global supply chain under threat. Energy is set to lead the way in net investment with agriculture investing the least, while generally larger enterprises plan to invest a higher proportion of their IT budgets demonstrating their commitment to the technology

These findings follow on from Inmarsat’s “The future of IoT in the Enterprise” report, which found that 82% of industry respondents will adopt IoT in the next two years.